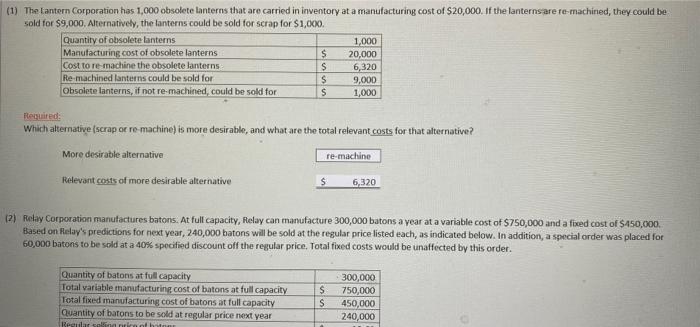

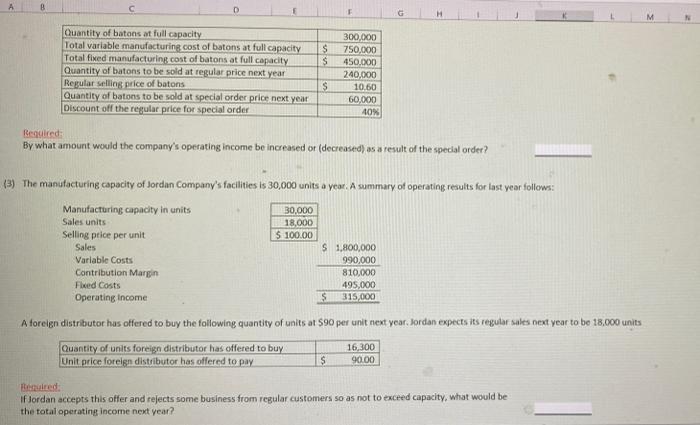

(1) The Lantern Corporation has 1,000 obsolete lanterns that are carried in inventory at a manufacturing cost of $20,000. If the lanterns are re-machined, they could be sold for $9,000, Alternatively, the lanterns could be sold for scrap for $1,000. Quantity of obsolete lanterns 1,000 Manufacturing cost of obsolete lanterns $ 20,000 Cost to re-machine the obsolete lanterns S 6,320 Re-machined lanterns could be sold for S 9,000 obsolete lanterns, if not re machined, could be sold for $ 1,000 Reguited: Which alternative (scrap or re machine) is more desirable, and what are the total relevant costs for that alternative? More desirable alternative re-machine Relevant costs of more desirable alternative 6,320 2) Relay Corporation manufactures batons. At full capacity, Relay can manufacture 300,000 batons a year at a variable cost of $750,000 and a fixed cost of $450,000 Based on Rela's predictions for next year, 240,000 batons will be sold at the regular price listed each, as indicated below. In addition, a special order was placed for 60,000 batons to be sold at a 40% specified discount off the regular price. Total fixed costs would be unaffected by this order. Quantity of batons at full capacity Total variable manufacturing cost of batons at full capacity Totalfixed manufacturing cost of batons at full capacity Quantity of batons to be sold at regular price next year Reeulat sollimino hann $ $ 300,000 750,000 450,000 240,000 B D F $ $ Quantity of batons at full capacity Total variable manufacturing cost of batons at full capacity Total fixed manufacturing cost of batons at full capacity Quantity of batons to be sold at regular price next year Regular selling price of batons Quantity of batons to be sold at special order price next year Discount off the regular price for special order 300,000 750,000 450.000 240,000 10.60 60,000 40% S Required By what amount would the company's operating income be increased or decreased) as a result of the special order? (3) The manufacturing capacity of Jordan Company's facilities is 30,000 units a year. A summary of operating results for last year follows: Manufacturing capacity in units 30,000 18.000 $ 100.00 Sales units Selling price per unit Sales Variable Costs Contribution Margin Fixed Costs Operating Income $ 1,800,000 990,000 810,000 495,000 S 315.000 90.00 A foreign distributor has offered to buy the following quantity of units at S90 per unit next year. Jordan expects its regular sales next year to be 18.000 units Quantity of units foreign distributor has offered to buy 16,300 Unit price foreign distributor has offered to pay $ Rewired if Jordan accepts this offer and rejects some business from regular customers so as not to exceed capacity, what would be the total operating income next year