Question: 1 to 3. First, post the unadjusted balances from the unadjusted trial balance that was given and the adjusting entries that were made in

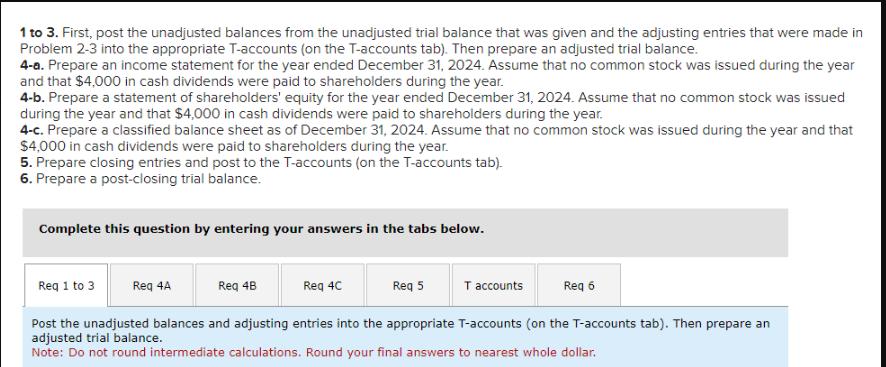

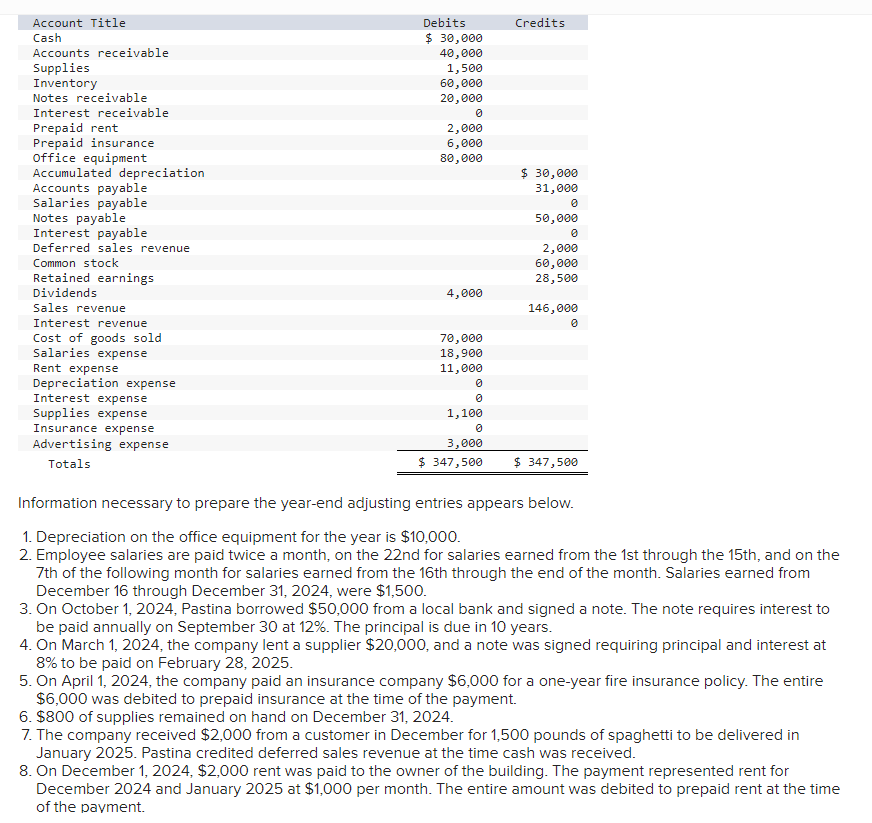

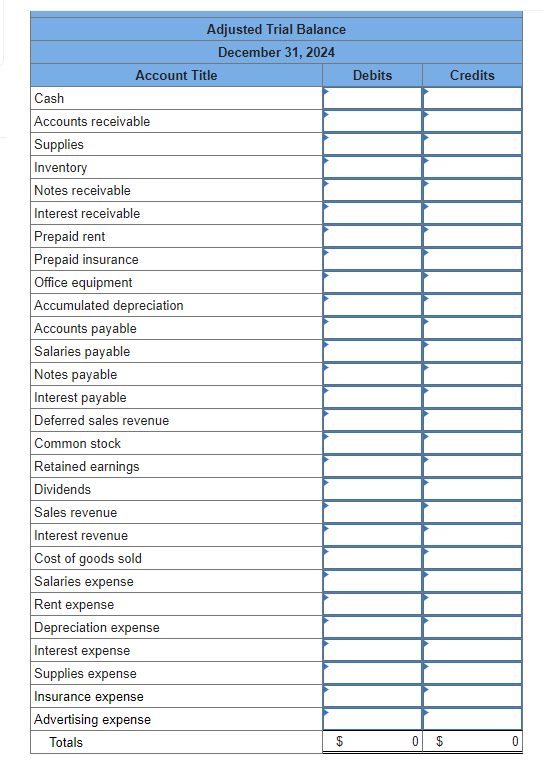

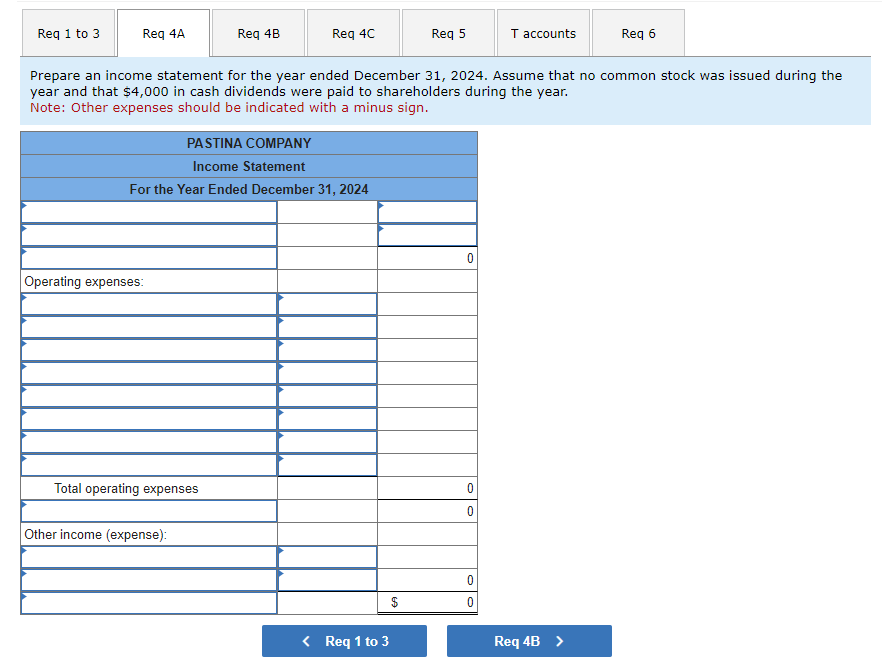

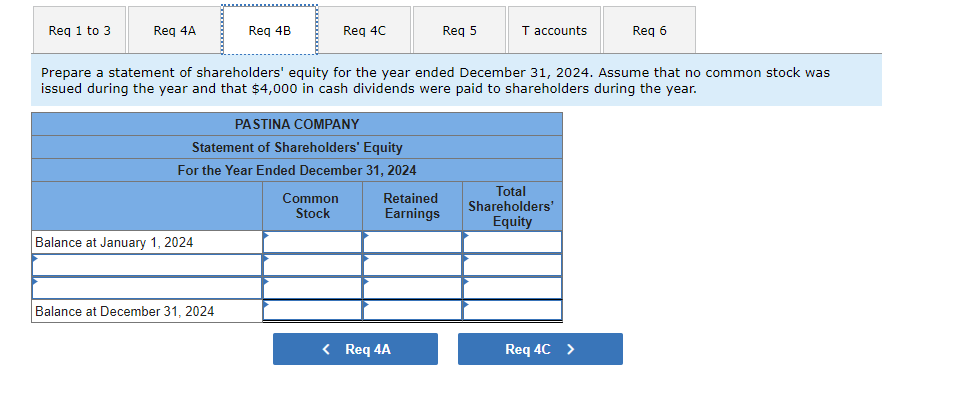

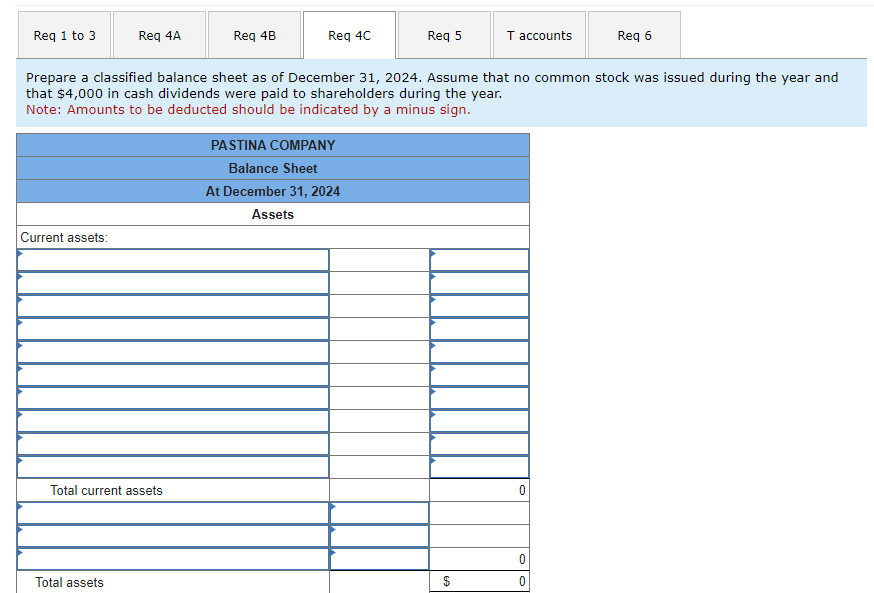

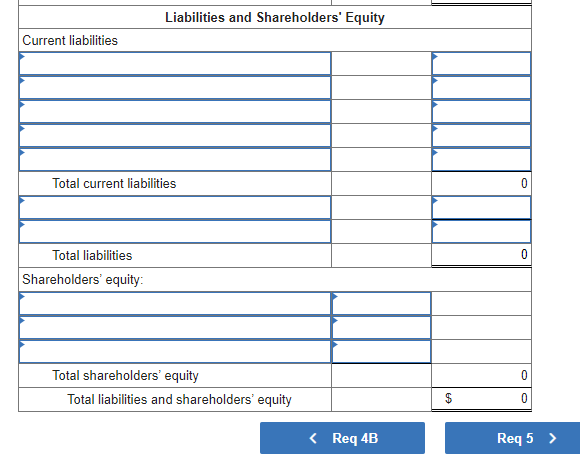

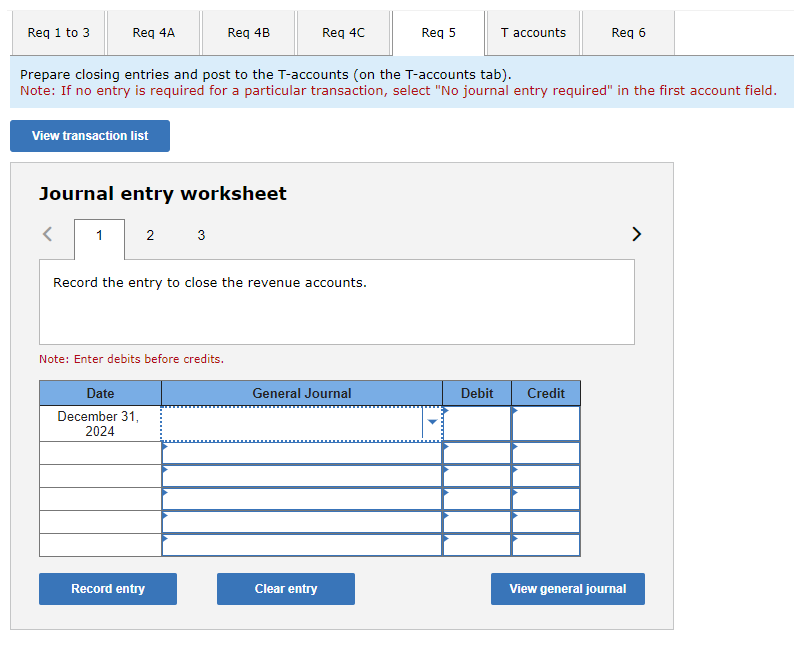

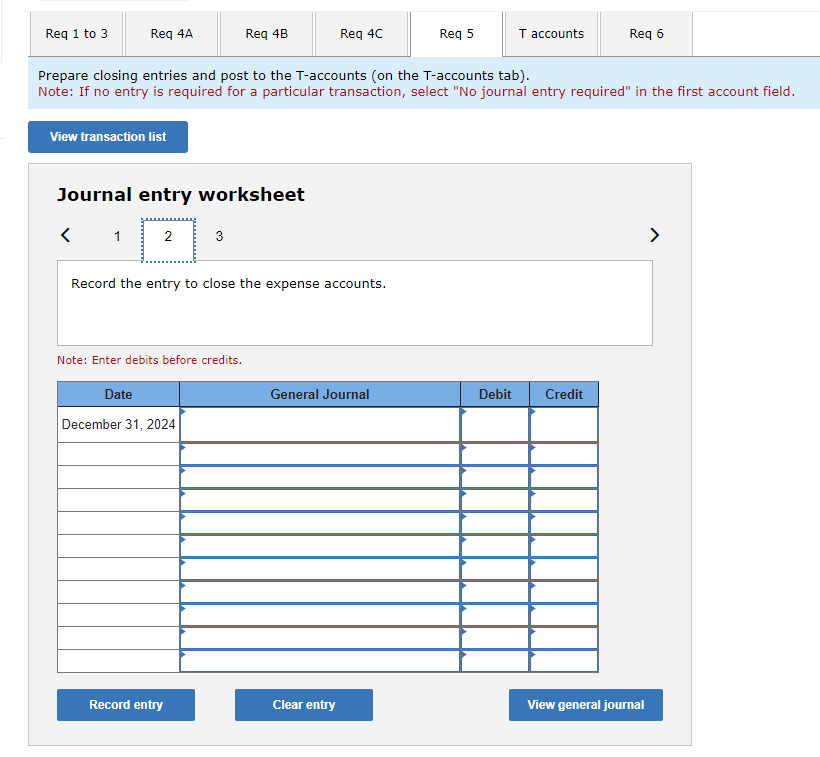

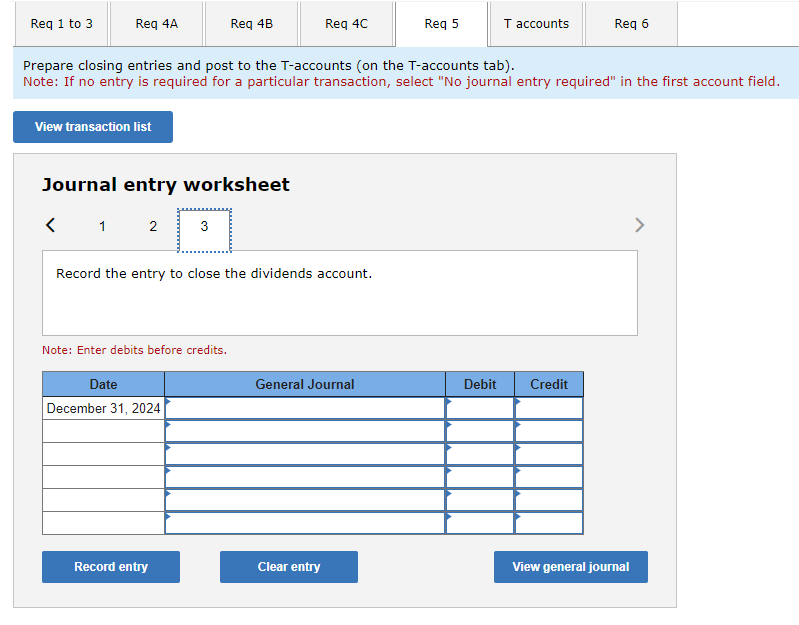

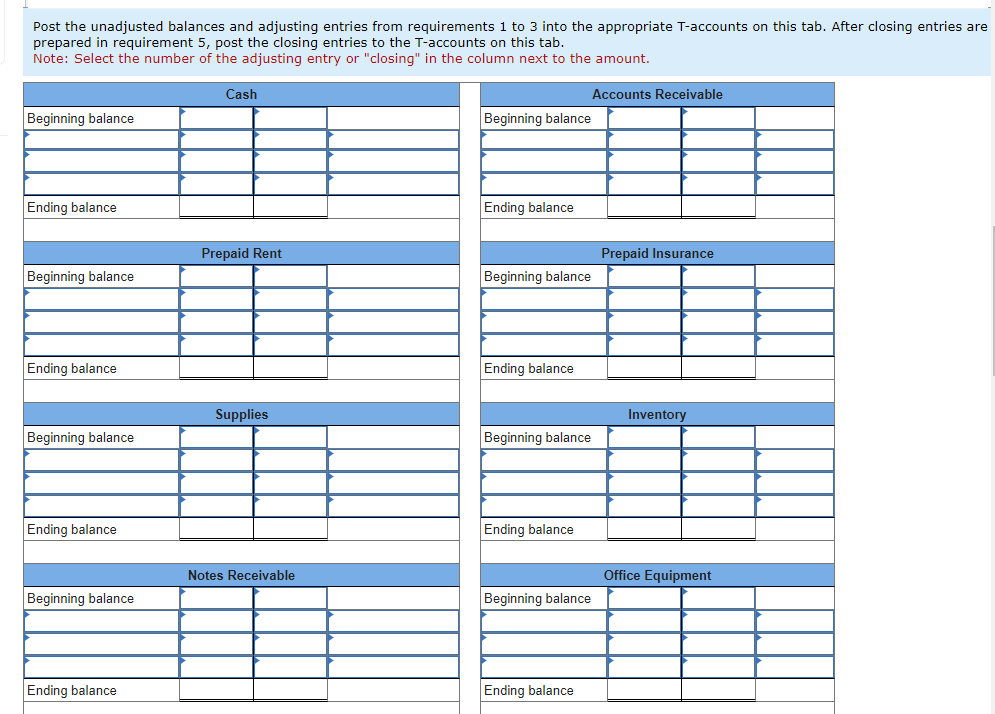

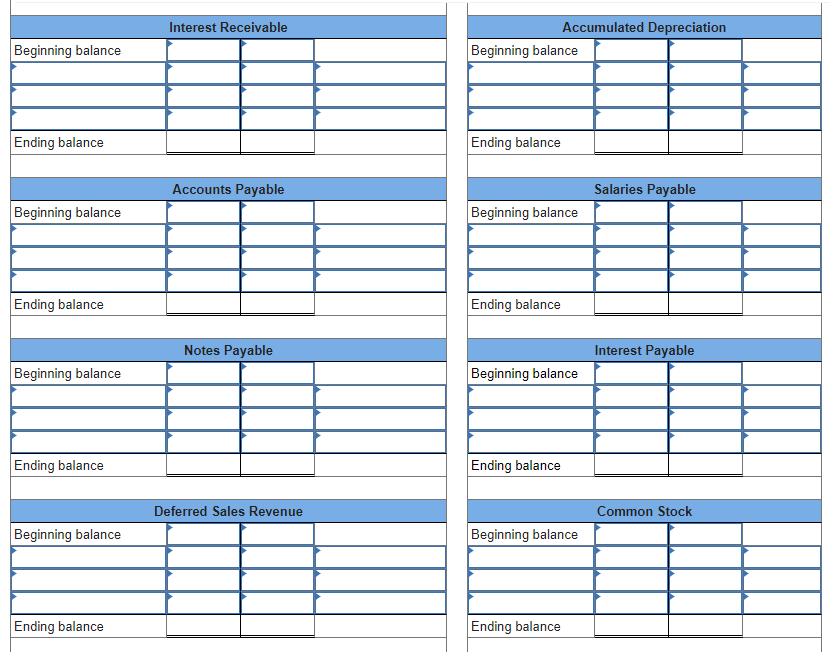

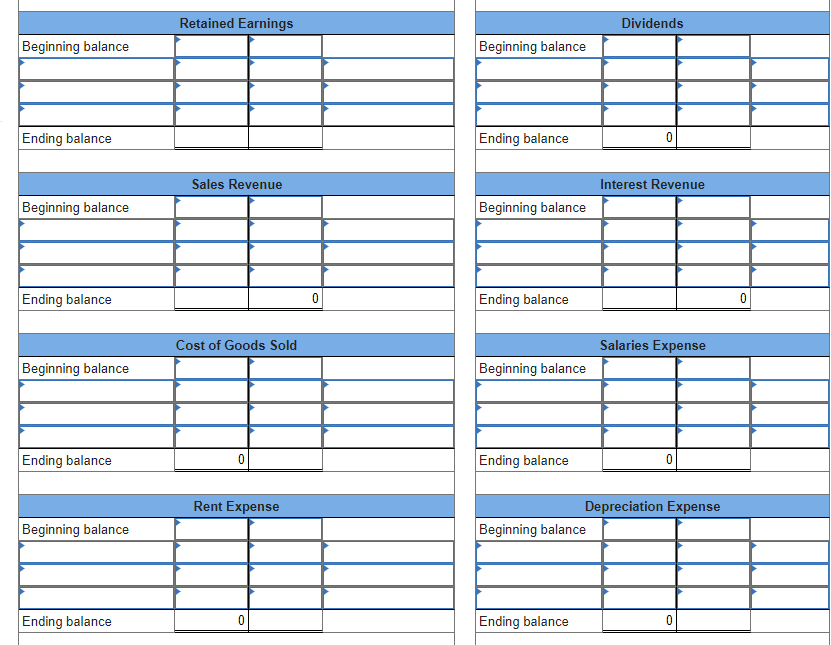

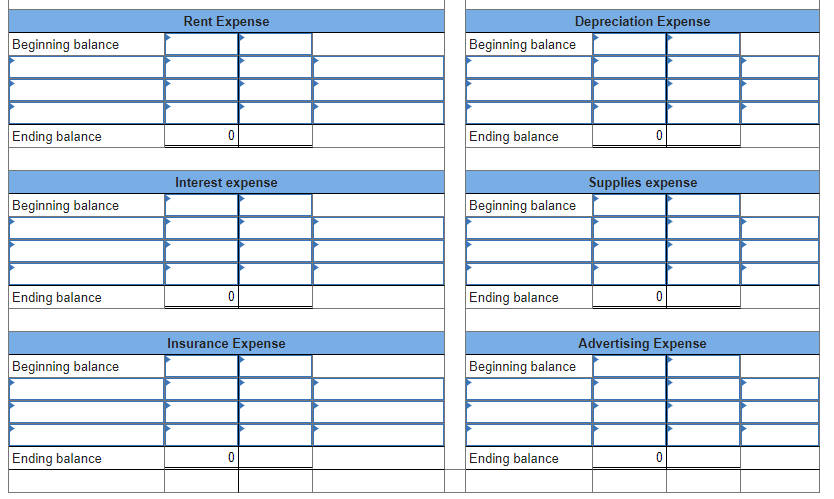

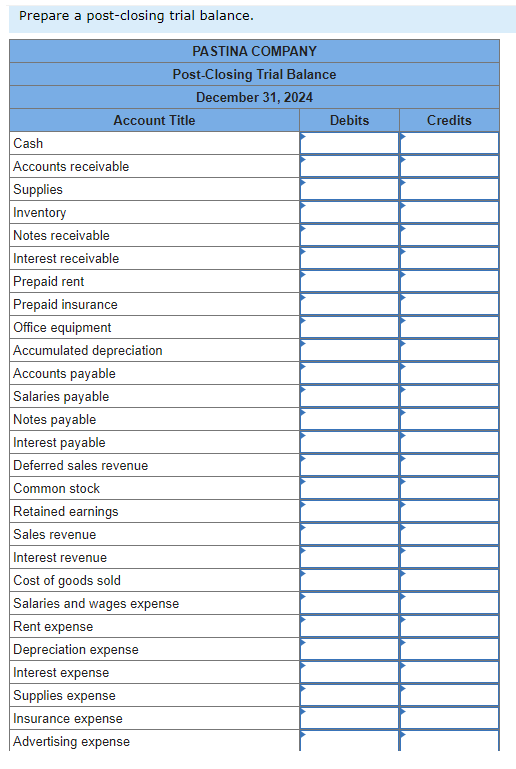

1 to 3. First, post the unadjusted balances from the unadjusted trial balance that was given and the adjusting entries that were made in Problem 2-3 into the appropriate T-accounts (on the T-accounts tab). Then prepare an adjusted trial balance. 4-a. Prepare an income statement for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 4-b. Prepare a statement of shareholders' equity for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 4-c. Prepare a classified balance sheet as of December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 5. Prepare closing entries and post to the T-accounts (on the T-accounts tab). 6. Prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Req 5 Post the unadjusted balances and adjusting entries into the appropriate T-accounts (on the T-accounts tab). Then prepare an adjusted trial balance. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. Req 1 to 3 Req 4A Req 4B Req 4C T accounts Req 6 Account Title Cash Accounts receivable Supplies Inventory Notes receivable Interest receivable Prepaid rent Prepaid insurance office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable Interest payable Deferred sales revenue Common stock Retained earnings Dividends Sales revenue Interest revenue Cost of goods sold Salaries expense Rent expense