Question

1. The equipment has a delivered cost of $105,000. An additional $3,000 is required to install and test the new system. 2. The new pumping

1. The equipment has a delivered cost of $105,000. An additional $3,000 is required to install and test the new system.

2. The new pumping system is classified by the IRS as 5-year property, although it has an 8-year estimated service life. For assets classified by the IRS as 5-year property, the Modified Accelerated Cost Recovery System (MACRS) permits the company to depreciate the asset over 6 years at the following rates: Year 1 = 20 percent, Year 2 = 32 percent, Year 3 = 19 percent, Year 4 = 12 percent, Year 5 = 11 percent, Year 6 = 6 percent. At the 5 end of 8 years, the salvage value is expected to be around 5 percent of the original purchase price, so the best estimate of salvage value at the end of the equipment's service life is $5,300, with removal costs of $1,200.

3. The existing pumping system was purchased at $45,000 eight years ago and has been depreciated on a straight-line basis over its economic life of 10 years. If the existing system is removed from the well and crated for pickup, it can be sold for $3,500 before tax. It will cost $1,000 to remove the system and crate it.

4. At the time of replacement, the firm will need to increase its net working capital requirements by $4,500 to support inventories.

5. The new pumping system offers lower maintenance costs and frees personnel who would otherwise have to monitor the system. In addition, it reduces product wastage because of a higher cooling efficiency. In total, it is estimated that the yearly savings will amount to $25,000 if the new pumping system is used.

6. The firm has its target debt ratio of 30 percent, and its cost of new debt is 10 percent. Its expected dividend per share next year, D1, is $2.00 with a future growth rate of 6 percent per year. The firms current stock price, P0, is $40.00. The firm uses its overall weighted average cost of capital in evaluating average risk projects, and the replacement project is perceived to be of average risk.

7. The firms federal-plus-state tax rate is 30 percent, and this rate is projected to remain fairly constant into the future. QUESTIONS (Please show all your work either through Excel formulas/equations on the Cash Flow Estimation Worksheet or in separate tables at the bottom of your spreadsheet, whenever applicable. NO WORK SHOWN, NO POINTS.)

(8 pts) 1. Compute the firms weighted average cost of capital given the info/data in the case. What other approaches/methods can be used to measure the firms cost of equity and thus its WACC? To that end, what additional info/data would you need? (Hint: A firms weighted average cost of capital is equal to = ()(1 - t) + , where and are the weights of debt and equity in the capital structure; and are the respective costs of debt and equity; and t is the corporate tax rate; Do no round up your WACC figure.) 6

(34 pts) 2. Develop a capital budgeting schedule using the attached Cash Flow Estimation Worksheet (Excel spreadsheet) that should list all relevant cash flow items and amounts related to the replacement project over the 8-year expected life of the new pumping system. (Reference Reading: Cash Flow Analysis Example (RIC Project), one of required Readings for the course.)

(8 pts) 3. Based on the capital budgeting schedule, evaluate the replacement project by computing NV, IRR, MIRR, and Payback Period. Would you recommend to accept or reject the replacement project based solely on your DCF analysis so far?

(10 pts) 4. Before you make the final accept/reject decision, what other factors and approaches would you consider further? Discuss also how to PRACTICALLY take into account those factors and approaches in the capital budgeting decision process, whenever applicable. (Reference Reading: (1) Textbook Chapter 11; and (2) Capital Asset Management Process: the Case of Hose & Fittings Corporation by Bae et al., International Journal of Managerial Finance (IJMF), Vol. 1, No. 3, 2005, pp. 204-220, one of required Readings for the course.)

