Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) The par or stated value of common stock is important for A) accounting purposes only B) helping the investor determine the stock's intrinsic value.

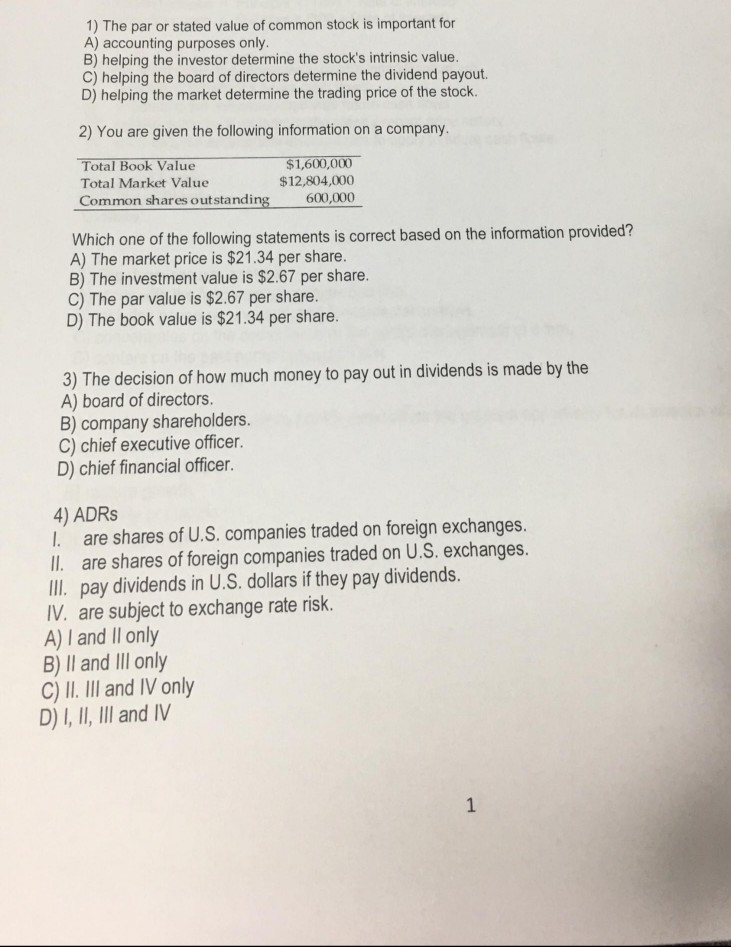

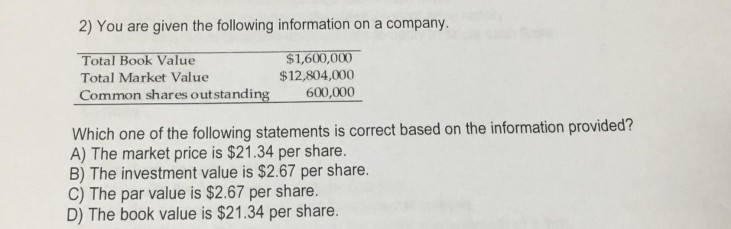

1) The par or stated value of common stock is important for A) accounting purposes only B) helping the investor determine the stock's intrinsic value. C) helping the board of directors determine the dividend payout. D) helping the market determine the trading price of the stock. 2) You are given the following information on a company. Total Book Value 1,600,000 $12,804,000 600,000 Total Market Value Common shares outstanding Which one of the following statements is correct based on the information provided? A) The market price is $21.34 per share B) The investment value is $2.67 per share. C) The par value is $2.67 per share. D) The book value is $21.34 per share 3) The decision of how much money to pay out in dividends is made by the A) board of directors. B) company shareholders C) chief executive officer. D) chief financial officer. 4) ADRs l. are shares of U.S. companies traded on foreign exchanges. Il. are shares of foreign companies traded on U.S. exchanges. II. pay dividends in U.S. dollars if they pay dividends. IV. are subject to exchange rate risk. A) I and Il only B) ll and Ill only C) I. ll and IV only D) 1, I, Ill and IV 2) You are given the following information on a company $1,600,000 $12,804,000 600,000 Total Book Value Total Market Value Common shares outstanding Which one of the following statements is correct based on the information provided? A) The market price is $21.34 per share. B) The investment value is $2.67 per share. C) The par value is $2.67 per share. D) The book value is $21.34 per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started