Depreciation expense Interest expense Supplies expense Insurance expense Advertising expense Totals Debits $ 30,000 40,000 1,500 60,000 20,000 0 2,000 6,000 80,000 4,000 70,000 18,900 11,000 0 0 1,100 0 3,000 $ 347,500 Credits $ 30,000 31,000 0 50,000 0 2,000 60,000 28,500 146,000 0 $ 347,500 Information necessary to prepare the year-end adjusting entries appears below. 1. Depreciation on the office equipment for the year is $10,000. 2. Employee salaries are paid twice a month, on the 22nd for salaries earned from the 1st through the 15th, and on the 7th of the following month for salaries earned from the 16th through the end of the month. Salaries earned from December 16 through December 31, 2024, were $1,500. 3. On October 1, 2024, Pastina borrowed $50,000 from a local bank and signed a note. The note requires interest to be paid annually on September 30 at 12%. The principal is due in 10 years. 4. On March 1, 2024, the company lent a supplier $20,000, and a note was signed requiring principal and interest at 8% to be paid on February 28, 2025. 5. On April 1, 2024, the company paid an insurance company $6,000 for a one-year fire insurance policy. The entire $6,000 was debited to prepaid insurance at the time of the payment. 6. $800 of supplies remained on hand on December 31, 2024. 7. The company received $2,000 from a customer in December for 1,500 pounds of spaghetti to be delivered in January 2025. Pastina credited deferred sales revenue at the time cash was received. 8. On December 1, 2024, $2,000 rent was paid to the owner of the building. The payment represented rent for December 2024 and January 2025 at $1,000 per month. The entire amount was debited to prepaid rent at the time of the payment. Account Title Cash Accounts receivable Supplies Inventory Notes receivable Interest receivable Prepaid rent Prepaid insurance Office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable Interest payable Deferred sales revenue Common stock Retained earnings Dividends Sales revenue Interest revenue Cost of goods sold Salaries expense Rent expense