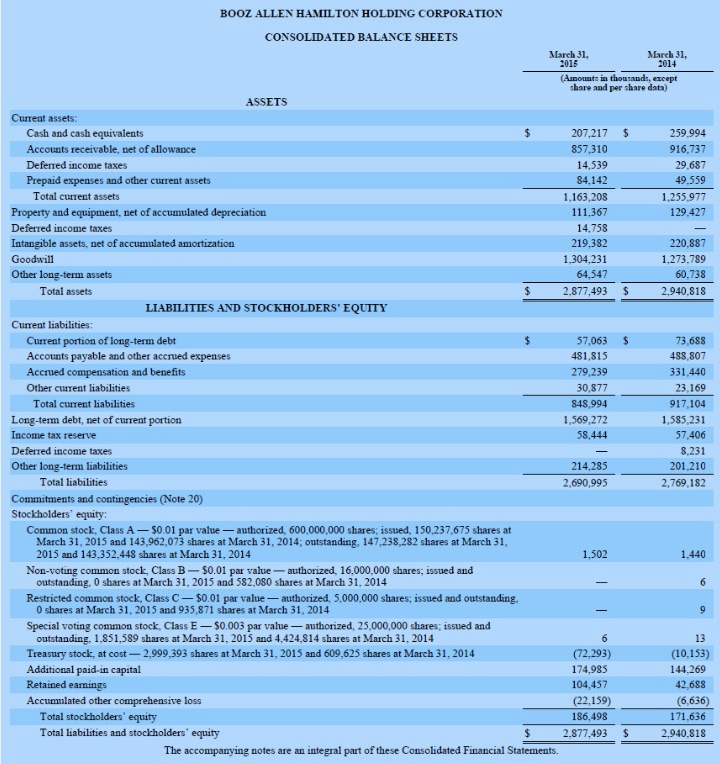

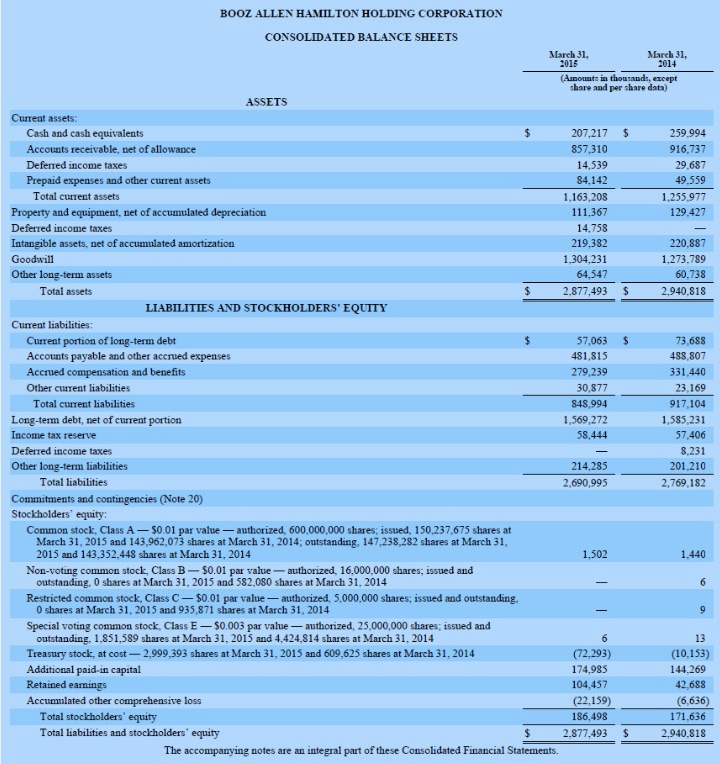

1) There were no usual transactions affecting the Companys Retained Earnings during FY15. If Net Income for FY2015 was $232,569 thousand, what was the value of dividends declared during the year?

I believe you need to start with the beginning RE + Net Income - Dividends to find the ending RE but I am confused on the caculation needed from there to find the dividends declared?

2) There were no sales of Treasury Stock during FY15. What was the average share price at which the Company repurchased additional Treasury Stock shares during FY15?

I did the caculations by finding the changes in Stock Value and the changes in Stock Price and divided those items but wanted to make sure I was going along the correct route.

BOOZ ALLEN HAMILTON HOLDING CORPORATION CONSOLIDATED BALANCE SHEETS March 31, March 31 015 014 (Arnounts in thousands share and per share data) ASSETS Cument assets 259.994 207.217 Cash and cash equivalents Accounts receivable, net of allowance 857.310 916.737 Deferred income taxes 14,539 29.687 Prepaid expenses and other current assets 84.142 49.559 Total current assets 1.163.208 1.255.977 111,367 Property and equipment, net of accumulated depreciation 129.427 Deferred income taxes 14.758 Intangible assets, net of accumulated amortization 219,382 220.887 Goodwill 1,304,231 1.273.789 other long-term assets 64.547 60.738 2,877,493 2,940,818 Total assets LIABILITIES AND STOCKHOLDERS' EQUITY iabilities 57,063 73,688 Current portion of long-term debt Accounts payable and other accrued expenses 481,815 488,807 Accrued compensation and benefits 279,239 331.440 Other cument liabilities 30,877 23,169 Total cument liabilities 848,994 917,104 Long-term debt, net of current portion 1,569,272 1,585,231 Income tax reserve 58,444 57.406 Deferred income taxes 8.231 201.210 Other long-term liabilities 214.285 Total liabilities 2,690,995 2,769,182 Commitments and contingencies (Note 200 Stockholders' equity: Common stock, Class A $0.01 par value au 600,000,000 shares; issued, 150.237.675 shares at thorized, March 31, 2015 and 143,962,073 shares at March 31, 2014; outstanding, 147,238,282 shares at March 31, 2015 and 143,352,448 shares at March 31, 2014 1,502 1.440 Non-voting common stock, Class B $0.01 par value 16,000,000 shares; issued and outstanding. 0 shares at March 31, 2015 and 5S2,080 shares at March 31, 2014 Restricted common stock, Class C $0.01 par value authorized, 5.000.000 shares; issued and outstanding. 0 shares at March 31, 2015 and 935,871 shares at March 31, 2014 Special voting common stock, Class E $0.003 par value authorized, 25,000,000 shares; issued and outstanding, 1,851,589 shares at March 31, 2015 and 4,424,si4 shares at March 31, 2014 13 Treasury stock, at cost -2,999,393 shares at March 31, 2015 and 609,625 shares at March 31, 2014 (2,293) Additional paid-in capital 174.985 144.269 104,457 42,688 2,159) (6,636) Accumulated other comprehensive loss Total stockholders' equity 186,498 171,636 Total liabilities and stockholders' equity 2,877,493 2,940 S18 The accompanying notes are an integral part of these Consolidated Financial Statements