Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Through selected ratios and the DuPont analysis, would you recommend to invest in Loblaw or Empire in the long run? Why? If you want

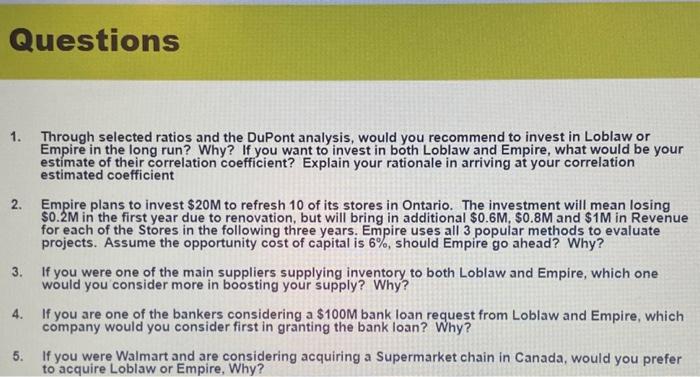

1. Through selected ratios and the DuPont analysis, would you recommend to invest in Loblaw or Empire in the long run? Why? If you want to invest in both Loblaw and Empire, what would be your estimate of their correlation coefficient? Explain your rationale in arriving at your correlation estimated coefficient 2. Empire plans to invest $20M to refresh 10 of its stores in Ontario. The investment will mean losing $0.2M in the first year due to renovation, but will bring in additional $0.6M, $0.8M and $1M in Revenue for each of the Stores in the following three years. Empire uses all 3 popular methods to evaluate projects. Assume the opportunity cost of capital is 6%, should Empire go ahead? Why? 3. If you were one of the main suppliers supplying inventory to both Loblaw and Empire, which one would you consider more in boosting your supply? Why? 4. If you are one of the bankers considering a $100M bank loan request from Loblaw and Empire, which company would you consider first in granting the bank loan? Why? 5. If you were Walmart and are considering acquiring a Supermarket chain in Canada, would you prefer to acquire Loblaw or Empire, Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started