Depreciation expense Interest expense Supplies expense Insurance expense Adjusted Trial Balance December 31, 2024 Advertising expense Totals 69 $ Debits 0 Credits 0 Req 1 to 3 Req 4A Operating expenses: Req 4B PASTINA COMPANY Income Statement For the Year Ended December 31, 2024 Total operating expenses Req 4C Other income (expense): Prepare an income statement for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. Note: Other expenses should be indicated with a minus sign. < Req 1 to 3 Req 5 $ 0 0 0 0 T accounts 0 Req 6 Req 4B > Req 1 to 3 Req 4A Req 4B Balance at January 1, 2024 PASTINA COMPANY Statement of Shareholders' Equity For the Year Ended December 31, 2024 Balance at December 31, 2024 Reg 4C Prepare a statement of shareholders' equity for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. Common Stock Retained Earnings Req 5 < Req 4A T accounts Total Shareholders' Equity Req 6 Req 4C > Req 1 to 3 Current assets: Req 4A Total current assets Total assets Req 4B Req 4C Prepare a classified balance sheet as of December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. Note: Amounts to be deducted should be indicated by a minus sign. Req 5 PASTINA COMPANY Balance Sheet At December 31, 2024 Assets T accounts $ 0 Req 6 0 0 Current liabilities Liabilities and Shareholders' Equity Total current liabilities Total liabilities Shareholders' equity: Total shareholders' equity Total liabilities and shareholders' equity < Req 4B $ Req 5 > Req 1 to 3 Req 4A View transaction list 1 Journal entry worksheet Prepare closing entries and post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. 2 Date December 31, 2024 Req 4B 3 Note: Enter debits before credits. Record the entry to close the revenue accounts. Record entry Req 4C General Journal Clear entry Req 5 T accounts Req 6 Debit Credit View general journal > Req 1 to 3 Req 4A Prepare closing entries and post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 2 Req 4B 3 Note: Enter debits before credits. Date December 31, 2024 Record the entry to close the expense accounts. Record