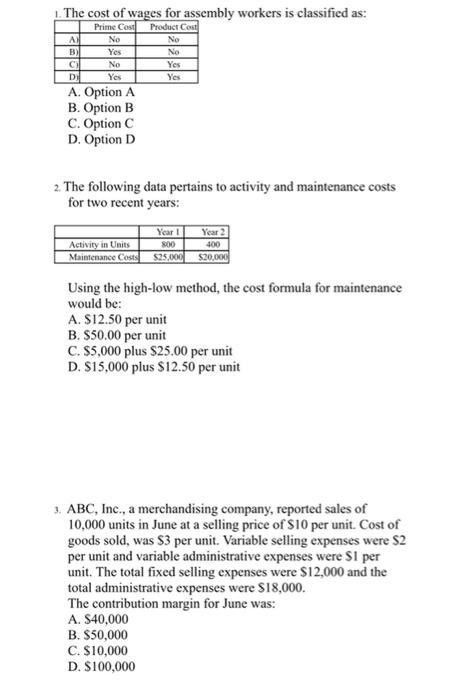

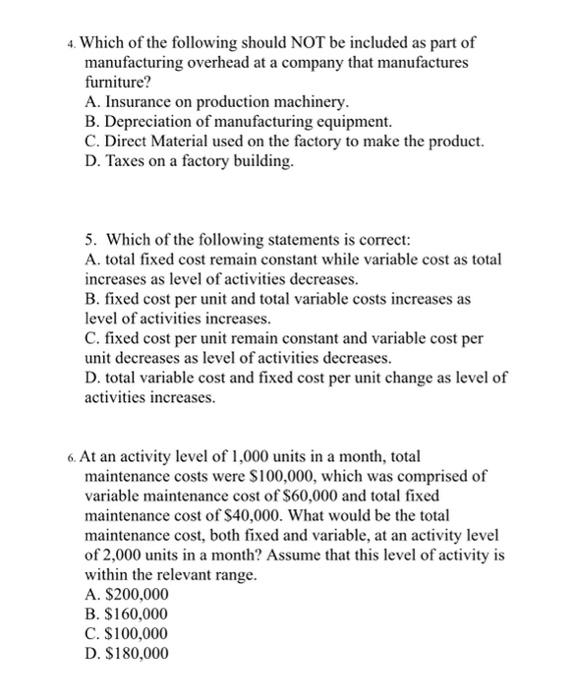

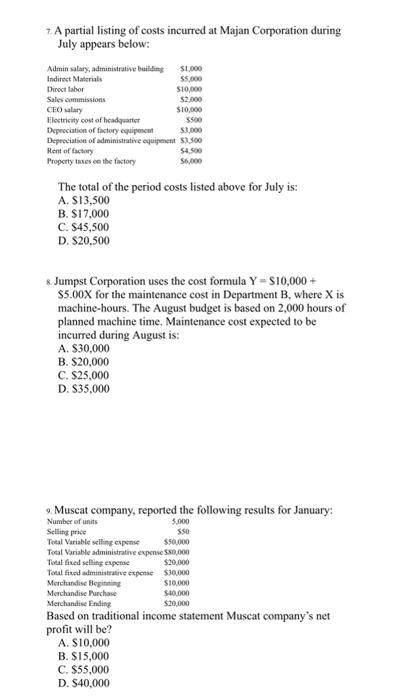

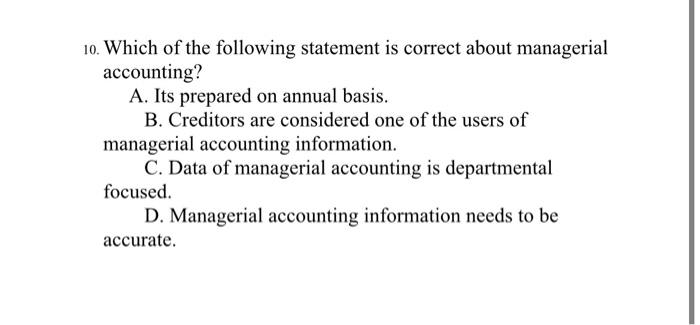

1. The cost of wages for assembly workers is classified as: Prime Cost No Yes No Product Cost No No A B) C) DI Yos Yes Yes A. Option A B. Option B C. Option C D. Option D 2. The following data pertains to activity and maintenance costs for two recent years: Activity in Units Maintenance Costs Year! 800 $25.000 Year 2 400 $20,000 Using the high-low method, the cost formula for maintenance would be: A. $12.50 per unit B. $50.00 per unit C. $5,000 plus $25.00 per unit D. $15,000 plus $12.50 per unit 3. ABC, Inc., a merchandising company, reported sales of 10,000 units in June at a selling price of $10 per unit. Cost of goods sold, was $3 per unit. Variable selling expenses were S2 per unit and variable administrative expenses were S1 per unit. The total fixed selling expenses were $12,000 and the total administrative expenses were $18,000. The contribution margin for June was: A. $40,000 B. $50,000 C. $10,000 D. $100,000 4. Which of the following should NOT be included as part of manufacturing overhead at a company that manufactures furniture? A. Insurance on production machinery. B. Depreciation of manufacturing equipment. C. Direct Material used on the factory to make the product. D. Taxes on a factory building. 5. Which of the following statements is correct: A. total fixed cost remain constant while variable cost as total increases as level of activities decreases. B. fixed cost per unit and total variable costs increases as level of activities increases. C. fixed cost per unit remain constant and variable cost per unit decreases as level of activities decreases. D. total variable cost and fixed cost per unit change as level of activities increases. 6. At an activity level of 1,000 units in a month, total maintenance costs were $100,000, which was comprised of variable maintenance cost of $60,000 and total fixed maintenance cost of $40,000. What would be the total maintenance cost, both fixed and variable, at an activity level of 2,000 units in a month? Assume that this level of activity is within the relevant range. A. $200,000 B. $160,000 C. $100,000 D. $180,000 A partial listing of costs incurred at Majan Corporation during July appears below: Admin salary, administrative building $1,000 Indirect Materials 55.000 Direct labor $10,000 Sales commissions 52.000 CEO salary $10,000 Electricity cost of headquarter 5500 Depreciation of factory equipment S1.000 Depreciation of administrative equipment 1.500 Rent of factory S4.500 Property taxes on the factory $6,000 The total of the period costs listed above for July is: A. S13,500 B. $17,000 C. $45,500 D. $20,500 8. Jumpst Corporation uses the cost formula Y - $10,000+ $5.00x for the maintenance cost in Department B, where X is machine-hours. The August budget is based on 2.000 hours of planned machine time. Maintenance cost expected to be incurred during August is: A. $30,000 B. $20,000 C. $25,000 D. S35,000 $50 Muscat company, reported the following results for January: Number of units 3.000 Selling price Total Variable selling expense $50,000 Total Variable administrative expense 580,000 Totalfixed selling expense $20.000 Total fixed administrative expense $30,000 Merchandise Begitu $10.000 Merchandise Purchase $40.000 Merchandise Ending $20,000 Based on traditional income statement Muscat company's net profit will be? A. $10,000 B. $15,000 C. $55,000 D. S40,000 10. Which of the following statement is correct about managerial accounting? A. Its prepared on annual basis. B. Creditors are considered one of the users of managerial accounting information. C. Data of managerial accounting is departmental focused D. Managerial accounting information needs to be accurate