Question

1. The Steely Dan Distribution Company (SDDC) buys an amount of pretzels for $250,000 each year, which in turn, they sell to street pretzel vendors.

1. The Steely Dan Distribution Company (SDDC) buys an amount of pretzels for $250,000 each year, which in turn, they sell to street pretzel vendors. SDDC is considering buying a pretzel making machine from Pretzel Logic, Inc. for $500,000 so that after paying for labor and materials, they produce the same amount of pretzels for $150,000 per year. The machine is expected to last for 15 years, at which time it can be salvage for $50,000. Assume an interest rate of 5%.

a) What is the EUAC of SDDC making its own pretzels?

B) Should Steely Dan buy the Pretzel Logic machine and make their own pretzels instead of buying them?

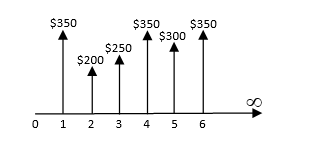

2. Given the cash flow diagram below at an interest rate of 7.5%, what is the EUAB if the same pattern continues forever?

Please explain your answers a step by step.

$350 $350 $350 $250 $200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started