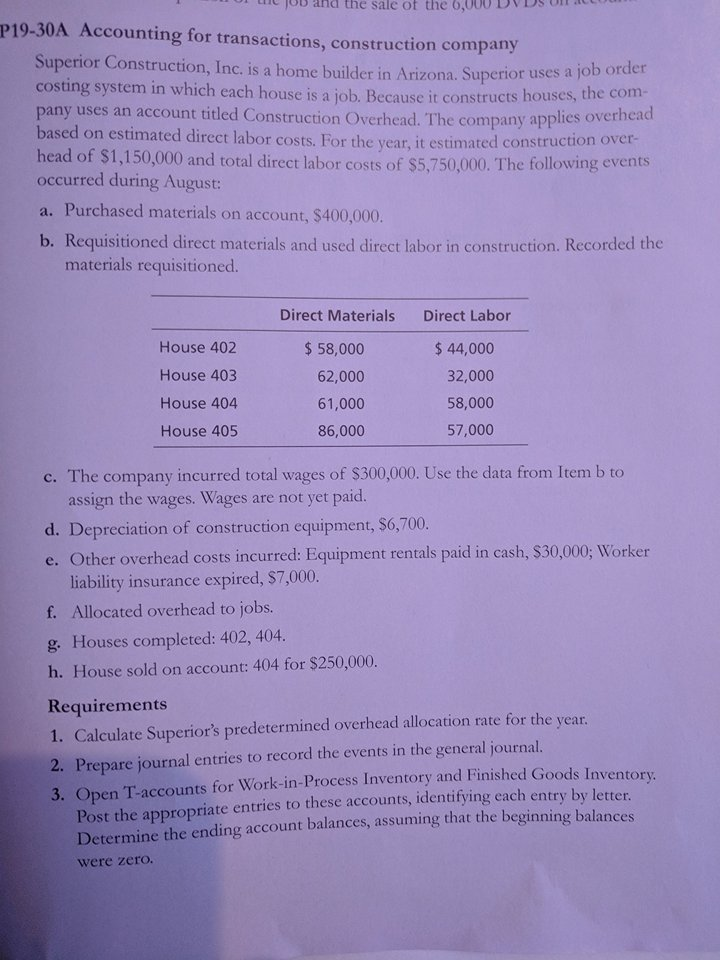

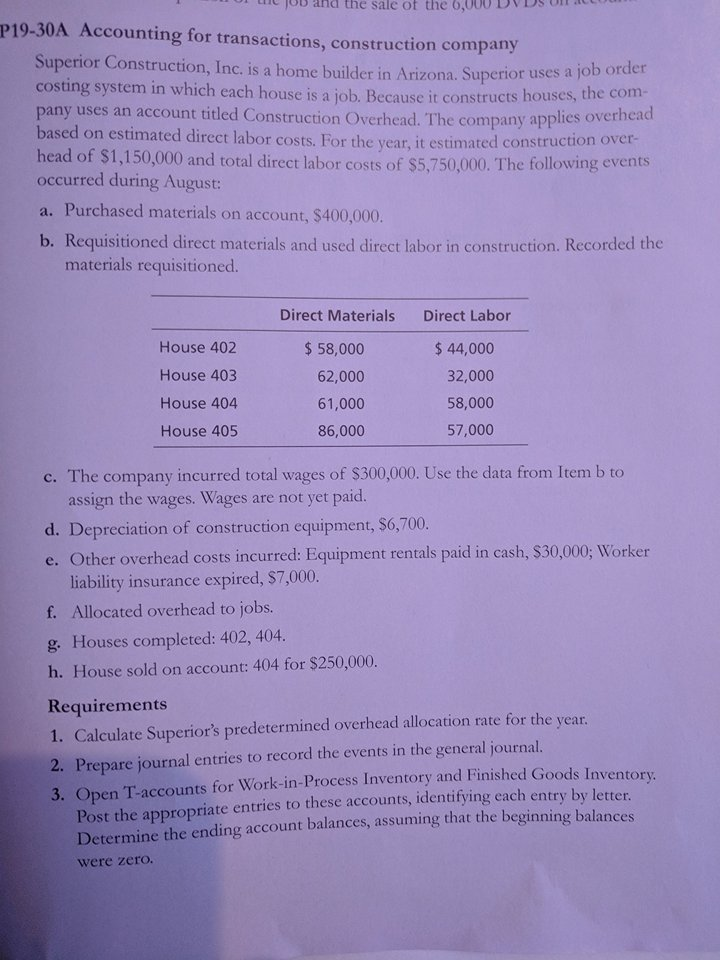

1 uit JOB and the sale of the 6,000 DVDs und P19-30A Accounting for transactions, construction company Superior Construction, Inc. is a home builder in Arizona. Superior uses Costing system in which each house is a job. Because it constructs houses, the pany uses an account titled Construction Overhead. The company applies based on estimated direct labor costs. For the year, it estimated construction head of $1,150,000 and total direct labor costs of S5.750,000. The following events occurred during August: a. Purchased materials on account, $400,000. b. Requisitioned direct materials and used direct labor in construction. Recorded the materials requisitioned. Direct Materials Direct Labor House 402 House 403 House 404 House 405 $ 58,000 62,000 61,000 86,000 $ 44,000 32,000 58,000 57,000 c. The company incurred total wages of $300,000. Use the data from Item b to assign the wages. Wages are not yet paid. d. Depreciation of construction equipment, $6,700. e. Other overhead costs incurred: Equipment rentals paid in cash, $30,000; Worker liability insurance expired, $7,000. f. Allocated overhead to jobs. g. Houses completed: 402,404. h. House sold on account: 404 for $250,000. Requirements 1. Calculate Superior's predetermined overhead allocation rate for the year. 2. Prepare journal entries to record the events in the general journal. 3. Open T-accounts for Work-in-Process Inventory and Finished Goods Inventory. Post the appropriate entries to these accounts, identifying each entry by letter Determine the ending account balances, assuming that the beginning balances were zero. 1 uit JOB and the sale of the 6,000 DVDs und P19-30A Accounting for transactions, construction company Superior Construction, Inc. is a home builder in Arizona. Superior uses Costing system in which each house is a job. Because it constructs houses, the pany uses an account titled Construction Overhead. The company applies based on estimated direct labor costs. For the year, it estimated construction head of $1,150,000 and total direct labor costs of S5.750,000. The following events occurred during August: a. Purchased materials on account, $400,000. b. Requisitioned direct materials and used direct labor in construction. Recorded the materials requisitioned. Direct Materials Direct Labor House 402 House 403 House 404 House 405 $ 58,000 62,000 61,000 86,000 $ 44,000 32,000 58,000 57,000 c. The company incurred total wages of $300,000. Use the data from Item b to assign the wages. Wages are not yet paid. d. Depreciation of construction equipment, $6,700. e. Other overhead costs incurred: Equipment rentals paid in cash, $30,000; Worker liability insurance expired, $7,000. f. Allocated overhead to jobs. g. Houses completed: 402,404. h. House sold on account: 404 for $250,000. Requirements 1. Calculate Superior's predetermined overhead allocation rate for the year. 2. Prepare journal entries to record the events in the general journal. 3. Open T-accounts for Work-in-Process Inventory and Finished Goods Inventory. Post the appropriate entries to these accounts, identifying each entry by letter Determine the ending account balances, assuming that the beginning balances were zero