Question

1 The minimum variance portfolio problem min Er st. ex=1, px= R where the target return must be achieved exactly, short-selling is allowed, and

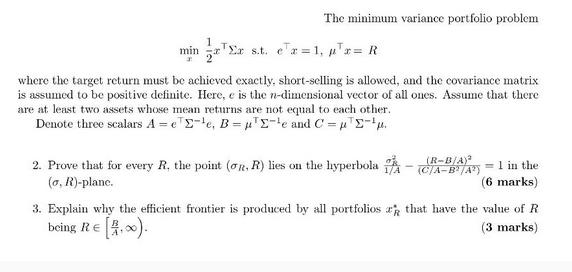

1 The minimum variance portfolio problem min Er st. ex=1, px= R where the target return must be achieved exactly, short-selling is allowed, and the covariance matrix is assumed to be positive definite. Here, e is the n-dimensional vector of all ones. Assume that there are at least two assets whose mean returns are not equal to each other. Denote three scalars A=ee, B=e and CE 2. Prove that for every R, the point (on, R) lies on the hyperbola (o, R)-plane. - (R-B/A) (C/A-BA) -1 in the (6 marks) 3. Explain why the efficient frontier is produced by all portfolios that have the value of R being Re[.). (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Optimization Models

Authors: Giuseppe C. Calafiore, Laurent El Ghaoui

1st Edition

1107050871, 9781107050877

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App