entry Req 4C General Journal Clear entry Req 5 T accounts Req 6 Debit Credit View general journal > Req 1 to 3 Req 4A View transaction list Journal entry worksheet < 1 2 3 Req 4B Note: Enter debits before credits. Prepare closing entries and post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Record the entry to close the dividends account. Date December 31, 2024 Record entry Req 4C General Journal Clear entry Req 5 T accounts Debit Req 6 Credit View general journal Post the unadjusted balances and adjusting entries from requirements 1 to 3 into the appropriate T-accounts on this tab. After closing entries are prepared in requirement 5, post the closing entries to the T-accounts on this tab. Note: Select the number of the adjusting entry or "closing" in the column next to the amount. Accounts Receivable Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Cash Prepaid Rent Supplies Notes Receivable Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Prepaid Insurance Inventory Office Equipment Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Interest Receivable Accounts Payable Notes Payable Deferred Sales Revenue Beginning balance Ending balance Beginning balance Ending balance Accumulated Depreciation Beginning balance Ending balance Beginning balance Ending balance Salaries Payable Interest Payable Common Stock Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Retained Earnings Sales Revenue Cost of Goods Sold 0 Rent Expense 0 Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Dividends 0 Interest Revenue Salaries Expense 0 Depreciation Expense 0 0 Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Rent Expense 0 Interest expense 0 Insurance Expense 0 Beginning balance Ending balance Depreciation Expense Beginning balance Ending balance Beginning balance Ending balance 0 Supplies expense Advertising Expense 0 Prepare a post-closing trial balance. Account Title Cash Accounts receivable Supplies Inventory Notes receivable Interest receivable Prepaid rent Prepaid insurance Office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable