Answered step by step

Verified Expert Solution

Question

1 Approved Answer

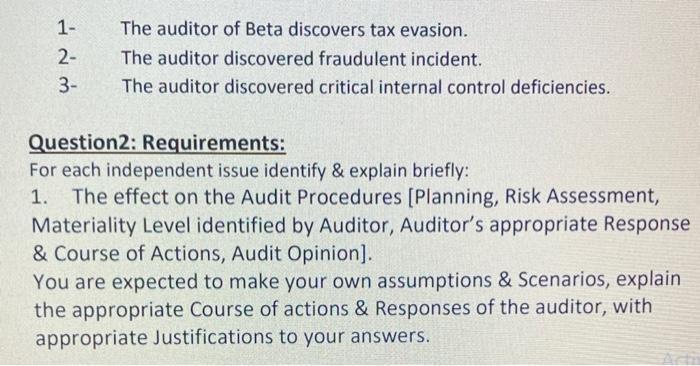

1- The auditor of Beta discovers tax evasion. 2- The auditor discovered fraudulent incident. 3- The auditor discovered critical internal control deficiencies. Question2: Requirements:

1- The auditor of Beta discovers tax evasion. 2- The auditor discovered fraudulent incident. 3- The auditor discovered critical internal control deficiencies. Question2: Requirements: For each independent issue identify & explain briefly: 1. The effect on the Audit Procedures [Planning, Risk Assessment, Materiality Level identified by Auditor, Auditor's appropriate Response & Course of Actions, Audit Opinion]. You are expected to make your own assumptions & Scenarios, explain the appropriate Course of actions & Responses of the auditor, with appropriate Justifications to your answers.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 The optimal audit policy is analysed for an independent revenue service when a social custom exists that rewards honest taxpaying The implication of the existence of the social custom is th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started