Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Throughout this question, assume that profit each year is equal to cash flow. For simplicity, assume all profits/cash flows occur at the end of

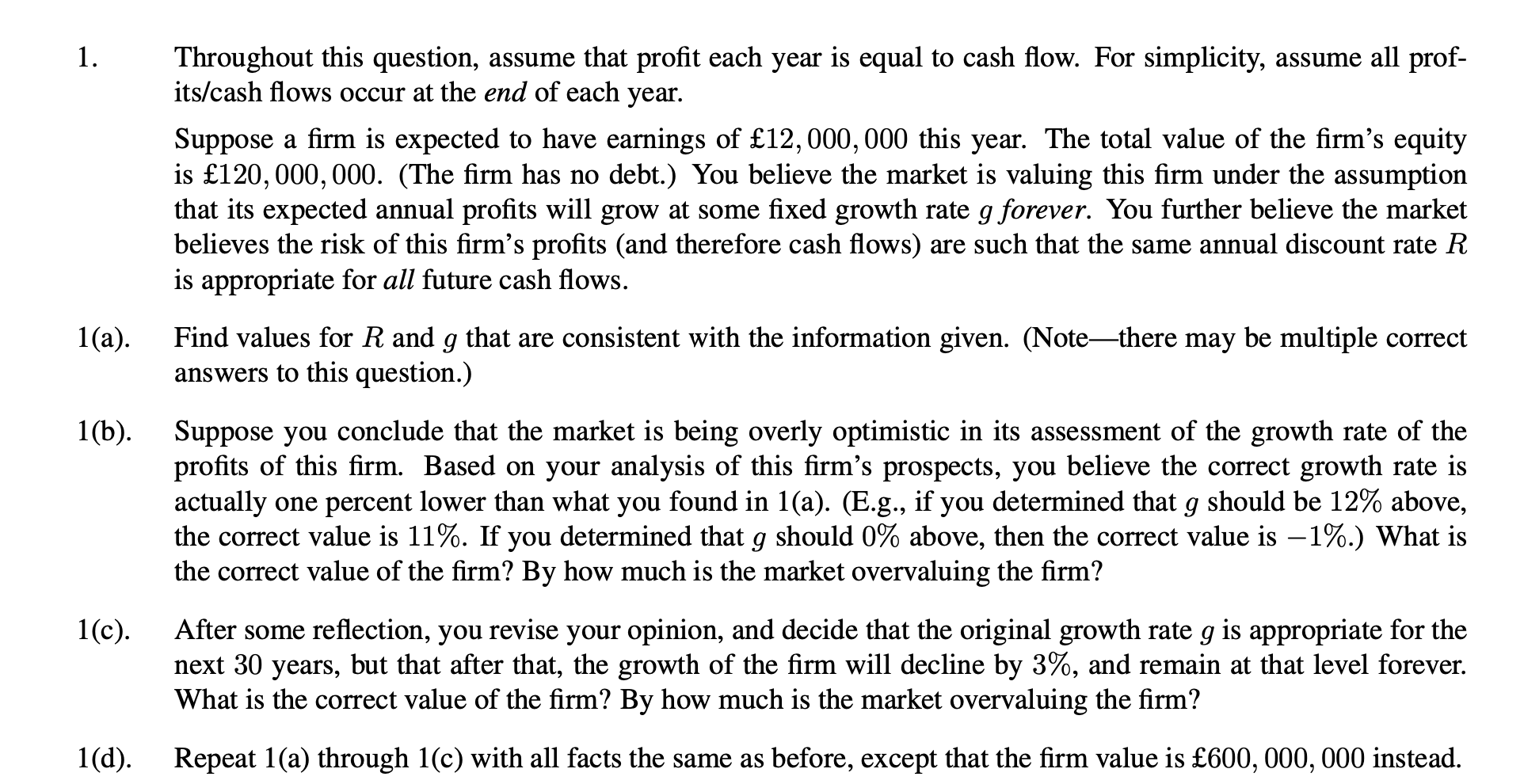

1. Throughout this question, assume that profit each year is equal to cash flow. For simplicity, assume all profits/cash flows occur at the end of each year. Suppose a firm is expected to have earnings of 12,000,000 this year. The total value of the firm's equity is 120,000,000. (The firm has no debt.) You believe the market is valuing this firm under the assumption that its expected annual profits will grow at some fixed growth rate g forever. You further believe the market believes the risk of this firm's profits (and therefore cash flows) are such that the same annual discount rate R is appropriate for all future cash flows. 1(a). Find values for R and g that are consistent with the information given. (Note-there may be multiple correct answers to this question.) 1(b). Suppose you conclude that the market is being overly optimistic in its assessment of the growth rate of the profits of this firm. Based on your analysis of this firm's prospects, you believe the correct growth rate is actually one percent lower than what you found in 1(a). (E.g., if you determined that g should be 12% above, the correct value is 11%. If you determined that g should 0% above, then the correct value is 1%.) What is the correct value of the firm? By how much is the market overvaluing the firm? 1(c). After some reflection, you revise your opinion, and decide that the original growth rate g is appropriate for the next 30 years, but that after that, the growth of the firm will decline by 3%, and remain at that level forever. What is the correct value of the firm? By how much is the market overvaluing the firm? 1(d). Repeat 1(a) through 1(c) with all facts the same as before, except that the firm value is 600,000,000 instead

1. Throughout this question, assume that profit each year is equal to cash flow. For simplicity, assume all profits/cash flows occur at the end of each year. Suppose a firm is expected to have earnings of 12,000,000 this year. The total value of the firm's equity is 120,000,000. (The firm has no debt.) You believe the market is valuing this firm under the assumption that its expected annual profits will grow at some fixed growth rate g forever. You further believe the market believes the risk of this firm's profits (and therefore cash flows) are such that the same annual discount rate R is appropriate for all future cash flows. 1(a). Find values for R and g that are consistent with the information given. (Note-there may be multiple correct answers to this question.) 1(b). Suppose you conclude that the market is being overly optimistic in its assessment of the growth rate of the profits of this firm. Based on your analysis of this firm's prospects, you believe the correct growth rate is actually one percent lower than what you found in 1(a). (E.g., if you determined that g should be 12% above, the correct value is 11%. If you determined that g should 0% above, then the correct value is 1%.) What is the correct value of the firm? By how much is the market overvaluing the firm? 1(c). After some reflection, you revise your opinion, and decide that the original growth rate g is appropriate for the next 30 years, but that after that, the growth of the firm will decline by 3%, and remain at that level forever. What is the correct value of the firm? By how much is the market overvaluing the firm? 1(d). Repeat 1(a) through 1(c) with all facts the same as before, except that the firm value is 600,000,000 instead Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started