Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The finance text is expensive, and an entrepreneurial student Bella found that I would have 75 students during the next. Term. She found

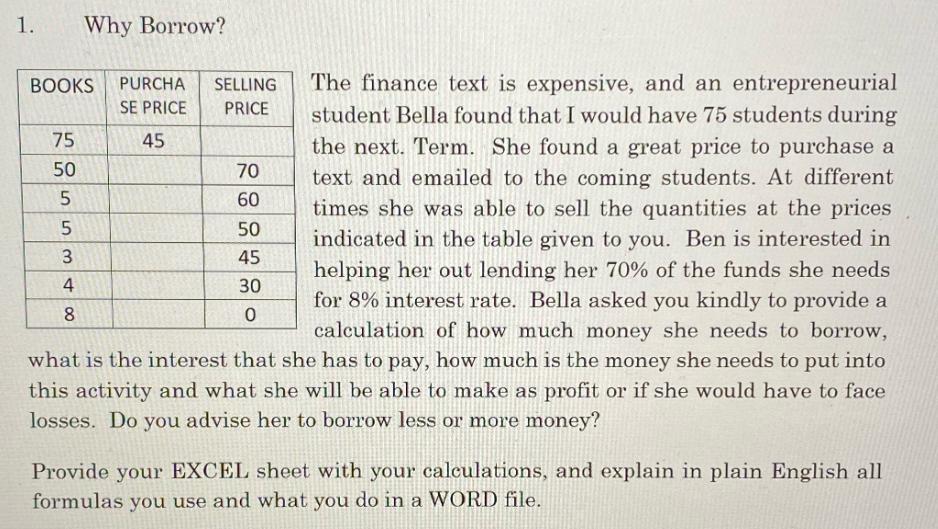

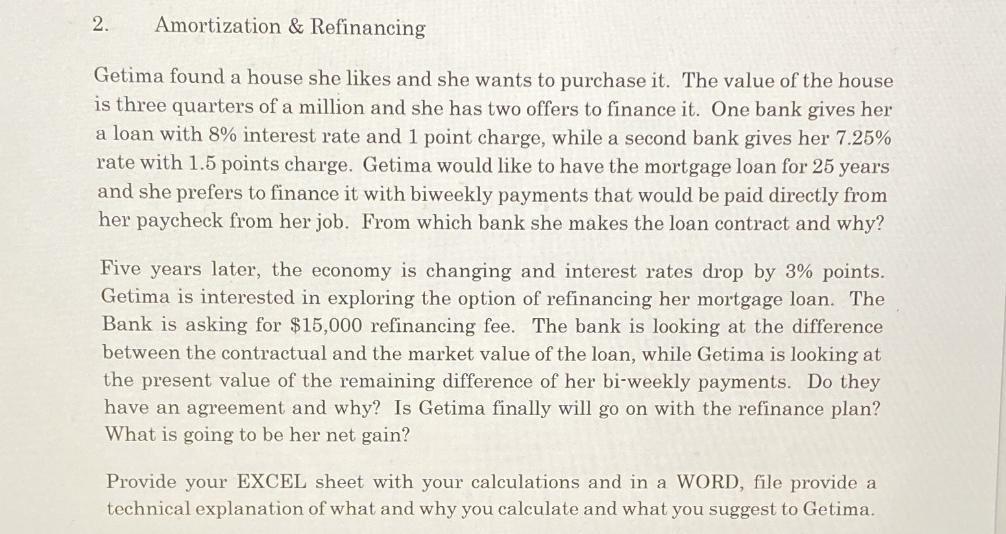

1. The finance text is expensive, and an entrepreneurial student Bella found that I would have 75 students during the next. Term. She found a great price to purchase a text and emailed to the coming students. At different times she was able to sell the quantities at the prices indicated in the table given to you. Ben is interested in helping her out lending her 70% of the funds she needs for 8% interest rate. Bella asked you kindly to provide a calculation of how much money she needs to borrow, what is the interest that she has to pay, how much is the money she needs to put into this activity and what she will be able to make as profit or if she would have to face losses. Do you advise her to borrow less or more money? BOOKS 75 50 Why Borrow? 553 4 8 PURCHA SELLING SE PRICE PRICE 45 70 60 50 45 30 0 Provide your EXCEL sheet with your calculations, and explain in plain English all formulas you use and what you do in a WORD file. Amortization & Refinancing Getima found a house she likes and she wants to purchase it. The value of the house is three quarters of a million and she has two offers to finance it. One bank gives her a loan with 8% interest rate and 1 point charge, while a second bank gives her 7.25% rate with 1.5 points charge. Getima would like to have the mortgage loan for 25 years and she prefers to finance it with biweekly payments that would be paid directly from her paycheck from her job. From which bank she makes the loan contract and why? 2. Five years later, the economy is changing and interest rates drop by 3% points. Getima is interested in exploring the option of refinancing her mortgage loan. The Bank is asking for $15,000 refinancing fee. The bank is looking at the difference between the contractual and the market value of the loan, while Getima is looking at the present value of the remaining difference of her bi-weekly payments. Do they have an agreement and why? Is Getima finally will go on with the refinance plan? What is going to be her net gain? Provide your EXCEL sheet with your calculations and in a WORD, file provide a technical explanation of what and why you calculate and what you suggest to Getima. 1. The finance text is expensive, and an entrepreneurial student Bella found that I would have 75 students during the next. Term. She found a great price to purchase a text and emailed to the coming students. At different times she was able to sell the quantities at the prices indicated in the table given to you. Ben is interested in helping her out lending her 70% of the funds she needs for 8% interest rate. Bella asked you kindly to provide a calculation of how much money she needs to borrow, what is the interest that she has to pay, how much is the money she needs to put into this activity and what she will be able to make as profit or if she would have to face losses. Do you advise her to borrow less or more money? BOOKS 75 50 Why Borrow? 553 4 8 PURCHA SELLING SE PRICE PRICE 45 70 60 50 45 30 0 Provide your EXCEL sheet with your calculations, and explain in plain English all formulas you use and what you do in a WORD file. Amortization & Refinancing Getima found a house she likes and she wants to purchase it. The value of the house is three quarters of a million and she has two offers to finance it. One bank gives her a loan with 8% interest rate and 1 point charge, while a second bank gives her 7.25% rate with 1.5 points charge. Getima would like to have the mortgage loan for 25 years and she prefers to finance it with biweekly payments that would be paid directly from her paycheck from her job. From which bank she makes the loan contract and why? 2. Five years later, the economy is changing and interest rates drop by 3% points. Getima is interested in exploring the option of refinancing her mortgage loan. The Bank is asking for $15,000 refinancing fee. The bank is looking at the difference between the contractual and the market value of the loan, while Getima is looking at the present value of the remaining difference of her bi-weekly payments. Do they have an agreement and why? Is Getima finally will go on with the refinance plan? What is going to be her net gain? Provide your EXCEL sheet with your calculations and in a WORD, file provide a technical explanation of what and why you calculate and what you suggest to Getima.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation for Bellas Borrowing To calculate how much money Bella needs to borrow we need to determine the total cost of purchasing the books and c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started