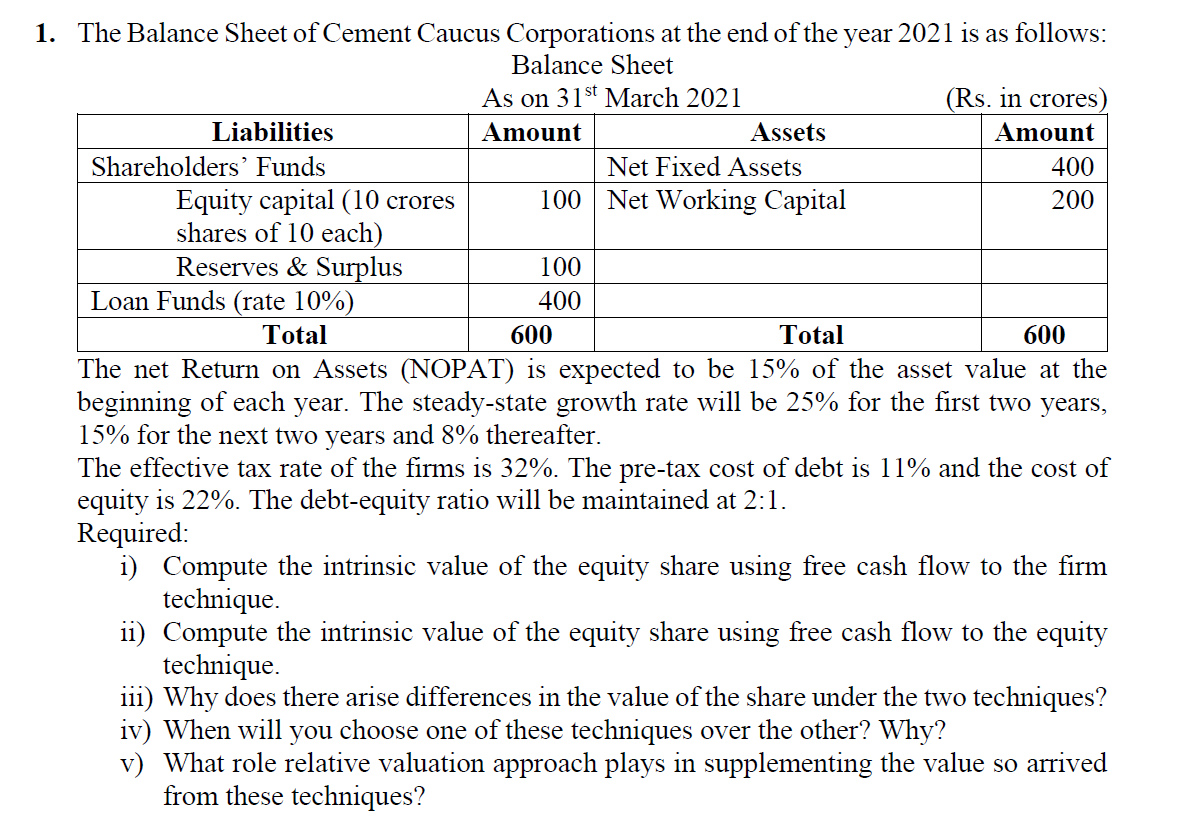

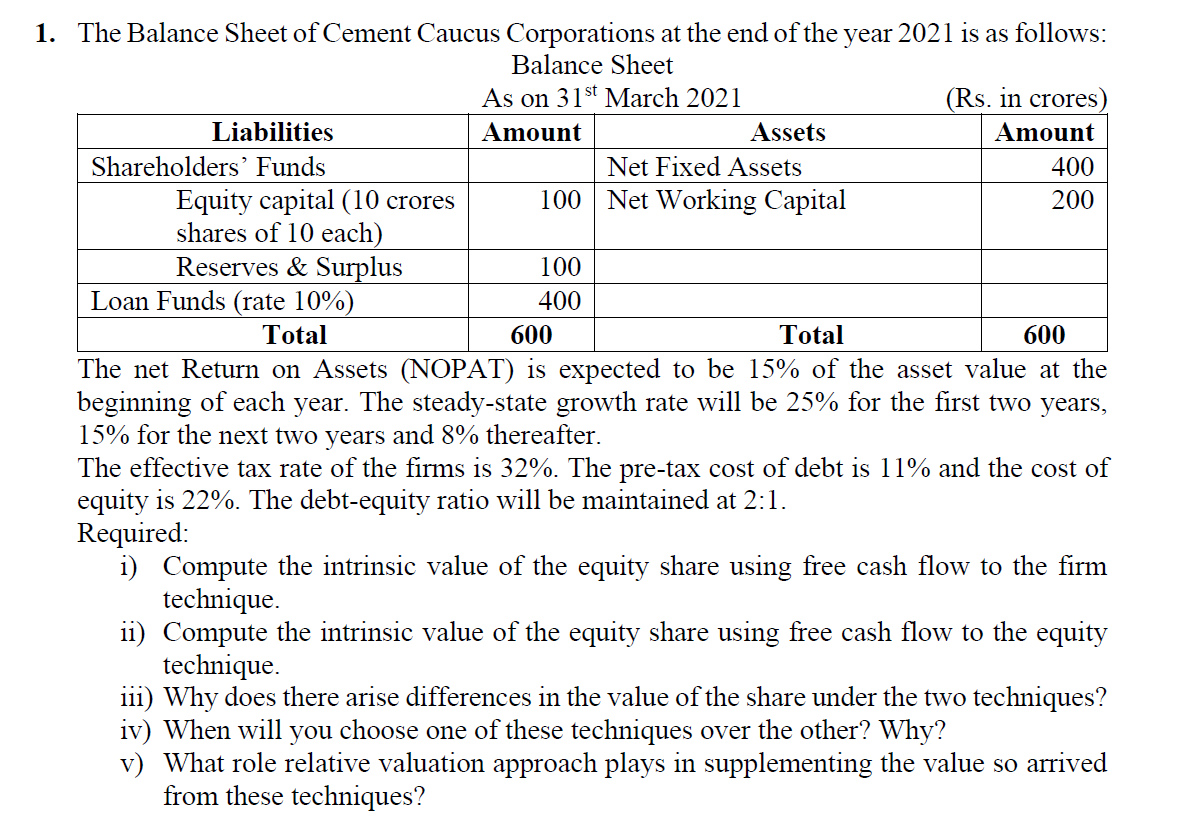

1. The Balance Sheet of Cement Caucus Corporations at the end of the year 2021 is as follows: Balance Sheet As on 31st March 2021 (Rs. in crores) Liabilities Amount Assets Amount Shareholders' Funds Net Fixed Assets 400 Equity capital (10 crores 100 Net Working Capital 200 shares of 10 each) Reserves & Surplus 100 Loan Funds (rate 10%) 400 Total 600 Total 600 The net Return on Assets (NOPAT) is expected to be 15% of the asset value at the beginning of each year. The steady-state growth rate will be 25% for the first two years, 15% for the next two years and 8% thereafter. The effective tax rate of the firms is 32%. The pre-tax cost of debt is 11% and the cost of equity is 22%. The debt-equity ratio will be maintained at 2:1. Required: i) Compute the intrinsic value of the equity share using free cash flow to the firm technique. ii) Compute the intrinsic value of the equity share using free cash flow to the equity technique. 111) Why does there arise differences in the value of the share under the two techniques? iv) When will you choose one of these techniques over the other? Why? V) What role relative valuation approach plays in supplementing the value so arrived from these techniques? 1. The Balance Sheet of Cement Caucus Corporations at the end of the year 2021 is as follows: Balance Sheet As on 31st March 2021 (Rs. in crores) Liabilities Amount Assets Amount Shareholders' Funds Net Fixed Assets 400 Equity capital (10 crores 100 Net Working Capital 200 shares of 10 each) Reserves & Surplus 100 Loan Funds (rate 10%) 400 Total 600 Total 600 The net Return on Assets (NOPAT) is expected to be 15% of the asset value at the beginning of each year. The steady-state growth rate will be 25% for the first two years, 15% for the next two years and 8% thereafter. The effective tax rate of the firms is 32%. The pre-tax cost of debt is 11% and the cost of equity is 22%. The debt-equity ratio will be maintained at 2:1. Required: i) Compute the intrinsic value of the equity share using free cash flow to the firm technique. ii) Compute the intrinsic value of the equity share using free cash flow to the equity technique. 111) Why does there arise differences in the value of the share under the two techniques? iv) When will you choose one of these techniques over the other? Why? V) What role relative valuation approach plays in supplementing the value so arrived from these techniques