Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Total Assets=$ 351 billion Total Liabilities = $287.91 billion Total Shareholders' Equity = $63.09 billion Total interest-bearing debt = $136.52 billion EBIT = $

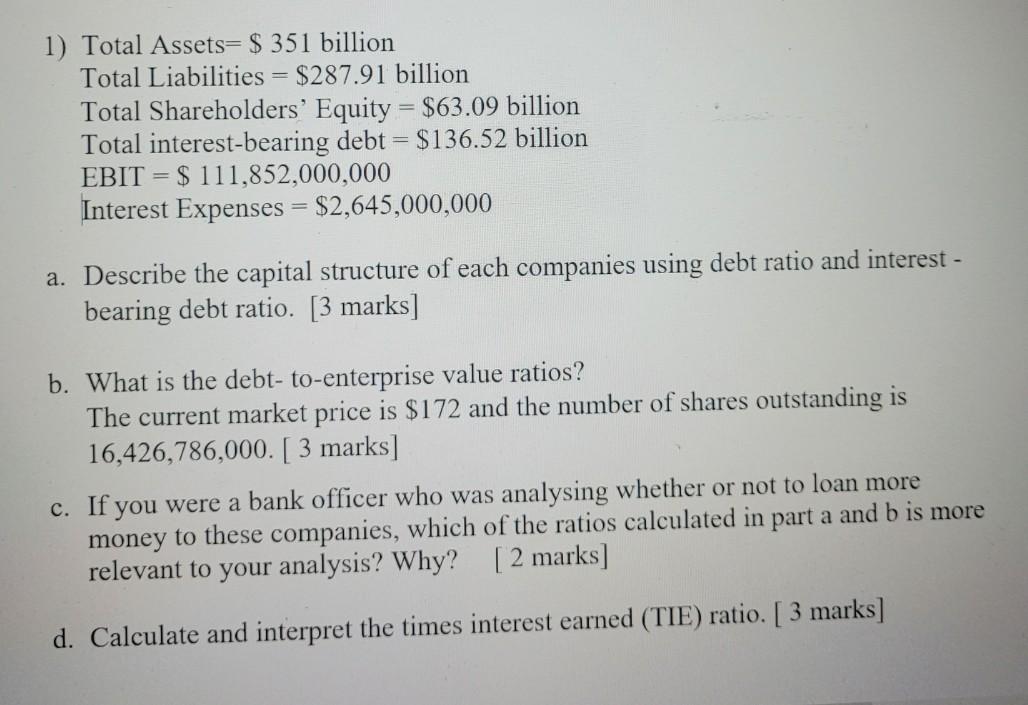

1) Total Assets=$ 351 billion Total Liabilities = $287.91 billion Total Shareholders' Equity = $63.09 billion Total interest-bearing debt = $136.52 billion EBIT = $ 111,852,000,000 Interest Expenses = $2,645,000,000 a. Describe the capital structure of each companies using debt ratio and interest - bearing debt ratio. [3 marks] b. What is the debt-to-enterprise value ratios? The current market price is $172 and the number of shares outstanding is 16,426,786,000. [3 marks] c. If you were a bank officer who was analysing whether or not to loan more money to these companies, which of the ratios calculated in part a and b is more relevant to your analysis? Why? [2 marks] d. Calculate and interpret the times interest earned (TIE) ratio. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started