Answered step by step

Verified Expert Solution

Question

1 Approved Answer

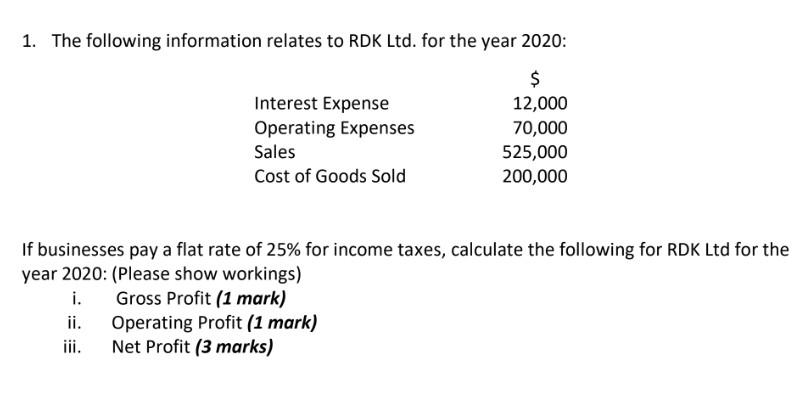

1. The following information relates to RDK Ltd. for the year 2020: Interest Expense Operating Expenses Sales Cost of Goods Sold $ 12,000 70,000 525,000

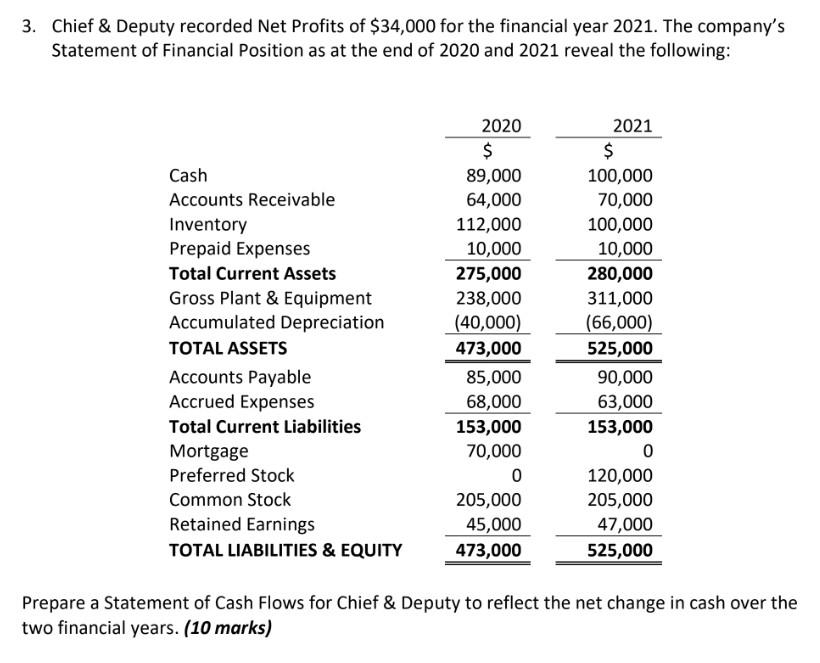

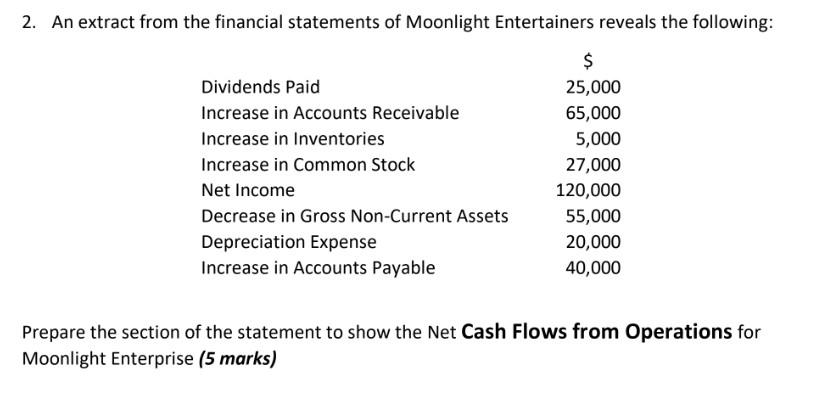

1. The following information relates to RDK Ltd. for the year 2020: Interest Expense Operating Expenses Sales Cost of Goods Sold $ 12,000 70,000 525,000 200,000 If businesses pay a flat rate of 25% for income taxes, calculate the following for RDK Ltd for the year 2020: (Please show workings) i. Gross Profit (1 mark) ii. Operating Profit (1 mark) iii. Net Profit (3 marks) 3. Chief & Deputy recorded Net Profits of $34,000 for the financial year 2021. The company's Statement of Financial Position as at the end of 2020 and 2021 reveal the following: Cash Accounts Receivable Inventory Prepaid Expenses Total Current Assets Gross Plant & Equipment Accumulated Depreciation TOTAL ASSETS Accounts Payable Accrued Expenses Total Current Liabilities Mortgage Preferred Stock Common Stock Retained Earnings TOTAL LIABILITIES & EQUITY 2020 $ 89,000 64,000 112,000 10,000 275,000 238,000 (40,000) 473,000 85,000 68,000 153,000 70,000 0 205,000 45,000 473,000 2021 $ 100,000 70,000 100,000 10,000 280,000 311,000 (66,000) 525,000 90,000 63,000 153,000 0 120,000 205,000 47,000 525,000 Prepare a Statement of Cash Flows for Chief & Deputy to reflect the net change in cash over the two financial years. (10 marks) 2. An extract from the financial statements of Moonlight Entertainers reveals the following: $ Dividends Paid 25,000 Increase in Accounts Receivable 65,000 Increase in Inventories 5,000 Increase in Common Stock 27,000 Net Income 120,000 Decrease in Gross Non-Current Assets 55,000 Depreciation Expense 20,000 Increase in Accounts Payable 40,000 Prepare the section of the statement to show the Net Cash Flows from Operations for Moonlight Enterprise

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started