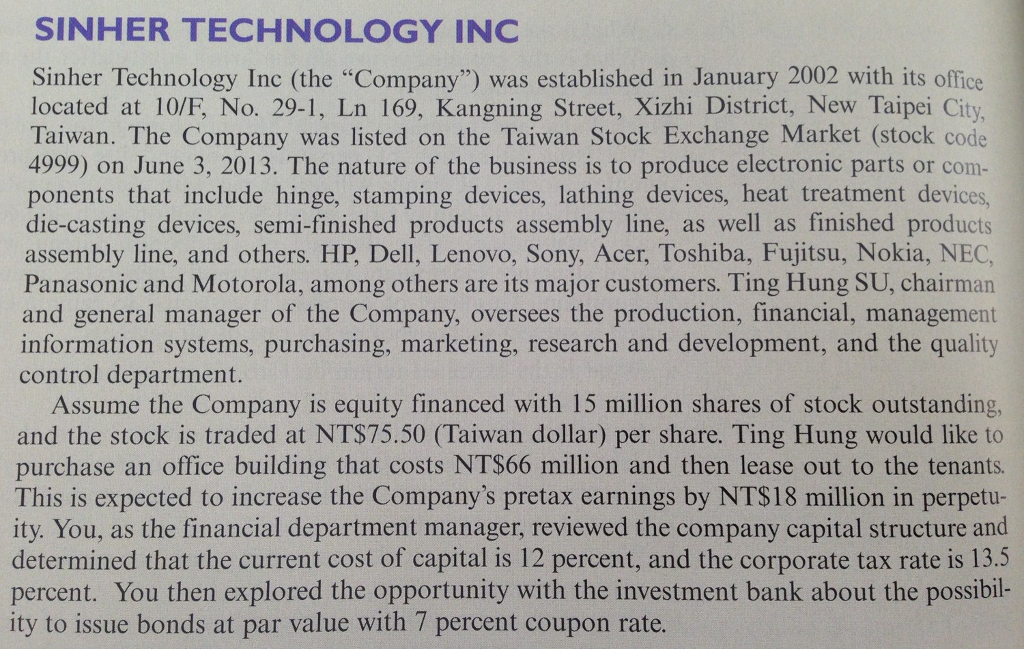

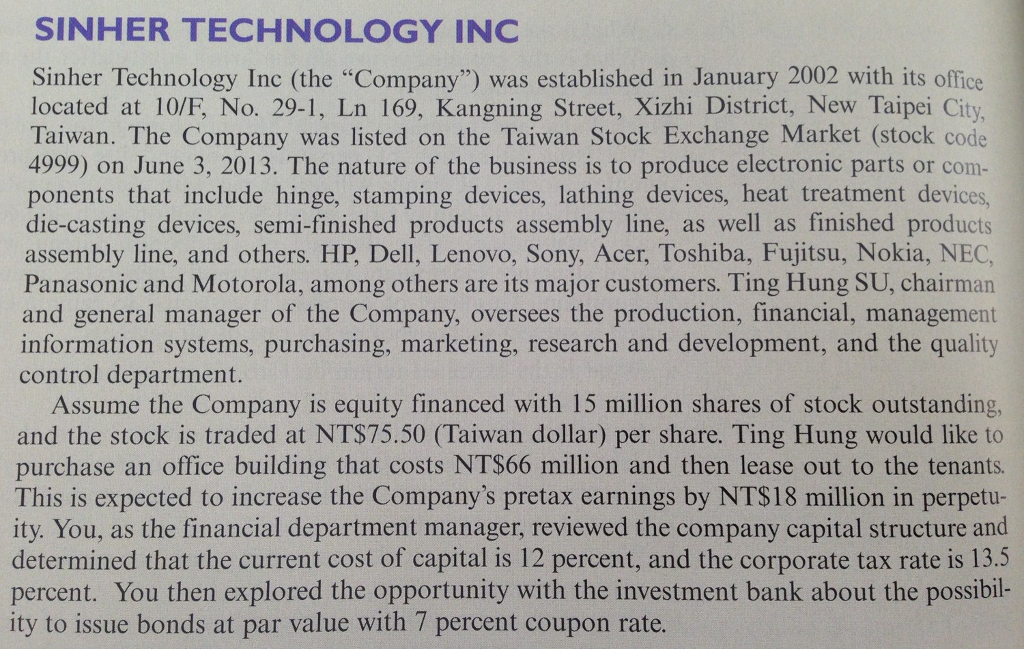

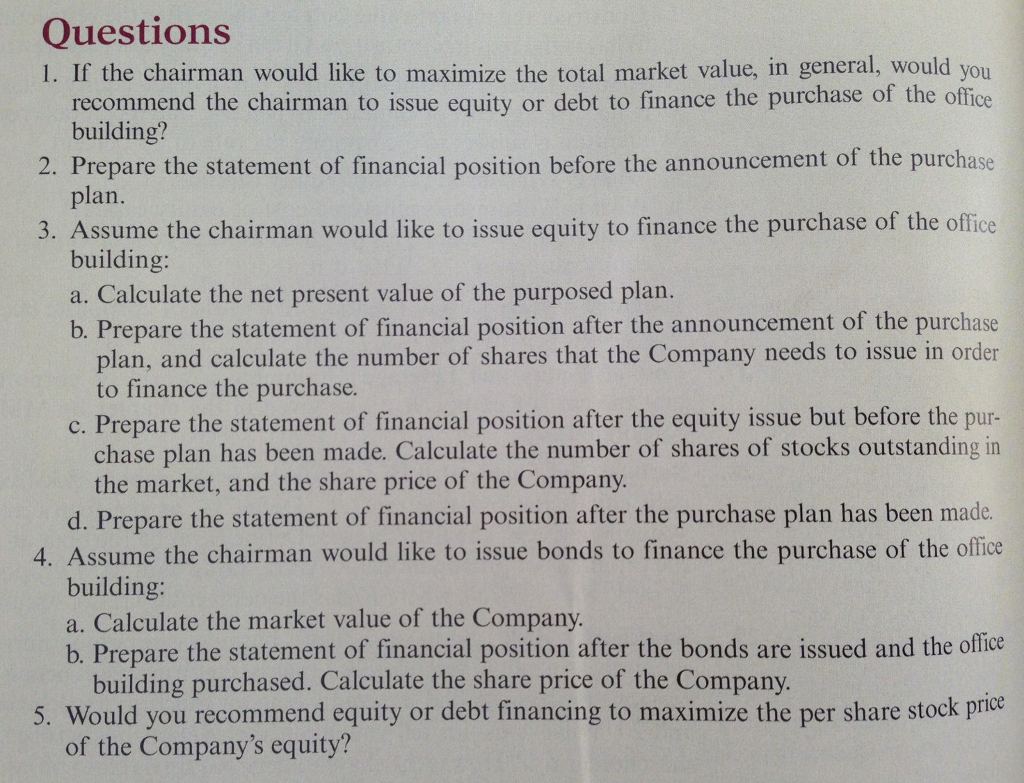

SINHER TECHNOLOGY INC Sinher Technology Inc (the "Company") was established in January 2002 with its office located at 10/F, No. 29-1, Ln 169, Kangning Street, Xizhi District, New Taipei City Taiwan. The Company was listed on the Taiwan Stock Exchange Market (stockc 4999) on June 3, 2013. The nature of the business is to produce electronic parts or com ponents that include hinge, stamping devices, lathing devices, heat treatment devices die-casting devices, semi-finished products assembly line, as well as finished products assembly line, and others. HP, Dell, Lenovo, Sony, Acer, Toshiba, Fujitsu, Nokia, NEC Panasonic and Motorola, among others are its major customers. Ting Hung SU, chairman and general manager of the Company, oversees the production, financial, management information systems, purchasing, marketing, research and development, and the quality control department Assume the Company is equity financed with 15 million shares of stock outstanding and the stock is traded at NT$75.50 (Taiwan dollar) per share. Ting Hung would like to purchase an office building that costs NT$66 million and then lease out to the tenants This is expected to increase the Company's pretax earnings by NTS18 million in perpetu ity. You, as the financial department manager, reviewed the company capital structure and determined that the current cost of capital is 12 percent, and the corporate tax rate is 13.5 percent. You then explored the opportunity with the investment bank about the