Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Using the DuPont system of analysis, holding other factors constant, an increase in financial leverage will result in A) an increase in the return

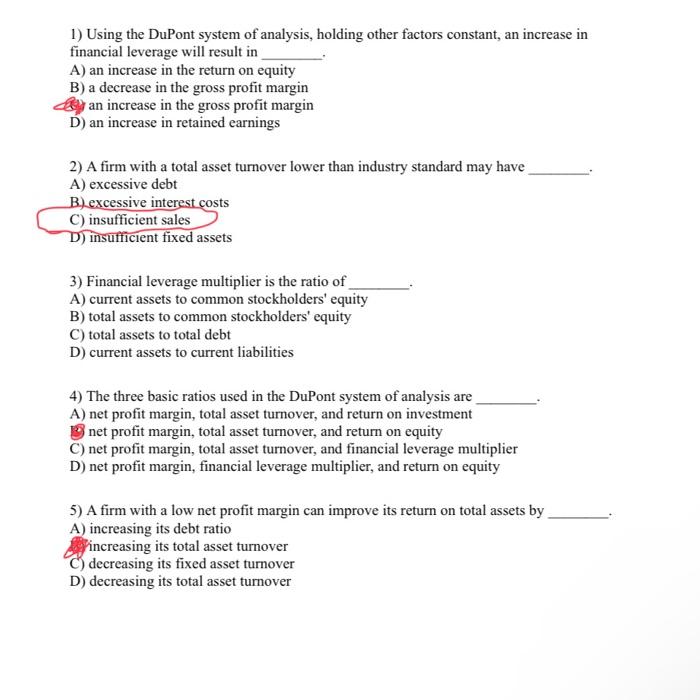

1) Using the DuPont system of analysis, holding other factors constant, an increase in financial leverage will result in A) an increase in the return on equity B) a decrease in the gross profit margin an increase in the gross profit margin D) an increase in retained earnings 2) A firm with a total asset turnover lower than industry standard may have A) excessive debt B) excessive interest costs C) insufficient sales D) insufficient fixed assets 3) Financial leverage multiplier is the ratio of A) current assets to common stockholders' equity B) total assets to common stockholders' equity C) total assets to total debt D) current assets to current liabilities 4) The three basic ratios used in the DuPont system of analysis are A) net profit margin, total asset turnover, and return on investment net profit margin, total asset turnover, and return on equity C) net profit margin, total asset turnover, and financial leverage multiplier D) net profit margin, financial leverage multiplier, and return on equity 5) A firm with a low net profit margin can improve its return on total assets by A) increasing its debt ratio increasing its total asset turnover C) decreasing its fixed asset turnover D) decreasing its total asset turnover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started