Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: 15 marks Required: a. For Canadian income tax purposes, determine the residency for 2020 (that is, resident, part- year resident, deemed resident

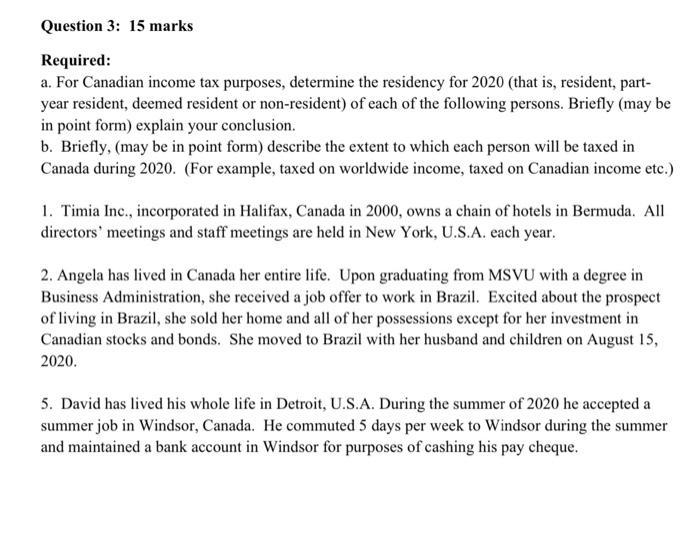

Question 3: 15 marks Required: a. For Canadian income tax purposes, determine the residency for 2020 (that is, resident, part- year resident, deemed resident or non-resident) of each of the following persons. Briefly (may be in point form) explain your conclusion. b. Briefly, (may be in point form) describe the extent to which each person will be taxed in Canada during 2020. (For example, taxed on worldwide income, taxed on Canadian income etc.) 1. Timia Inc., incorporated in Halifax, Canada in 2000, owns a chain of hotels in Bermuda. All directors' meetings and staff meetings are held in New York, U.S.A. each year. 2. Angela has lived in Canada her entire life. Upon graduating from MSVU with a degree in Business Administration, she received a job offer to work in Brazil. Excited about the prospect of living in Brazil, she sold her home and all of her possessions except for her investment in Canadian stocks and bonds. She moved to Brazil with her husband and children on August 15, 2020. 5. David has lived his whole life in Detroit, U.S.A. During the summer of 2020 he accepted a summer job in Windsor, Canada. He commuted 5 days per week to Windsor during the summer and maintained a bank account in Windsor for purposes of cashing his pay cheque.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Timia Inc is a nonresident of Canada for 2020 The company is incorporated in Canada but all ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started