Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. the goodwill or gain on acquisition is? 2. Prepare the entry on the books of Papa Corporation to record the acquisition of Baby Company.

1. the goodwill or gain on acquisition is?

2. Prepare the entry on the books of Papa Corporation to record the acquisition of Baby Company.

3. Assume the net income of baby Company is Php 240,000 for 2012. As a result, the likelihood of paying the contingent consideration is believed to be 90%. What, if any, adjusting entry is required as of December 31, 2012? 4. The total assets of Papa on December 31, 2011, after business combination would be?

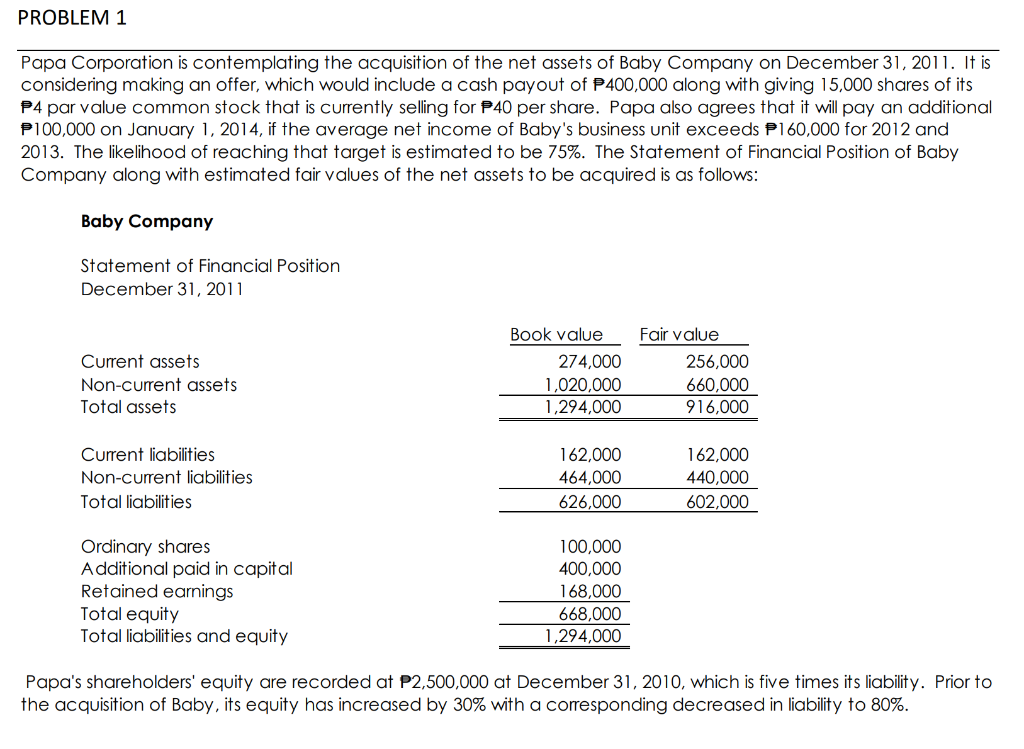

Papa Corporation is contemplating the acquisition of the net assets of Baby Company on December 31,2011 . It is considering making an offer, which would include a cash payout of P400,000 along with giving 15,000 shares of its P4 par value common stock that is currently selling for P40 per share. Papa also agrees that it will pay an additional P100,000 on January 1, 2014, if the average net income of Baby's business unit exceeds P 160,000 for 2012 and 2013. The likelihood of reaching that target is estimated to be 75%. The Statement of Financial Position of Baby Company along with estimated fair values of the net assets to be acquired is as follows: Papa's shareholders' equity are recorded at P2,500,000 at December 31, 2010, which is five times its liability. Prior to the acquisition of Baby, its equity has increased by 30% with a corresponding decreased in liability to 80%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started