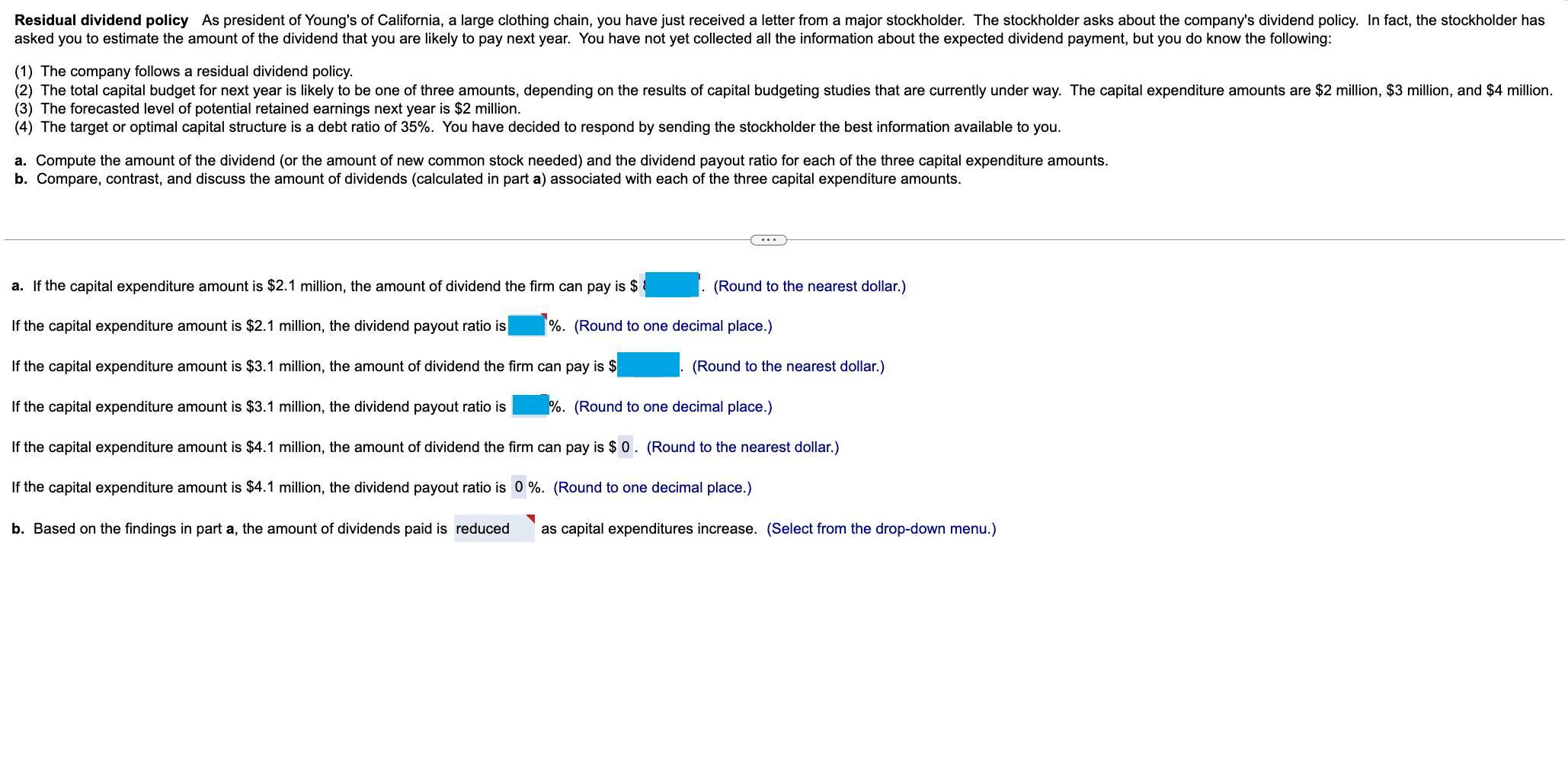

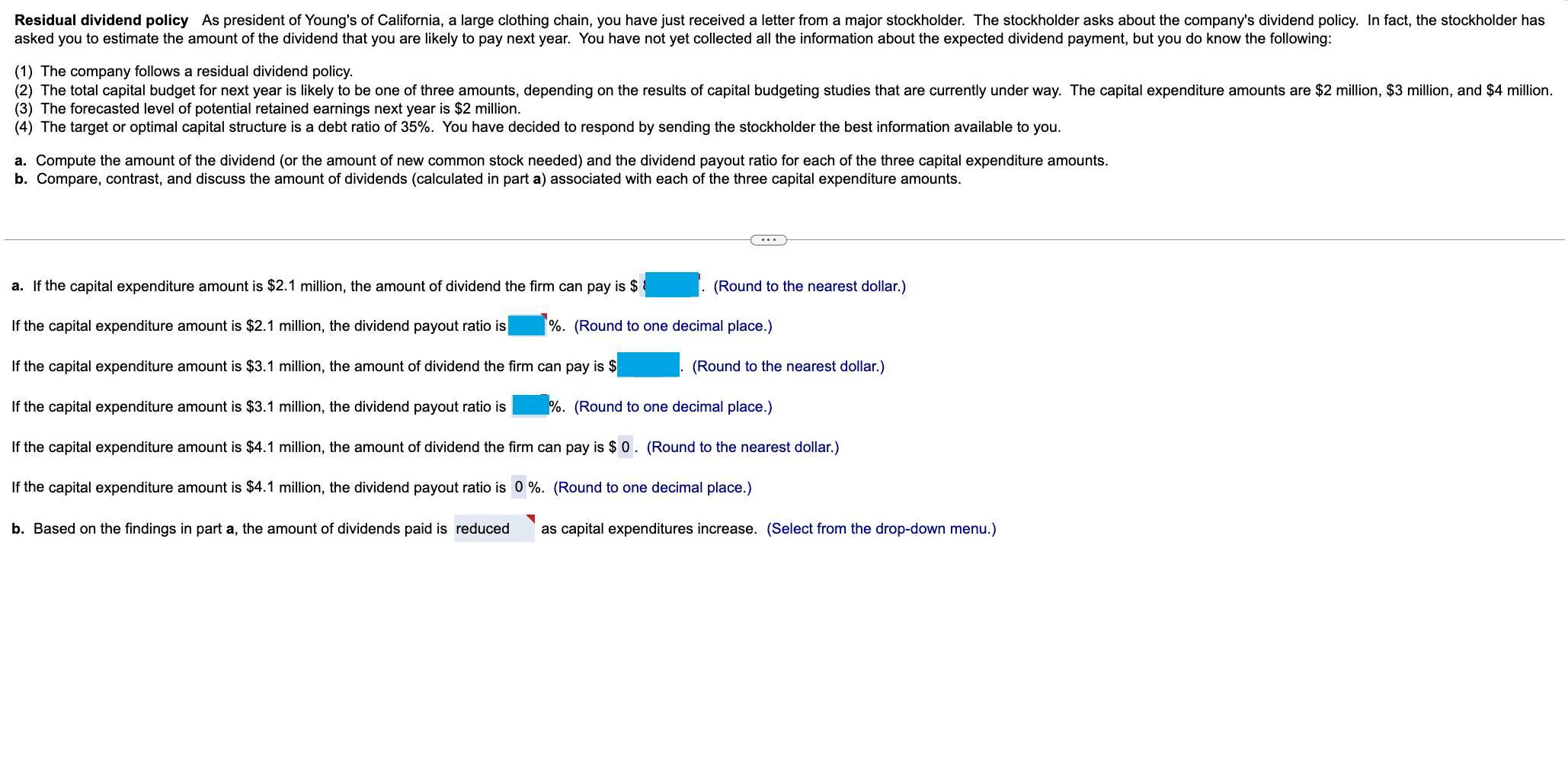

(1) The company follows a residual dividend policy. (3) The forecasted level of potential retained earnings next year is $2 million. (4) The target or optimal capital structure is a debt ratio of 35%. You have decided to respond by sending the stockholder the best information available to you. a. Compute the amount of the dividend (or the amount of new common stock needed) and the dividend payout ratio for each of the three capital expenditure amounts. b. Compare, contrast, and discuss the amount of dividends (calculated in part a) associated with each of the three capital expenditure amounts. a. If the capital expenditure amount is $2.1 million, the amount of dividend the firm can pay is $ (Round to the nearest dollar.) If the capital expenditure amount is $2.1 million, the dividend payout ratio is %. (Round to one decimal place.) If the capital expenditure amount is $3.1 million, the amount of dividend the firm can pay is 9 (Round to the nearest dollar.) If the capital expenditure amount is $3.1 million, the dividend payout ratio is j. (Round to one decimal place.) If the capital expenditure amount is $4.1 million, the amount of dividend the firm can pay is $0. (Round to the nearest dollar.) If the capital expenditure amount is $4.1 million, the dividend payout ratio is 0%. (Round to one decimal place.) b. Based on the findings in part a, the amount of dividends paid is as capital expenditures