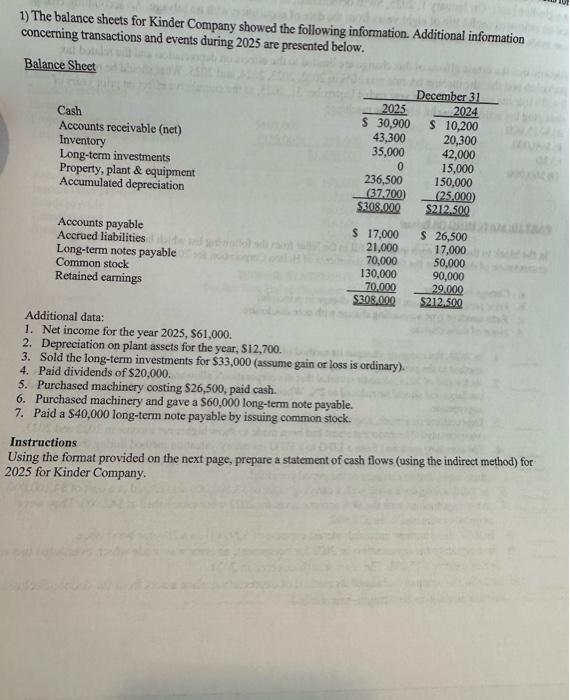

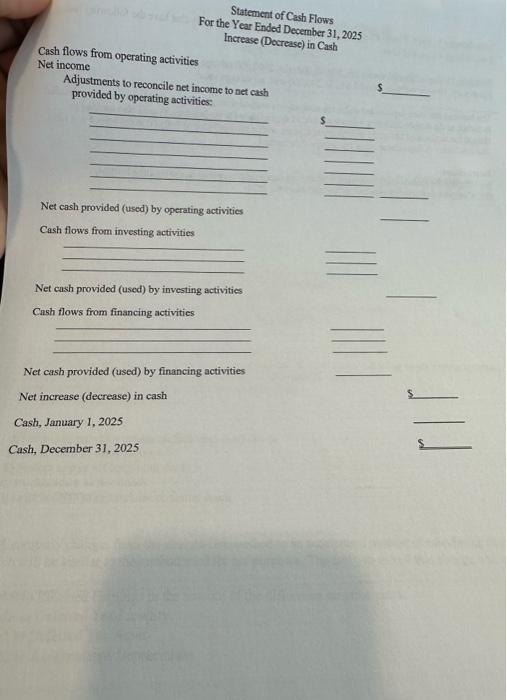

1) The balance sheets for Kinder Company showed the following information. Additional information concerning transactions and events during 2025 are presented below. Balance Sheet Additional data: 1. Net income for the year 2025,$61,000. 2. Depreciation on plant assets for the year, $12,700. 3. Sold the long-term investments for $33,000 (assume gain or loss is ordinary). 4. Paid dividends of $20,000. 5. Purchased machinery costing $26,500, paid cash. 6. Purchased machinery and gave a $60,000 long-term note payable. 7. Paid a $40,000 long-term note payable by issuing common stock: Instructions Using the format provided on the next page, prepare a statement of cash flows (using the indirect method) for: 2025 for Kinder Company. For the Year Ended December 31, 2025 Cash flows from operating activities Increase (Decrease) in Cash Net income Adjustments to reconcile net income to net cash provided by operating activities: S Net cash provided (used) by operating activities Cash flows from investing activities Net cash provided (used) by investing activities Cash flows from financing activities Net cash provided (used) by financing activities Net increase (decrease) in cash Cash, January 1, 2025 ash, December 31, 2025 1) The balance sheets for Kinder Company showed the following information. Additional information concerning transactions and events during 2025 are presented below. Balance Sheet Additional data: 1. Net income for the year 2025,$61,000. 2. Depreciation on plant assets for the year, $12,700. 3. Sold the long-term investments for $33,000 (assume gain or loss is ordinary). 4. Paid dividends of $20,000. 5. Purchased machinery costing $26,500, paid cash. 6. Purchased machinery and gave a $60,000 long-term note payable. 7. Paid a $40,000 long-term note payable by issuing common stock: Instructions Using the format provided on the next page, prepare a statement of cash flows (using the indirect method) for: 2025 for Kinder Company. For the Year Ended December 31, 2025 Cash flows from operating activities Increase (Decrease) in Cash Net income Adjustments to reconcile net income to net cash provided by operating activities: S Net cash provided (used) by operating activities Cash flows from investing activities Net cash provided (used) by investing activities Cash flows from financing activities Net cash provided (used) by financing activities Net increase (decrease) in cash Cash, January 1, 2025 ash, December 31, 2025