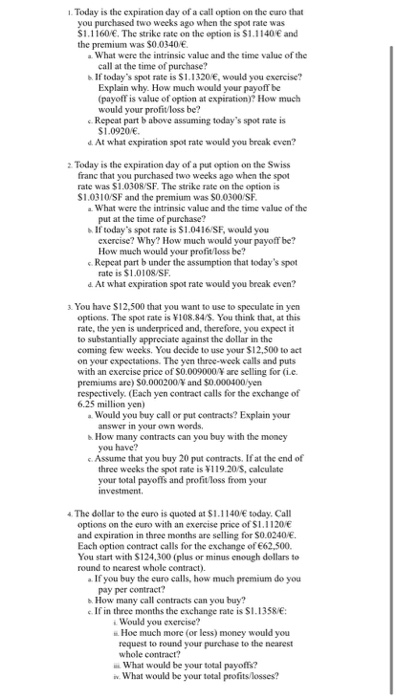

1. Today is the expiration day of a call option on the curo that you purchased two weeks ago when the spot rate was $1.1160/. The strike rate on the option is $1.1140 and the premium was $0.0340/. What were the intrinsic value and the time value of the call at the time of purchase? If today's spot rate is $1. 1320 , would you exercise Explain why. How much would your payoff be (payoff is value of option at expiration)? How much would your profit loss be? Repeat part babove assuming today's spot rate is $1.0920/. 4. At what expiration spot rate would you break even? 2. Today is the expiration day of a put option on the Swiss franc that you purchased two weeks ago when the spot rate was $1.0308/SF. The strike rate on the option is $1.0310/SF and the premium was $0.0300/SF. a. What were the intrinsic value and the time value of the put at the time of purchase? If today's spot rate is $1.0416/SF, would you exercise? Why? How much would your payoff be? How much would your profit loss be? 6. Repeat part b under the assumption that today's spot rate is 1.0108/SF. d. At what expiration spot rate would you break even? 3. You have S12,500 that you want to use to speculate in yen options. The spot rate is 108,84/5. You think that at this rate, the ven is underpriced and therefore, vou expect it to substantially appreciate against the dollar in the coming few weeks. You decide to use your $12.500 to act on your expectations. The yen three-week calls and puts with an excrcise price of S0.009000/ are selling for i.e. premiums are) S0.000200/Vand S0.000400/yen respectively. (Each yen contract calls for the exchange of 6.25 million yen) Would you buy call or put contracts? Explain your answer in your own words, How many contracts can you buy with the money you have? Assume that you buy 20 put contracts. If at the end of three weeks the spot rate is 119.20/S, calculate your total payoffs and profit loss from your investment The dollar to the curo is quoted at $1.1140/ today. Call options on the cure with an exercise price of S1,1120 and expiration in three months are selling for S0.0240/. Each option contract calls for the exchange of 62.500. You start with S124,300 (plus or minus enough dollars to round to nearest whole contract). . If you buy the euro calls, how much premium do you pay per contract? How many call contracts can you buy? c. If in three months the exchange rate is $1.1358/: Would you exercise? Hoe much more or less) money would you request to round your purchase to the nearest whole contract? What would be your total payoffs? What would be your total profits.losses