possibil- ity to issue bonds at par value with 7 percent coupon rate. SINHER TECHNOLOGY INC Sinher Technology Inc (the "Company") was established in January 2002 with its office located at 10/F, No. 29-1, Ln 169, Kangning Street, Xizhi District, New Taipei City Taiwan. The Company was listed on the Taiwan Stock Exchange Market (stockc 4999) on June 3, 2013. The nature of the business is to produce electronic parts or com ponents that include hinge, stamping devices, lathing devices, heat treatment devices die-casting devices, semi-finished products assembly line, as well as finished products assembly line, and others. HP, Dell, Lenovo, Sony, Acer, Toshiba, Fujitsu, Nokia, NEC Panasonic and Motorola, among others are its major customers. Ting Hung SU, chairman and general manager of the Company, oversees the production, financial, management information systems, purchasing, marketing, research and development, and the quality control department Assume the Company is equity financed with 15 million shares of stock outstanding and the stock is traded at NT$75.50 (Taiwan dollar) per share. Ting Hung would like to purchase an office building that costs NT$66 million and then lease out to the tenants This is expected to increase the Company's pretax earnings by NTS18 million in perpetu ity. You, as the financial department manager, reviewed the company capital structure and determined that the current cost of capital is 12 percent, and the corporate tax rate is 13.5 percent. You then explored the opportunity with the investment bank about the possibil- ity to issue bonds at par value with 7 percent coupon rate