Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Using a binomial interest rate tree, fill out the table below. (100 points) The first four columns are inputs. P0.5 is the price

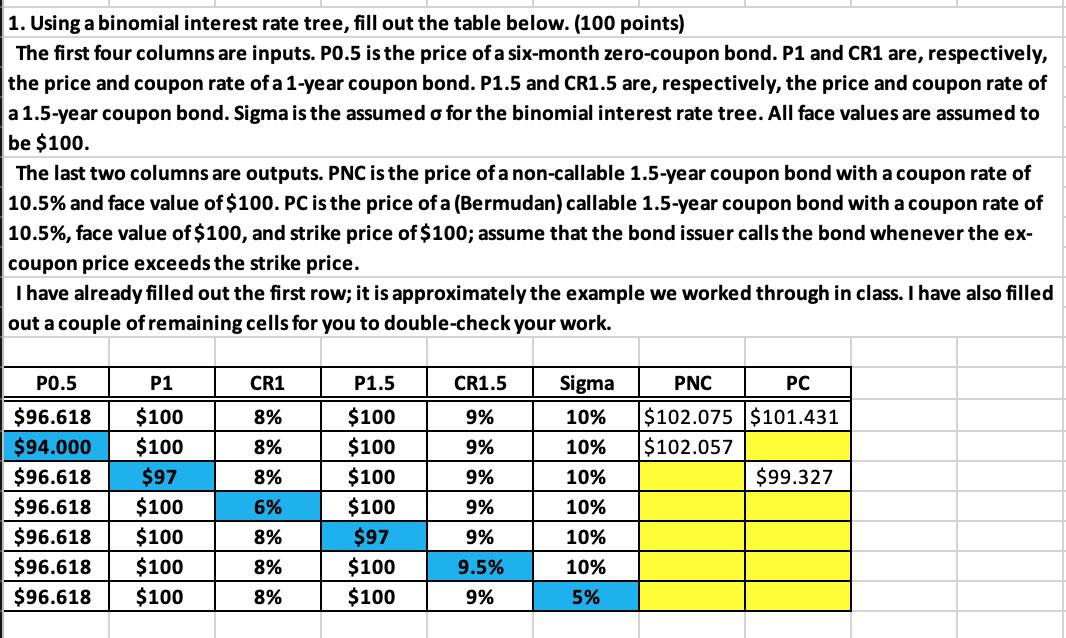

1. Using a binomial interest rate tree, fill out the table below. (100 points) The first four columns are inputs. P0.5 is the price of a six-month zero-coupon bond. P1 and CR1 are, respectively, the price and coupon rate of a 1-year coupon bond. P1.5 and CR1.5 are, respectively, the price and coupon rate of a 1.5-year coupon bond. Sigma is the assumed o for the binomial interest rate tree. All face values are assumed to be $100. The last two columns are outputs. PNC is the price of a non-callable 1.5-year coupon bond with a coupon rate of 10.5% and face value of $100. PC is the price of a (Bermudan) callable 1.5-year coupon bond with a coupon rate of 10.5%, face value of $100, and strike price of $100; assume that the bond issuer calls the bond whenever the ex- coupon price exceeds the strike price. I have already filled out the first row; it is approximately the example we worked through in class. I have also filled out a couple of remaining cells for you to double-check your work. P0.5 P1 $96.618 $100 $94.000 $100 $96.618 $97 $96.618 $100 $96.618 $100 $96.618 $100 $96.618 $100 CR1 8% 8% 8% 6% 8% 8% 8% P1.5 $100 $100 $100 $100 $97 $100 $100 CR1.5 9% 9% 9% 9% 9% 9.5% 9% Sigma 10% 10% $102.057 10% 10% 10% 10% 5% PNC PC $102.075 $101.431 $99.327

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

P05P1CR1P15CR15SigmaPNCPC 89108910102075101431 102057993278910966189400096618 9661896618966189661810010097 10010010010097100100 610010010010097100100 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started