PASTINA COMPANY Post-Closing Trial Balance December 31, 2024 Interest payable Deferred sales revenue Common stock Retained earnings Sales revenue Interest revenue Cost of goods sold Salaries and wages expense Rent expense Depreciation expense Interest expense Supplies expense Insurance expense Advertising expense Debits Credits 1 to 3. First, post the unadjusted balances from the unadjusted trial balance that was given and the adjusting entries that were made in Problem 2-3 into the appropriate T-accounts (on the T-accounts tab). Then prepare an adjusted trial balance. 4-a. Prepare an income statement for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 4-b. Prepare a statement of shareholders' equity for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 4-c. Prepare a classified balance sheet as of December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 5. Prepare closing entries and post to the T-accounts (on the T-accounts tab). 6. Prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Req 5 Post the unadjusted balances and adjusting entries into the appropriate T-accounts (on the T-accounts tab). Then prepare an adjusted trial balance. Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. Req 1 to 3 Req 4A Req 4B Req 4C T accounts Req 6 Account Title Cash Accounts receivable Supplies Inventory Notes receivable Interest receivable Prepaid rent Prepaid insurance office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable Interest payable Deferred sales revenue Common stock Retained earnings Dividends Sales revenue Interest revenue Cost of goods sold Salaries expense Rent expense Depreciation expense Interest expense Supplies expense Insurance expense Advertising expense Totals Debits $ 30,000 40,000 1,500 60,000 20,000 0 2,000 6,000 80,000 4,000 70,000 18,900 11,000 0 0 1,100 0 3,000 $ 347,500 Credits $ 30,000 31,000 0 50,000 0 2,000 60,000 28,500 146,000 0 $ 347,500 Information necessary to prepare the year-end adjusting entries appears below. 1. Depreciation on the office equipment for the year is $10,000. 