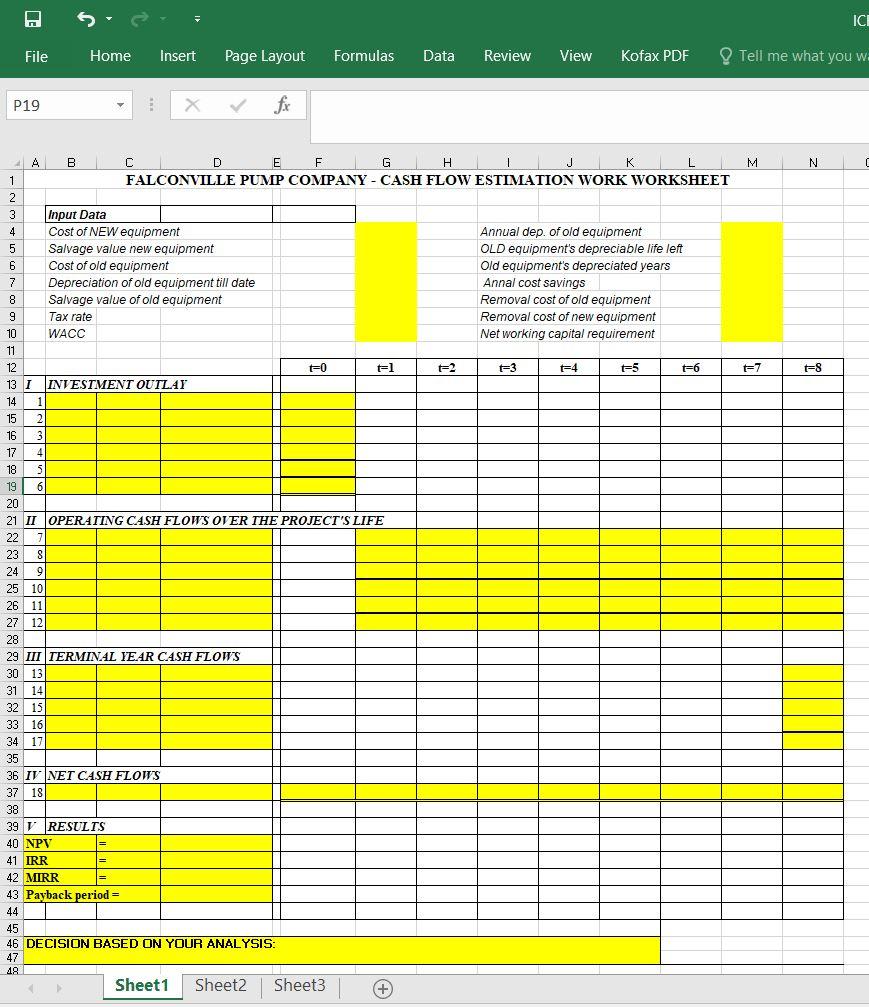

Please use the Excel Format Below:

ICI File Home Insert Page Layout Formulas Data Review View Kofax PDF Tell me what you w P19 fir M N t=7 t=8 4A B C D E F G H J K L 1 FALCONVILLE PUMP COMPANY - CASH FLOW ESTIMATION WORK WORKSHEET 2 3 Input Data 4 Cost of NEW equipment Annual dep. of old equipment 5 Salvage value new equipment OLD equipment's depreciable life left 6 Cost of old equipment Old equipment's depreciated years 7 Depreciation of old equipment till date Annal cost savings 8 Salvage value of old equipment Removal cost of old equipment 9 Tax rate Removal cost of new equipment 10 WACC Networking capital requirement 11 12 FO t=1 3 TE=4 t5 t=6 13 I INTESTMENT OUTLAY 14 1 15 2 16 3 17 4 5 19 6 20 21 II OPERATING CASH FLOWS OVER THE PROJECT'S LIFE 22 23 8 24 9 25 10 26 11 27 12 28 29 III TERMINAL YEAR CASH FLOWS 30 13 31 14 32 15 33 16 34 17 35 36 IV NET CASH FLOWS 37 18 38 39 V RESULTS 40 NPV 41 IRR 42 MRR 43 Payback period 44 45 46 DECISION BASED ON YOUR ANALYSIS: 47 48 Sheet1 Sheet2 Sheet3 = =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started