Answered step by step

Verified Expert Solution

Question

1 Approved Answer

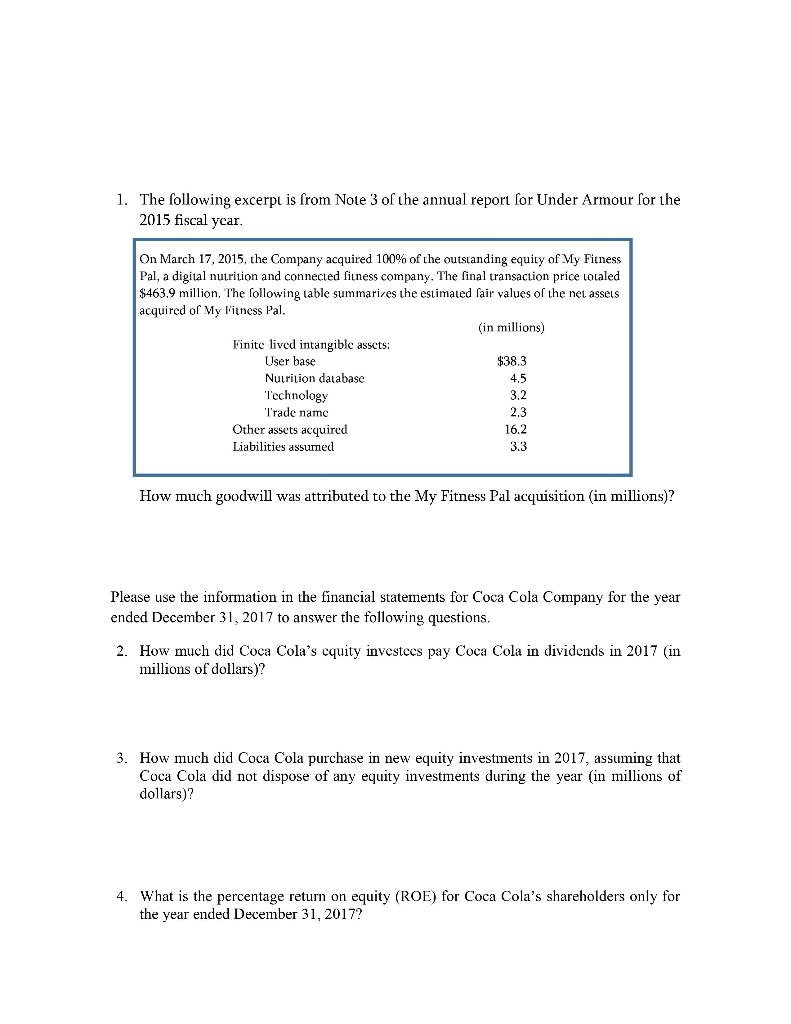

1. The following excerpt is from Note 3 of the annual report for Under Armour for the 2015 fiscal year. On March 17, 2015, the