2. Employee salaries are paid twice a month, on the 22nd for salaries earned from the 1st through the 15th, and on the 7th of the following month for salaries earned from the 16th through the end of the month. Salaries earned from December 16 through December 31, 2024, were $1,500. 3. On October 1, 2024, Pastina borrowed $50,000 from a local bank and signed a note. The note requires interest to be paid annually on September 30 at 12%. The principal is due in 10 years. 4. On March 1, 2024, the company lent a supplier $20,000, and a note was signed requiring principal and interest at 8% to be paid on February 28, 2025. 5. On April 1, 2024, the company paid an insurance company $6,000 for a one-year fire insurance policy. The entire $6,000 was debited to prepaid insurance at the time of the payment. 6. $800 of supplies remained on hand on December 31, 2024. 7. The company received $2,000 from a customer in December for 1,500 pounds of spaghetti to be delivered in January 2025. Pastina credited deferred sales revenue at the time cash was received. 8. On December 1, 2024, $2,000 rent was paid to the owner of the building. The payment represented rent for December 2024 and January 2025 at $1,000 per month. The entire amount was debited to prepaid rent at the time of the payment. Account Title Cash Accounts receivable Supplies Inventory Notes receivable Interest receivable Prepaid rent Prepaid insurance Office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable Interest payable Deferred sales revenue Common stock Retained earnings Dividends Sales revenue Interest revenue Cost of goods sold Salaries expense Rent expense Depreciation expense Interest expense Supplies expense Insurance expense Adjusted Trial Balance December 31, 2024 Advertising expense Totals 69 $ Debits 0 Credits 0 Req 1 to 3 Req 4A Operating expenses: Req 4B PASTINA COMPANY Income Statement For the Year Ended December 31, 2024 Total operating expenses Req 4C Other income (expense): Prepare an income statement for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. Note: Other