increase. (Select from the drop-down menu.) (1) The company follows a residual dividend policy. (3) The forecasted level of potential retained earnings next year is $2 million. (4) The target or optimal capital structure is a debt ratio of 35%. You have decided to respond by sending the stockholder the best information available to you. a. Compute the amount of the dividend (or the amount of new common stock needed) and the dividend payout ratio for each of the three capital expenditure amounts. b. Compare, contrast, and discuss the amount of dividends (calculated in part a) associated with each of the three capital expenditure amounts. a. If the capital expenditure amount is $2.1 million, the amount of dividend the firm can pay is $ (Round to the nearest dollar.) If the capital expenditure amount is $2.1 million, the dividend payout ratio is %. (Round to one decimal place.) If the capital expenditure amount is $3.1 million, the amount of dividend the firm can pay is 9 (Round to the nearest dollar.) If the capital expenditure amount is $3.1 million, the dividend payout ratio is j. (Round to one decimal place.) If the capital expenditure amount is $4.1 million, the amount of dividend the firm can pay is $0. (Round to the nearest dollar.) If the capital expenditure amount is $4.1 million, the dividend payout ratio is 0%. (Round to one decimal place.) b. Based on the findings in part a, the amount of dividends paid is as capital expenditures increase. (Select from the drop-down menu.)