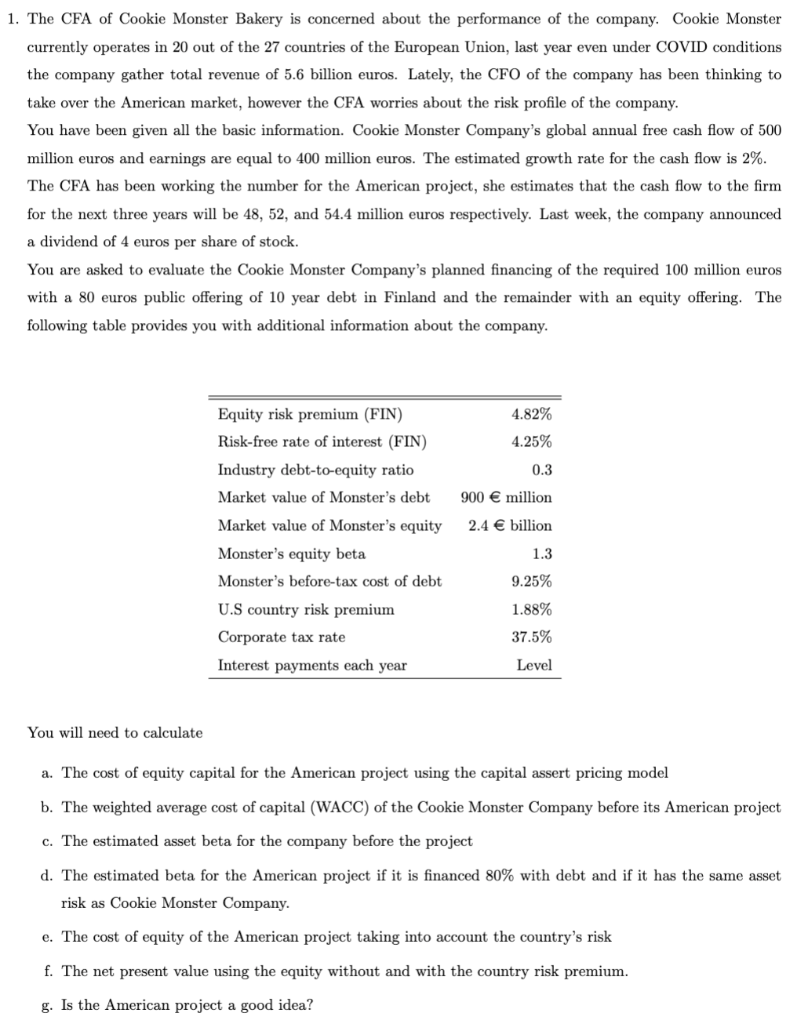

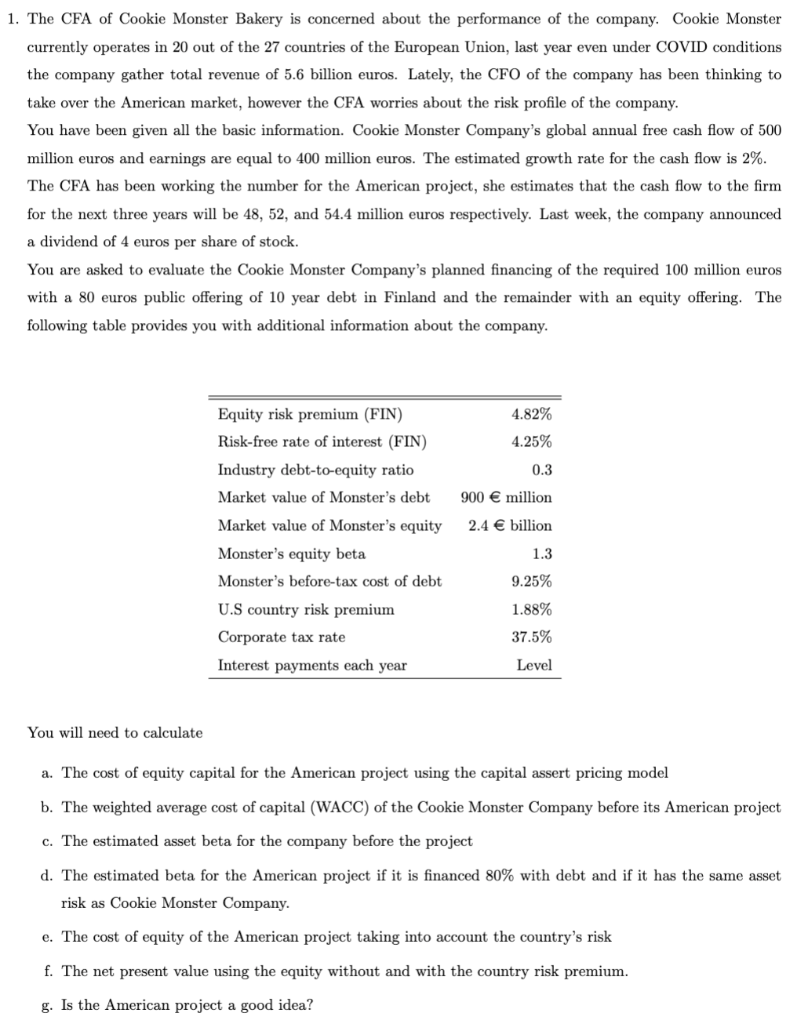

1. The CFA of Cookie Monster Bakery is concerned about the performance of the company. Cookie Monster currently operates in 20 out of the 27 countries of the European Union, last year even under COVID conditions the company gather total revenue of 5.6 billion euros. Lately, the CFO of the company has been thinking to take over the American market, however the CFA worries about the risk profile of the company. You have been given all the basic information. Cookie Monster Company's global annual free cash flow of 500 million euros and earnings are equal to 400 million euros. The estimated growth rate for the cash flow is 2%. The CFA has been working the number for the American project, she estimates that the cash flow to the firm for the next three years will be 48, 52, and 54.4 million euros respectively. Last week, the company announced a dividend of 4 euros per share of stock. You are asked to evaluate the Cookie Monster Company's planned financing of the required 100 million euros with a 80 euros public offering of 10 year debt in Finland and the remainder with an equity offering. The following table provides you with additional information about the company. 4.82% 4.25% 0.3 900 million 2.4 billion Equity risk premium (FIN) Risk-free rate of interest (FIN) Industry debt-to-equity ratio Market value of Monster's debt Market value of Monster's equity Monster's equity beta Monster's before-tax cost of debt U.S country risk premium Corporate tax rate Interest payments each year 1.3 9.25% 1.88% 37.5% Level You will need to calculate a. The cost of equity capital for the American project using the capital assert pricing model b. The weighted average cost of capital (WACC) of the Cookie Monster Company before its American project c. The estimated asset beta for the company before the project d. he estimate beta for the American project if it is financed 80% with debt and if it has the same asset risk as Cookie Monster Company. e. The cost of equity of the American project taking into account the country's risk f. The net present value using the equity without and with the country risk premium. g. Is the American project a good idea