expenses should be indicated with a minus sign. < Req 1 to 3 Req 5 $ 0 0 0 0 T accounts 0 Req 6 Req 4B > Req 1 to 3 Req 4A Req 4B Balance at January 1, 2024 PASTINA COMPANY Statement of Shareholders' Equity For the Year Ended December 31, 2024 Balance at December 31, 2024 Reg 4C Prepare a statement of shareholders' equity for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. Common Stock Retained Earnings Req 5 < Req 4A T accounts Total Shareholders' Equity Req 6 Req 4C > Req 1 to 3 Current assets: Req 4A Total current assets Total assets Req 4B Req 4C Prepare a classified balance sheet as of December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. Note: Amounts to be deducted should be indicated by a minus sign. Req 5 PASTINA COMPANY Balance Sheet At December 31, 2024 Assets T accounts $ 0 Req 6 0 0 Current liabilities Liabilities and Shareholders' Equity Total current liabilities Total liabilities Shareholders' equity: Total shareholders' equity Total liabilities and shareholders' equity < Req 4B $ Req 5 > Req 1 to 3 Req 4A View transaction list 1 Journal entry worksheet Prepare closing entries and post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. 2 Date December 31, 2024 Req 4B 3 Note: Enter debits before credits. Record the entry to close the revenue accounts. Record entry Req 4C General Journal Clear entry Req 5 T accounts Req 6 Debit Credit View general journal > Req 1 to 3 Req 4A Prepare closing entries and post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 2 Req 4B 3 Note: Enter debits before credits. Date December 31, 2024 Record the entry to close the expense accounts. Record entry Req 4C General Journal Clear entry Req 5 T accounts Req 6 Debit Credit View general journal > Req 1 to 3 Req 4A View transaction list Journal entry worksheet < 1 2 3 Req 4B Note: Enter debits before credits. Prepare closing entries and post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Record the entry to close the dividends account. Date December 31, 2024 Record entry Req 4C General Journal Clear entry Req 5 T accounts Debit