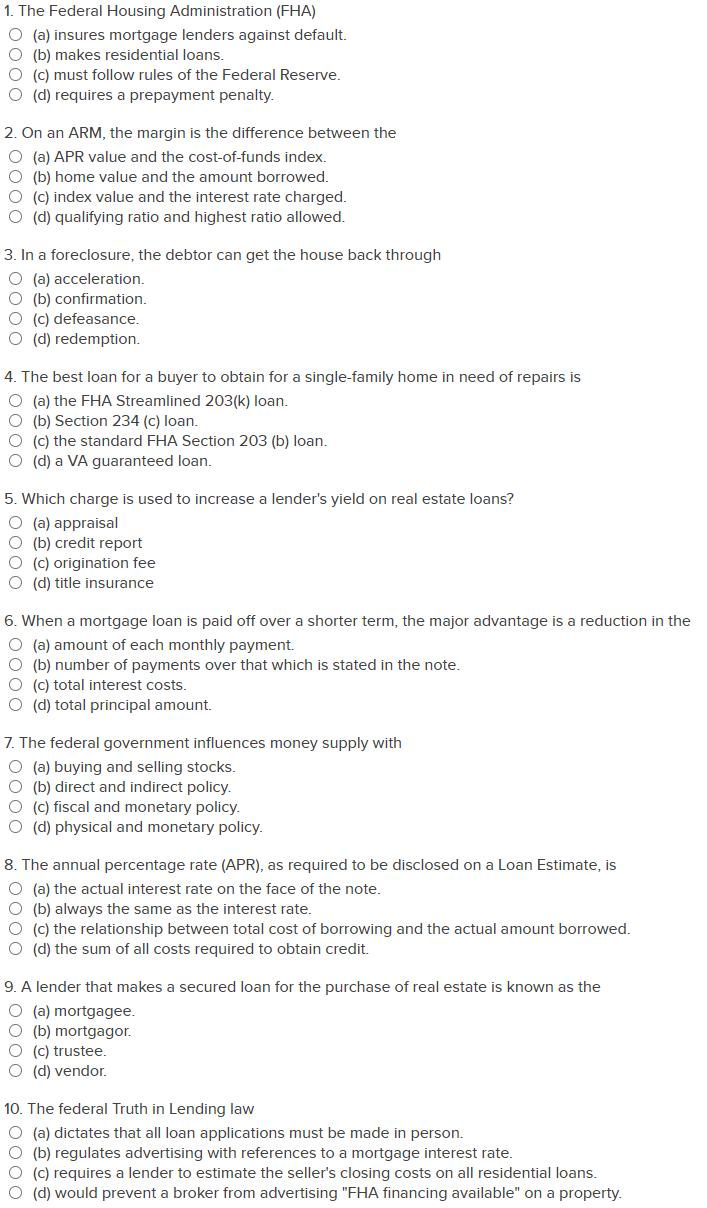

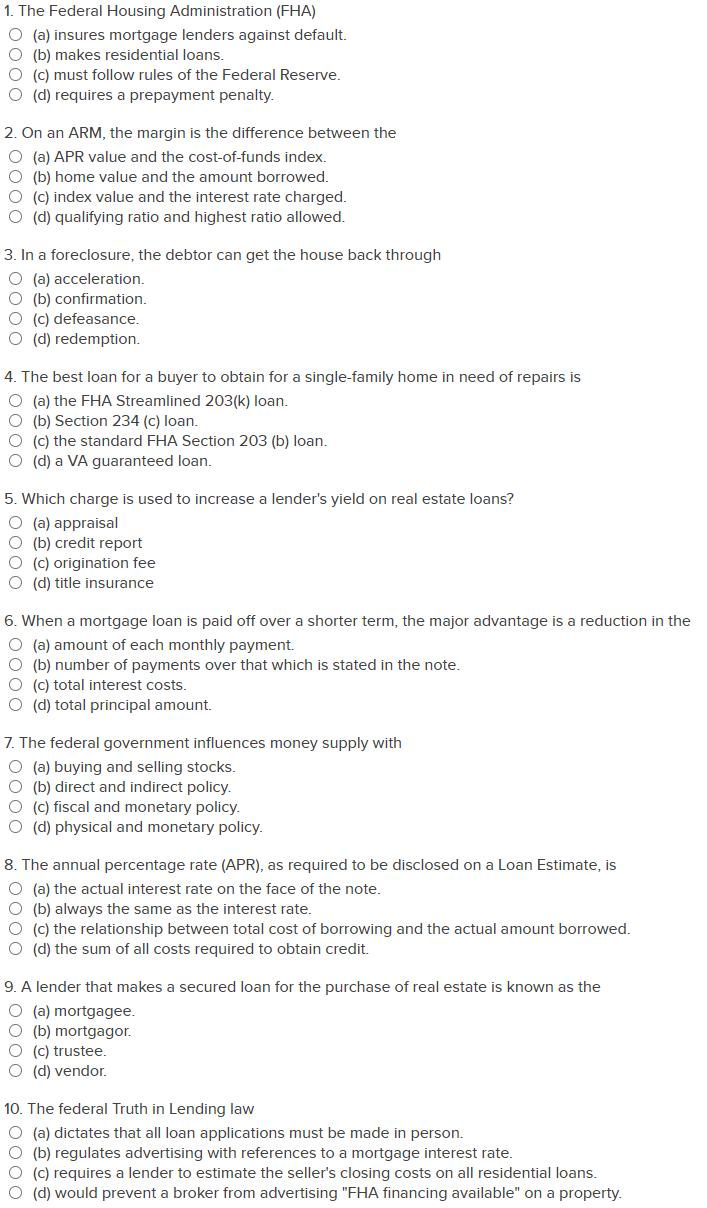

1. The Federal Housing Administration (FHA) (a) insures mortgage lenders against default. (b) makes residential loans. O (c) must follow rules of the Federal Reserve. (d) requires a prepayment penalty. 2. On an ARM, the margin is the difference between the O (a) APR value and the cost-of-funds index O (b) home value and the amount borrowed. O (c) index value and the interest rate charged. (d) qualifying ratio and highest ratio allowed. 3. In a foreclosure, the debtor can get the house back through O (a) acceleration. O (b) confirmation. O (c) defeasance. O (d) redemption. 4. The best loan for a buyer to obtain for a single-family home in need of repairs is O (a) the FHA Streamlined 203(k) loan. O (b) Section 234 (c) loan. O (c) the standard FHA Section 203 (b) loan. O (d) a VA eed loan. 5. Which charge is used to increase a lender's yield on real estate loans? (a) appraisal O (b) credit report O (c) origination fee O (d) title insurance 6. When a mortgage loan is paid off over a shorter term, the major advantage is a reduction in the (a) amount of each monthly payment. (b) number of payments over that which is stated in the note. O (c) total interest costs. O (d) total principal amount. 7. The federal government influences money supply with O (a) buying and selling stocks. (b) direct and indirect policy. O (c) fiscal and monetary policy. (d) physical and monetary policy. 8. The annual percentage rate (APR), as required to be disclosed on a Loan Estimate, is O (a) the actual interest rate on the face of the note. O (b) always the same as the interest rate. O (c) the relationship between total cost of borrowing and the actual amount borrowed. O (d) the sum of all costs required to obtain credit 9. A lender that makes a secured loan for the purchase of real estate is known as the O (a) mortgagee. O (b) mortgagor. O (c) trustee. O (d) vendor. 10. The federal Truth in Lending law O (a) dictates that all loan applications must be made in person. O (b) regulates advertising with references to a mortgage interest rate. O (c) requires a lender to estimate the seller's closing costs on all residential loans. O (d) would prevent a broker from advertising "FHA financing available" on a property