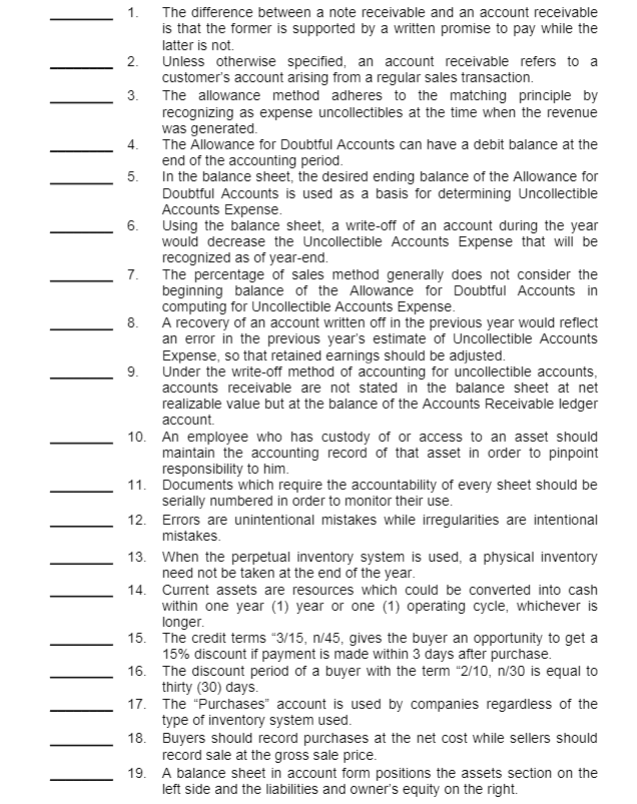

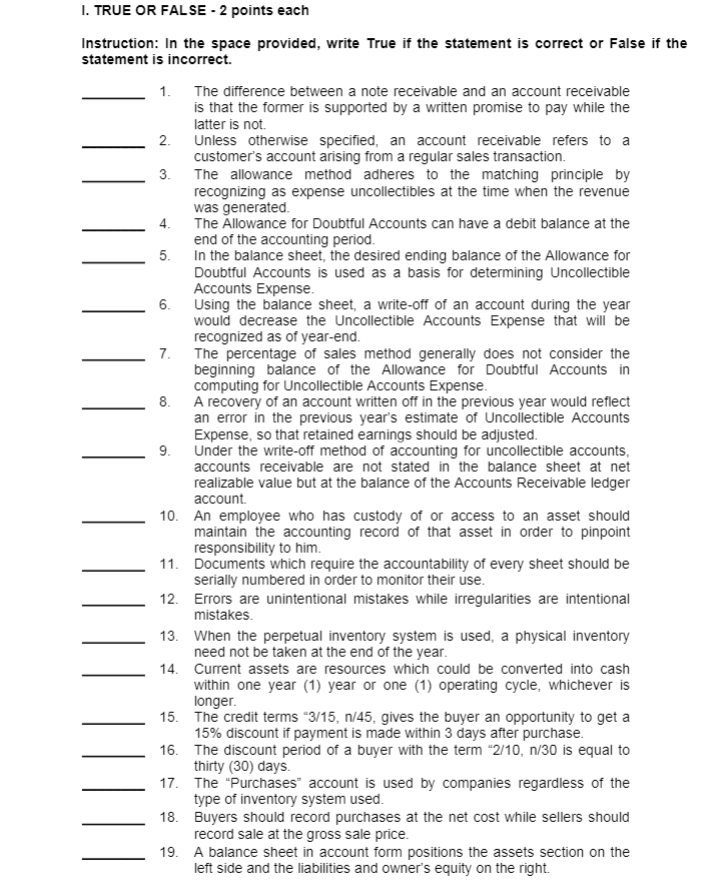

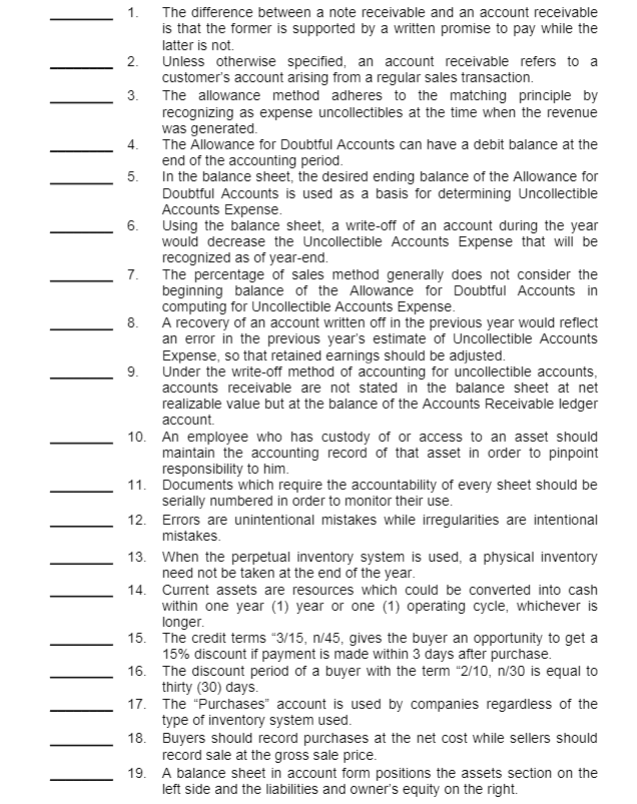

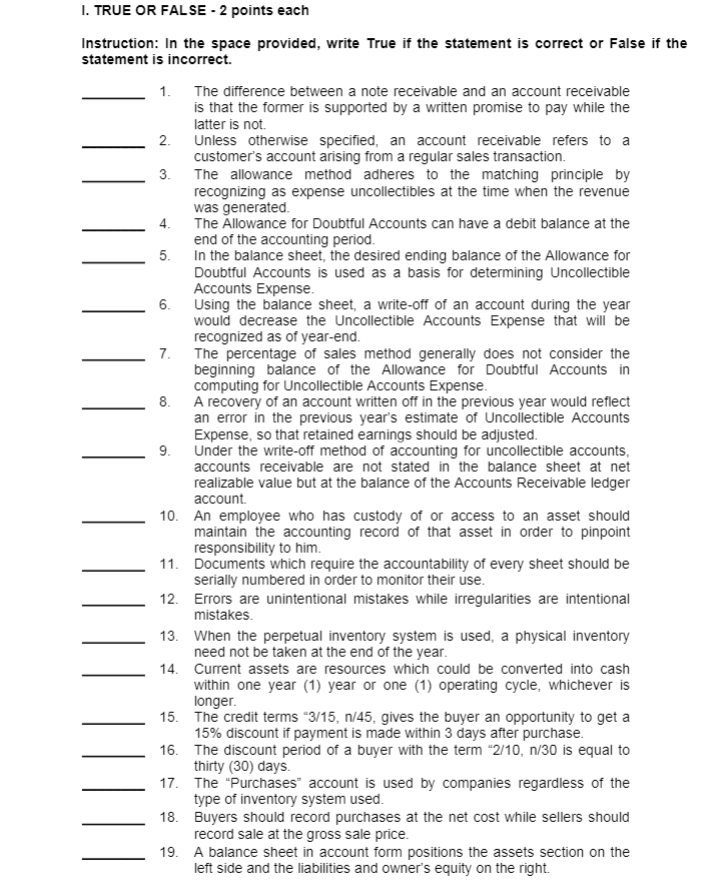

1. The difference between a note receivable and an account receivable is that the former is supported by a written promise to pay while the latter is not 2. Unless otherwise specified, an account receivable refers to a customer's account arising from a regular sales transaction. 3. The allowance method adheres to the matching principle by recognizing as expense uncollectibles at the time when the revenue was generated. 4. The Allowance for Doubtful Accounts can have a debit balance at the end of the accounting period. 5. In the balance sheet, the desired ending balance of the Allowance for Doubtful Accounts is used as a basis for determining Uncollectible Accounts Expense. 6. Using the balance sheet, a write-off of an account during the year would decrease the Uncollectible Accounts Expense that will be recognized as of year-end. 7. The percentage of sales method generally does not consider the beginning balance of the Allowance for Doubtful Accounts in computing for Uncollectible Accounts Expense. 8. A recovery of an account written off in the previous year would reflect an error in the previous year's estimate of Uncollectible Accounts Expense, so that retained earnings should be adjusted. 9. Under the write-off method of accounting for uncollectible accounts, accounts receivable are not stated in the balance sheet at net realizable value but at the balance of the Accounts Receivable ledger account 10. An employee who has custody of or access to an asset should maintain the accounting record of that asset in order to pinpoint responsibility to him. 11. Documents which require the accountability of every sheet should be serially numbered in order to monitor their use. 12. Errors are unintentional mistakes while irregularities are intentional mistakes. 