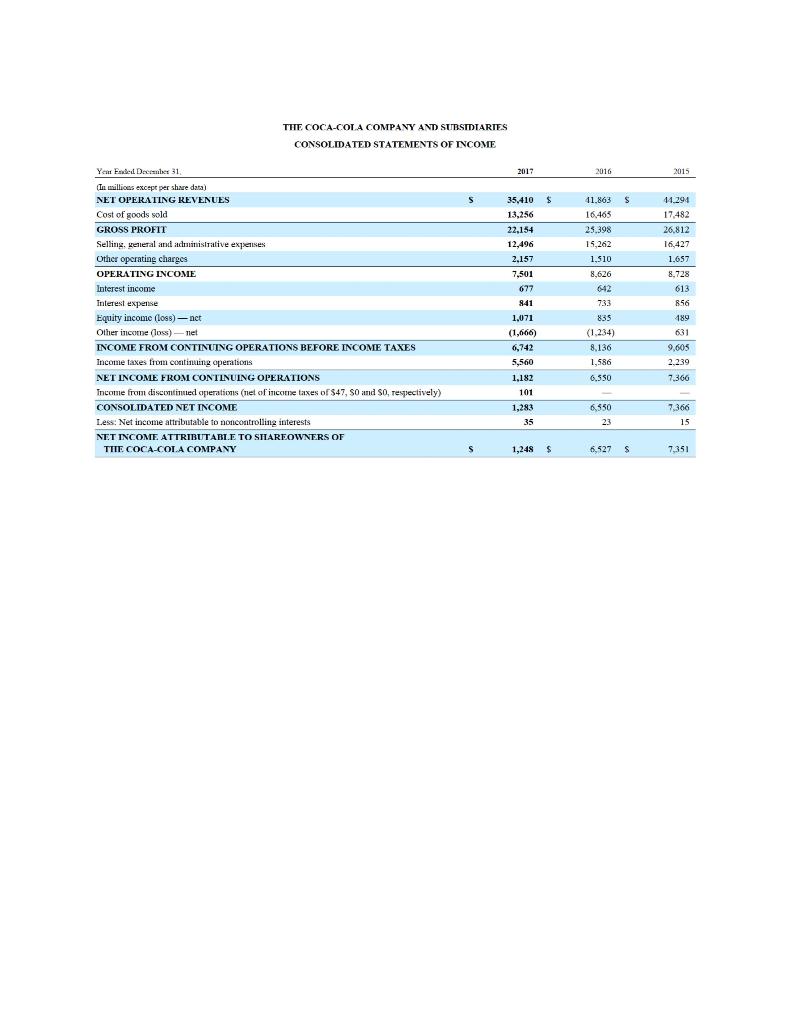

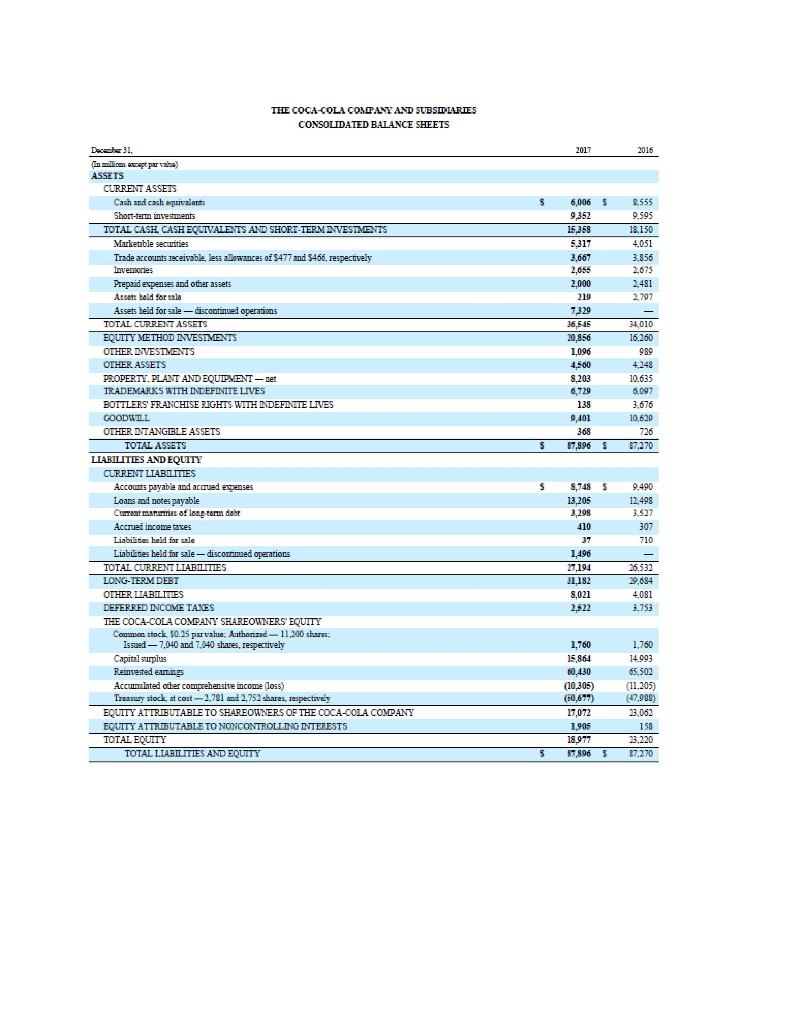

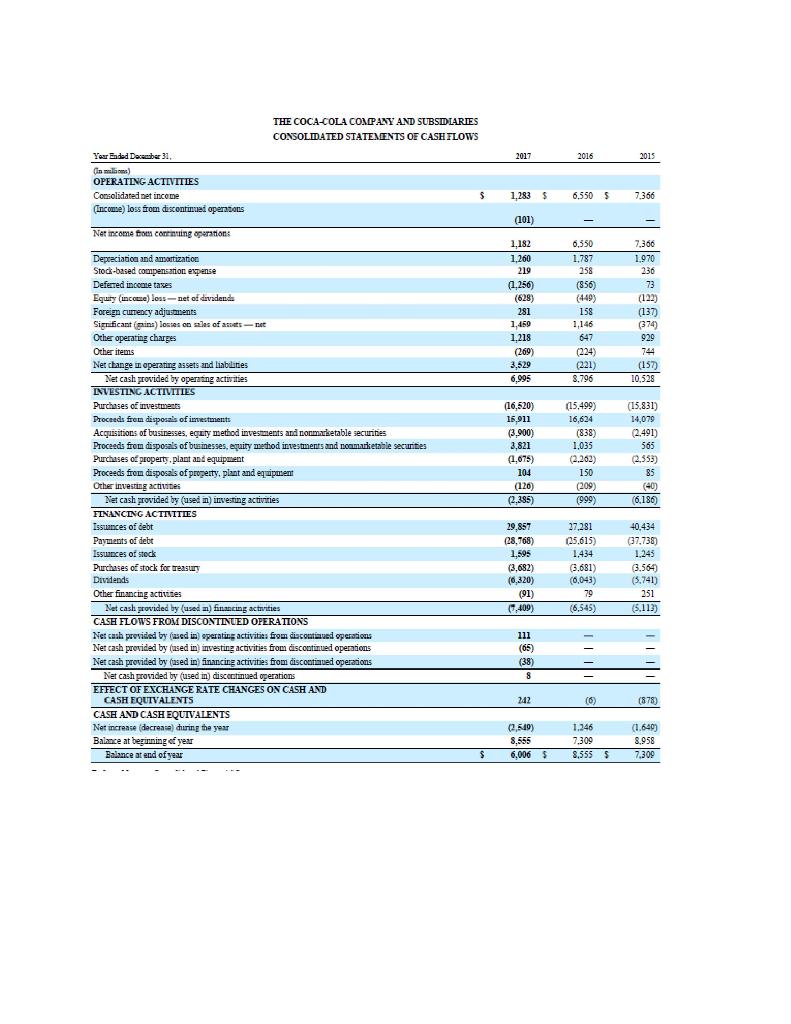

1. The following excerpt is from Note 3 of the annual report for Under Armour for the 2015 fiscal year. On March 17, 2015, the Company acquired 100% of the outstanding equity of My Fitness Pal, a digital nutrition and connected fitness company. The final transaction price localed $463.9 million. The following table summarizes the estimated fair values of the net assets acquired of My litness Pal. (in millions) Finite lived intangible assets: User base $38.3 Nutrition database 4,5 Technology 3,2 Trade name 2.3 Other assets acquired 16.2 Liabilities assumed 3.3 How much goodwill was attributed to the My Fitness Pal acquisition (in millions)? Please use the information in the financial statements for Coca Cola Company for the year ended December 31, 2017 to answer the following questions. 2. How much did Coca Cola's cquity investees pay Coca Cola in dividends in 2017 (in millions of dollars)? 3. How much did Coca Cola purchase in new equity investments in 2017, assuming that Coca Cola did not dispose of any equity investments during the year (in millions of dollars)? 4. What is the percentage return on equity (ROE) for Coca Cola's shareholders only for the year ended December 31, 2017? THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME Ye Faded December 31 2017 2016 2015 41.863 $ 35,410 $ 13,256 22,154 12.496 2.157 7,501 677 16,465 25.398 15.262 44.291 17.482 26.812 16,427 1.657 8.728 613 1,510 8,626 642 733 841 856 (In millions except per share data) NET OPERATING KEVENUES Cost of goods sold GROSS PROFIT Selling, elleral and administrative expenses Other operating charges OPERATING INCOME Interest income Interest expense Equity income (Loss) -act Other income (oss) Tet INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes from continuing operations NET INCOME FROM CONTINUING OPERATIONS Income from discontinued operations (niet of income taxes of 547, SO and So, respectively) CONSOLIDATED NET INCOME Less: Net income attributable to non