Question

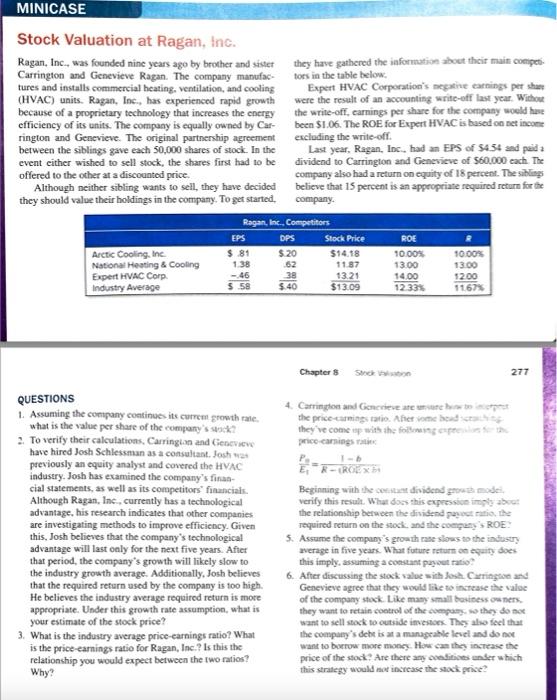

1. [Textbook Ch.8 p.276~277] Answer the Question 1 in page 277. Q. Assuming the company continues its current growth rate, what is the value per

1. [Textbook Ch.8 p.276~277]

Answer the Question 1 in page 277.

Q. Assuming the company continues its current growth rate, what is the value per share of the company's stock?

Hint: [STEP 1] What was the company's total earnings last year?

Hint: [STEP 2] The company has a total of two shareholders (siblings). What was the company's total dividend payment last year? What is the percentage of dividends as a percentage of net income?

Hint: [STEP 3] What was the company's retained earnings rate (= b = 1 - dividend payoutet income) last year?

Hint: [STEP 4] Use the equation "Growth rate of the company = g = ROE b"

Hint: [STEP 5] Apply dividend growth model with g and an appropriate required return R.

1

2. [Textbook Ch.8 p.276~277]

Answer the Question 3 in page 277.

Q. What is the industry average price-earnings ratio? What is the price-earnings ratio for Ragan, Inc.? Is this the relationship you would expect between the two ratios? Why?

Hint: PER = Stock price / EPS

Price-Earnings Ratio = PER, Earnings per share = EPS

Hint: Apply $1.06 as Expert HVAC Corp's EPS (not -$0.46).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started