13. When the perpetual inventory system is used, a physical inventory need not be taken at the end of the year. 14. Current assets are resources which could be converted into cash within one year (1) year or one (1) operating cycle, whichever is longer. 15. The credit terms "3/15, 1/45, gives the buyer an opportunity to get a 15% discount if payment is made within 3 days after purchase. 16. The discount period of a buyer with the term "2/10, 1/30 is equal to thirty (30) days. 17. The "Purchases account is used by companies regardless of the type of inventory system used. 18. Buyers should record purchases at the net cost while sellers should record sale at the gross sale price. 19. A balance sheet in account form positions the assets section on the left side and the liabilities and owner's equity on the right. 1. TRUE OR FALSE - 2 points each Instruction: In the space provided, write True if the statement is correct or False if the statement is incorrect. 1. The difference between a note receivable and an account receivable is that the former is supported by a written promise to pay while the latter is not 2. Unless otherwise specified, an account receivable refers to a customer's account arising from a regular sales transaction. 3. The allowance method adheres to the matching principle by recognizing as expense uncollectibles at the time when the revenue was generated. 4. The Allowance for Doubtful Accounts can have a debit balance at the end of the accounting period. 5. In the balance sheet, the desired ending balance of the Allowance for Doubtful Accounts is used as a basis for determining Uncollectible Accounts Expense. 