controlling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF TIIE COCA-COLA COMPANY 835 (1.234) 489 6.31 1,071 (1,666) 6,742 5,560 1.182 8.136 1,586 6.550 9,605 2.239 7.366 101 1,283 6,350 7,366 15 35 23 S 1,248 $ 6,527 S 7,351 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS 2017 2016 s 8.555 9.595 18.150 4,051 3.856 2.673 2.481 2.797 6,006 5 9,352 15,358 5,317 3,667 2,055 2,000 219 7.329 36.545 20,856 1,096 4,500 8.203 6,729 138 9,401 368 57,896 $ 34,010 16.260 989 4,248 10.635 6,097 3,676 10.620 726 $7.270 S December 31. in millions except para ASSETS CURRENT ASSETS Cash and cash equivalent Short-term investments TOTAL CASH CASH EQUIVALE, TS AND SHORT-TERM INVESTMENTS Marketable securities Trade accounts receivable, less allowances of $477 and 5466, respectively Inventories Prepaid expenses and other assets Assets bald for sale Assets held for sale - discontinued operations TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS OTHER ASSETS PROPERTY. PLANT AND EQUIPMENT -net TRADEMARKS WITH INDEFINITE LIVES BOTTLERS FRANCHISE RIGHTS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current sunt of long term dat Accrued income taxes Liabilities held for sale Liabilities held for sale - discorrimed operations TOTAL CURRENT LIABILITIES LONG-TERM DEBT OTHER LIABILITIES DEFERRED INCOME TAXES THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock $0.25 par vals: Authorized - 11,300 shares; Issued - 7,040 and 7.040 shares, respectively Capital surplus Reinvested eamings Accumulated other comprehensive income loss) Treasury stock, at cost-2.781 and 2,752 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY $ 9.490 12.498 3.527 307 710 8.748 5 13,205 3.299 410 37 1,496 27,194 31,182 8,021 2.522 26.532 29,684 4,081 3,753 1,760 15,864 60.430 (10,305) (50.677) 17,072 1905 18.977 87.8065 1.760 14.993 65,502 (11.205) 147.989) 13,062 158 3.220 87.270 $ THE COCA-COLA COMPANY AND SUBSDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS 2017 2016 2015 Your Ended Deceber 31 Comi) OPERATING ACTIVITIES Consolidated income (Income) loss from discontinued operations $ 1,283 $ 6,550 $ 7366 (101) Net income from continuing operations 1,182 1,260 219 (1.256) (628) 281 1.450 1,218 (269) 3,529 6,995 6,350 1,787 258 (856) (449) 158 1,146 647 (224) (221 3.796 7,366 1.970 236 73 ( (122) (137) (374 929 744 (157) 10,528 (16,520) 15,911 (3.900) 2,821 (1.075) 104 (120) (2,385) (15,499 16,624 (838) 1,035 ( (2.262) 150 (209) (999) (15.831) 14,079 (2.491) 565 (2,553) 85 (40) (6.186) Depreciation and amartization Stock-based compensation expense Deferred income taxes Equry (income) loss-net od daydende Foreign currency adjustments Significant (prina) losses on sales of ass-net Other operating charges Other items Ner change in operating assets and liabilities Net cash provided by operating activities INVESTING ACTIVITIES Purchases of investments Proceeds from disposals of imestments Acquisitions of businesses, equity method investments and nonmarketable securities Proceeds from disposals of businesses, equity method investments and no marketinle securities Purchases of property, plant and equipment Proceeds from disposals of property, plant and equipment Other investing activities Net cash provided by (used in) investing activities FINANCING ACTIVITIES Issuances of debt Payments of debt Issuances of stock Purchases of stock for treasury Dividends Other financing activites Net cash provided by (used m) financing activities CASH FLOWS FROM DISCONTINUED OPERATIONS Ne cash provided by wedi) operating activities from discontinued operations Net cash provided by used in investing activities from discontinued operations Net cash provided by used in financing activities from discontinued operations Net cash provided by (used in) discoctinued operations EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS Net increase (decrease) during the year Balance at beginning of year Balance at end of year 29,857 (28,768) 1.595 (3,682) (6,320) (91) 7,409) 27,281 (25.615) 1,434 3.681) (0,043) 79 (6.545) 40,434 37,738) 1,243 3.564 (5.741) 251 (5.113) 111 (65) (38) 8 - 242 (6) (878) (2.519) 8,555 6.006 $ 1.146 7.309 8,555 $ (1.640) 8.958 7.309 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started