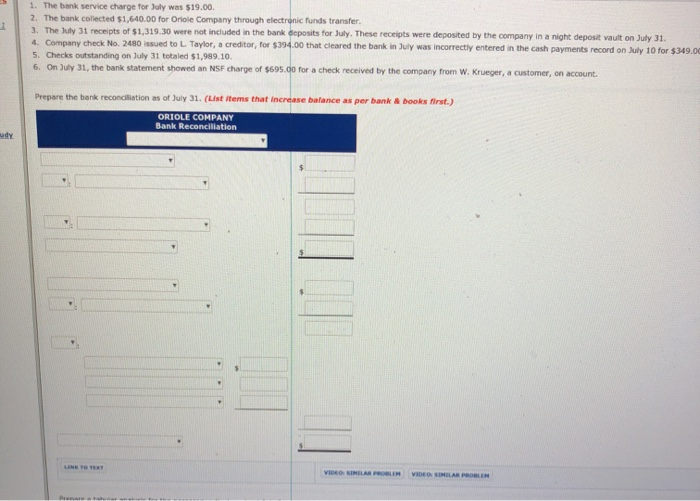

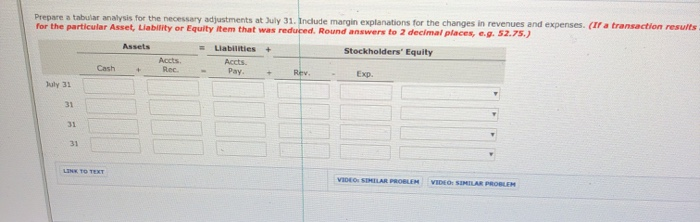

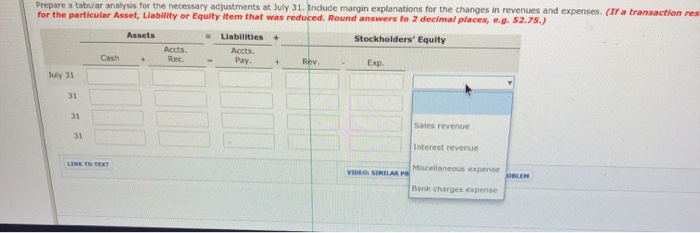

1. The bank service charge for July was $19.00 2. The bank collected $1,640.00 for Oriole Company through electronic funds transfer 3. They 31 receipts of $1,319.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. Company check No. 2480 issued to L. Taylor, a creditor, for $394.00 that cleared the bank in July was incorrectly entered in the cash payments record on July 10 for $349.00 5. Checks outstanding on July 31 totaled $1,989.10. 6. On July 31, the bank statement showed an NSF charge of $695.00 for a check received by the company from W. Krueger, a customer, on account. Prepare the bank reconciliation as of July 31. (ist items that increase balance as per bank & books first.) ORIOLE COMPANY Bank Reconciliation Prepare a tabular analysis for the necessary adjustments at July 31. Include margin explanations for the changes in revenues and expenses. (If a transaction results for the particular Asset Liability or Equity item that was reduced. Round answer to 2 decimal places, e.g. 52.75.) Liabilities + Stockholders' Equity July 31 VIDEO SIMILAR PROBLEM VIDEO SIMILAR PROBLEM Prepare a tabular analysis for the necessary adjustments at July 31. Include margin explanations for the changes in revenues and expenses. (If a transaction res for the particular Asset, Liability or Equity Item that was reduced. Round answers to 2 decimal places, e.g. 52.75.) Assets Liabilities + Stockholders' Equity Aucts. Accts. Cash July 31 sales revenue Interest revenue Miscellaneous expense VIDEO: SIHILAR Bank charges expense 1. The bank service charge for July was $19.00 2. The bank collected $1,640.00 for Oriole Company through electronic funds transfer 3. They 31 receipts of $1,319.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. Company check No. 2480 issued to L. Taylor, a creditor, for $394.00 that cleared the bank in July was incorrectly entered in the cash payments record on July 10 for $349.00 5. Checks outstanding on July 31 totaled $1,989.10. 6. On July 31, the bank statement showed an NSF charge of $695.00 for a check received by the company from W. Krueger, a customer, on account. Prepare the bank reconciliation as of July 31. (ist items that increase balance as per bank & books first.) ORIOLE COMPANY Bank Reconciliation Prepare a tabular analysis for the necessary adjustments at July 31. Include margin explanations for the changes in revenues and expenses. (If a transaction results for the particular Asset Liability or Equity item that was reduced. Round answer to 2 decimal places, e.g. 52.75.) Liabilities + Stockholders' Equity July 31 VIDEO SIMILAR PROBLEM VIDEO SIMILAR PROBLEM Prepare a tabular analysis for the necessary adjustments at July 31. Include margin explanations for the changes in revenues and expenses. (If a transaction res for the particular Asset, Liability or Equity Item that was reduced. Round answers to 2 decimal places, e.g. 52.75.) Assets Liabilities + Stockholders' Equity Aucts. Accts. Cash July 31 sales revenue Interest revenue Miscellaneous expense VIDEO: SIHILAR Bank charges expense