6. Using the balance sheet, a write-off of an account during the year would decrease the Uncollectible Accounts Expense that will be recognized as of year-end. 7. The percentage of sales method generally does not consider the beginning balance of the Allowance for Doubtful Accounts in computing for Uncollectible Accounts Expense. 8. A recovery of an account written off in the previous year would reflect an error in the previous year's estimate of Uncollectible Accounts Expense, so that retained earnings should be adjusted. 9. Under the write-off method of accounting for uncollectible accounts, accounts receivable are not stated in the balance sheet at net realizable value but at the balance of the Accounts Receivable ledger account 10. An employee who has custody of or access to an asset should maintain the accounting record of that asset in order to pinpoint responsibility to him. 11. Documents which require the accountability of every sheet should be serially numbered in order to monitor their use. 12. Errors are unintentional mistakes while irregularities are intentional mistakes. 13. When the perpetual inventory system is used, a physical inventory need not be taken at the end of the year. 14. Current assets are resources which could be converted into cash within one year (1) year or one (1) operating cycle, whichever is longer. 15. The credit terms 3/15, n/45, gives the buyer an opportunity to get a 15% discount if payment is made within 3 days after purchase. 16. The discount period of a buyer with the term "2/10, n/30 is equal to thirty (30) days. 17. The Purchases" account is used by companies regardless of the type of inventory system used. 18. Buyers should record purchases at the net cost while sellers should record sale at the gross sale price. 19. A balance sheet in account form positions the assets section on the left side and the liabilities and owner's equity on the right