Req 6 Credit View general journal Post the unadjusted balances and adjusting entries from requirements 1 to 3 into the appropriate T-accounts on this tab. After closing entries are prepared in requirement 5, post the closing entries to the T-accounts on this tab. Note: Select the number of the adjusting entry or "closing" in the column next to the amount. Accounts Receivable Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Cash Prepaid Rent Supplies Notes Receivable Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Prepaid Insurance Inventory Office Equipment Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Interest Receivable Accounts Payable Notes Payable Deferred Sales Revenue Beginning balance Ending balance Beginning balance Ending balance Accumulated Depreciation Beginning balance Ending balance Beginning balance Ending balance Salaries Payable Interest Payable Common Stock Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Retained Earnings Sales Revenue Cost of Goods Sold 0 Rent Expense 0 Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Dividends 0 Interest Revenue Salaries Expense 0 Depreciation Expense 0 0 Beginning balance Ending balance Beginning balance Ending balance Beginning balance Ending balance Rent Expense 0 Interest expense 0 Insurance Expense 0 Beginning balance Ending balance Depreciation Expense Beginning balance Ending balance Beginning balance Ending balance 0 Supplies expense Advertising Expense 0 Prepare a post-closing trial balance. Account Title Cash Accounts receivable Supplies Inventory Notes receivable Interest receivable Prepaid rent Prepaid insurance Office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable PASTINA COMPANY Post-Closing Trial Balance December 31, 2024 Interest payable Deferred sales revenue Common stock Retained earnings Sales revenue Interest revenue Cost of goods sold Salaries and wages expense Rent expense Depreciation expense Interest expense Supplies expense Insurance expense Advertising expense Debits Credits

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts