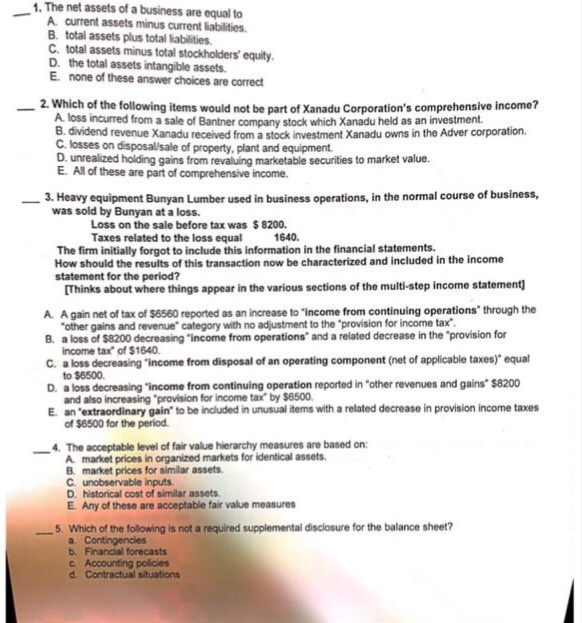

1. The net assets of a business are equal to A. current assets minus current liabilities B. total assets plus total liabilities C. total assets minus total stockholders' equity D. the total assets intangible assets. E. none of these answer choices are correct 2. Which of the following items would not be part of Xanadu Corporation's comprehensive income? A. loss incurred from a sale of Bantner B. dividend revenue Xanadu received from a stock investment Xanadu owns in the Adver corporation C. losses on disposal/sale of property, plant and equipment. D. unrealized holding gains from revaluing marketable securities to market value. E. All of these are part of comprehensive income. company stock which Xanadu held as an investment. 3. Heavy equipment Bunyan Lumber used in business operations, in the normal course of business, was sold by Bunyan at a loss. Loss on the sale before tax was $8200. Taxes related to the loss equal 1640 The firm initially forgot to include this information in the financial statements. How should the results of this transaction now be characterized and included in the income statement for the period? [Thinks about where things appear in the various sections of the multi-step income statement A. A gain net of tax of $8560 reported as an increase to "income from continuing operations" through the B. a loss of $8200 decreasing "income from operations' and a related decrease in the "provision for C. a loss decreasing "income from disposal of an operating component (net of applicable taxes) equal D. a loss decreasing "income from continuing operation reported in "other revenues and gains $8200 E. an 'extraordinary gain" to be included in unusual items with a related decrease in provision income taxes other gains and revenue category with no adjustment to the "provision for income tax income tax of $1640 to $6500 and also increasing provision for income tax by $6500 of $6500 for the period 4. The acceptable level of fair value hierarchy measures are based on: A market prices in organized markets for identical assets B. market prices for similar assets C. unobservable inputs D. historical cost of similar assets E. Any of these are acceptable fair value measures 5. Which of the following is not a required supplemental disclosure for the balance sheet? b. Financial forecasts c. Accounting policies