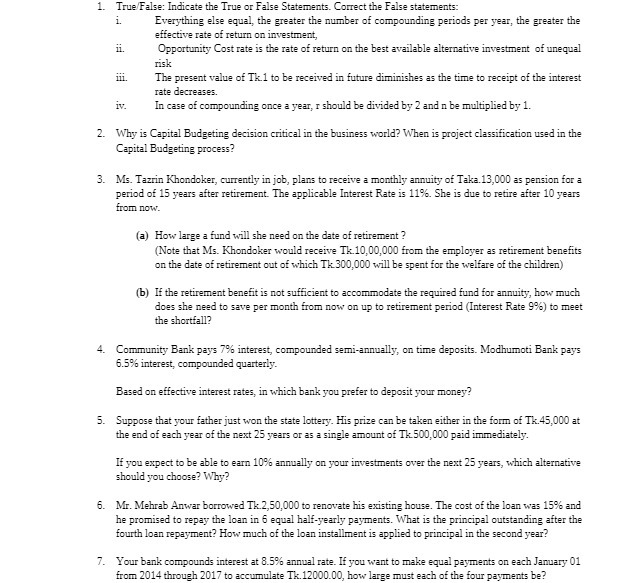

1. True False: Indicate the True or False Statements. Correct the False statements: 1 . Everything else equal, the greater the number of compounding periods per year, the greater the effective rate of return on investment, ii . Opportunity Cost rate is the rate of return on the best available alternative investment of unequal risk ini The present value of Th.1 to be received in future diminishes as the time to receipt of the interest rate decreases. IV. In case of compounding once a year, I should be divided by 2 and n be multiplied by 1. 2. Why is Capital Budgeting decision critical in the business world? When is project classification used in the Capital Budgeting process? 3. Ms. Tazrin Khondoker, currently in job, plans to receive a monthly annuity of Taka. 13,000 as pension for a period of 15 years after retirement. The applicable Interest Rate is 11%. She is due to retire after 10 years from now. (a) How large a fund will she need on the date of retirement ? (Note that Ms. Khondoker would receive TK.10,00,000 from the employer as retirement benefits on the date of retirement out of which TK.300,000 will be spent for the welfare of the children) (b) If the retirement benefit is not sufficient to accommodate the required fund for annuity, how much does she need to save per month from now on up to retirement period (Interest Rate 99%) to meet the shortfall? 4. Community Bank pays 7% interest, compounded semi-annually, on time deposits. Modhumoti Bank pays 6.5% interest, compounded quarterly. Based on effective interest rates, in which bank you prefer to deposit your money? 5. Suppose that your father just won the state lottery. His prize can be taken either in the form of Ik.45,000 at the end of each year of the next 25 years or as a single amount of Tk. 500,000 paid immediately. If you expect to be able to earn 10% annually on your investments over the next 25 years, which alternative should you choose? Why? 6. Mr. Mehrab Anwar borrowed TK.2,50,000 to renovate his existing house. The cost of the loan was 15% and he promised to repay the loan in 6 equal half-yearly payments. What is the principal outstanding after the fourth loan repayment? How much of the loan installment is applied to principal in the second year? 7. Your bank compounds interest at 8.5% annual rate. If you want to make equal payments on each January 01 from 2014 through 2017 to accumulate Tk. 12000.00, how large must each of the four payments be