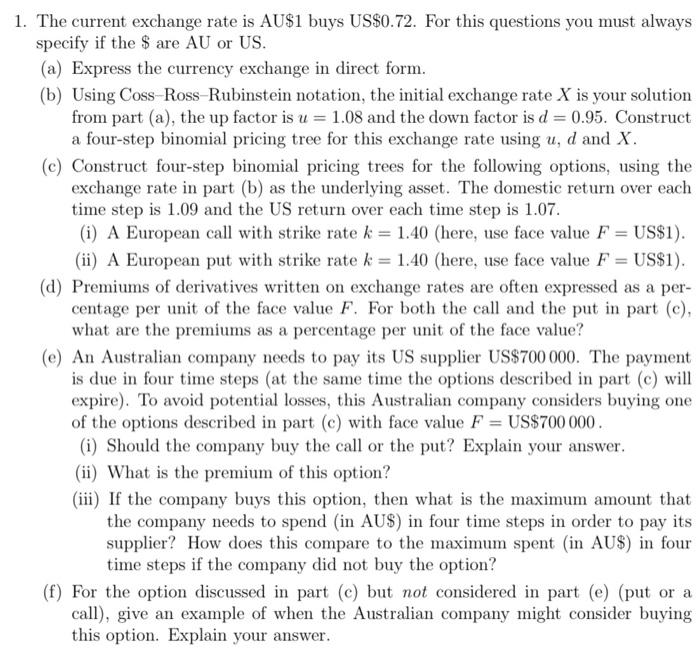

1. The current exchange rate is AU$1 buys US$0.72. For this questions you must always specify if the $ are AU or US. (a) Express the currency exchange in direct form. (b) Using Coss-Ross Rubinstein notation, the initial exchange rate X is your solution from part (a), the up factor is u = 1.08 and the down factor is d = 0.95. Construct a four-step binomial pricing tree for this exchange rate using u, d and X. (c) Construct four-step binomial pricing trees for the following options, using the exchange rate in part (b) as the underlying asset. The domestic return over each time step is 1.09 and the US return over each time step is 1.07. (i) A European call with strike rate k = 1.40 (here, use face value F = US$1). (ii) A European put with strike rate k = 1.40 (here, use face value F = US$1). (d) Premiums of derivatives written on exchange rates are often expressed as a per- centage per unit of the face value F. For both the call and the put in part (e), what are the premiums as a percentage per unit of the face value? (e) An Australian company needs to pay its US supplier US$700 000. The payment is due in four time steps (at the same time the options described in part (c) will expire). To avoid potential losses, this Australian company considers buying one of the options described in part (e) with face value F = US$700 000. (i) Should the company buy the call or the put? Explain your answer. (ii) What is the premium of this option? (iii) If the company buys this option, then what is the maximum amount that the company needs to spend (in AU$) in four time steps in order to pay its supplier? How does this compare to the maximum spent (in AU$) in four time steps if the company did not buy the option? (f) For the option discussed in part (e) but not considered in part (e) (put or a call), give an example of when the Australian company might consider buying this option. Explain your answer. 1. The current exchange rate is AU$1 buys US$0.72. For this questions you must always specify if the $ are AU or US. (a) Express the currency exchange in direct form. (b) Using Coss-Ross Rubinstein notation, the initial exchange rate X is your solution from part (a), the up factor is u = 1.08 and the down factor is d = 0.95. Construct a four-step binomial pricing tree for this exchange rate using u, d and X. (c) Construct four-step binomial pricing trees for the following options, using the exchange rate in part (b) as the underlying asset. The domestic return over each time step is 1.09 and the US return over each time step is 1.07. (i) A European call with strike rate k = 1.40 (here, use face value F = US$1). (ii) A European put with strike rate k = 1.40 (here, use face value F = US$1). (d) Premiums of derivatives written on exchange rates are often expressed as a per- centage per unit of the face value F. For both the call and the put in part (e), what are the premiums as a percentage per unit of the face value? (e) An Australian company needs to pay its US supplier US$700 000. The payment is due in four time steps (at the same time the options described in part (c) will expire). To avoid potential losses, this Australian company considers buying one of the options described in part (e) with face value F = US$700 000. (i) Should the company buy the call or the put? Explain your answer. (ii) What is the premium of this option? (iii) If the company buys this option, then what is the maximum amount that the company needs to spend (in AU$) in four time steps in order to pay its supplier? How does this compare to the maximum spent (in AU$) in four time steps if the company did not buy the option? (f) For the option discussed in part (e) but not considered in part (e) (put or a call), give an example of when the Australian company might consider buying this option. Explain your