Answered step by step

Verified Expert Solution

Question

1 Approved Answer

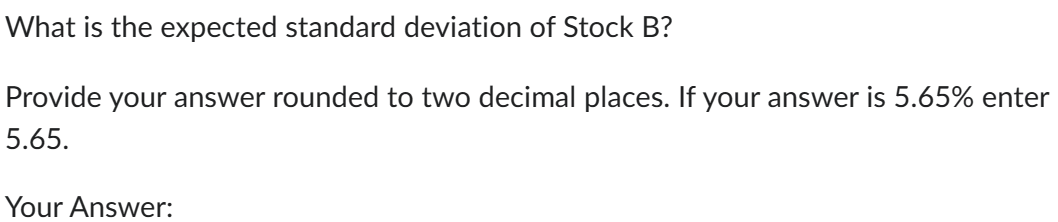

What is the expected standard deviation of Stock B? Provide your answer rounded to two decimal places. If your answer is 5.65% enter 5.65 What

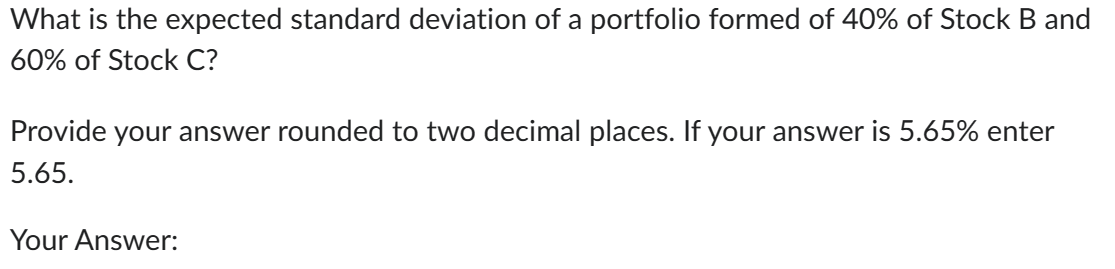

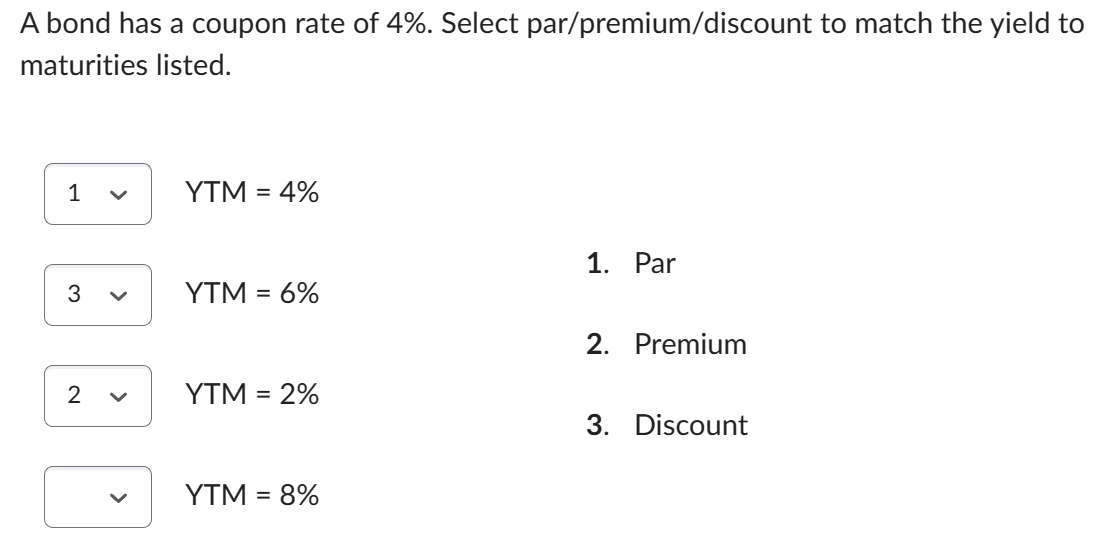

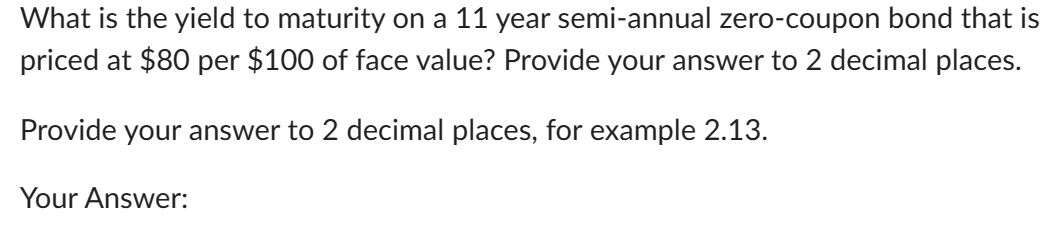

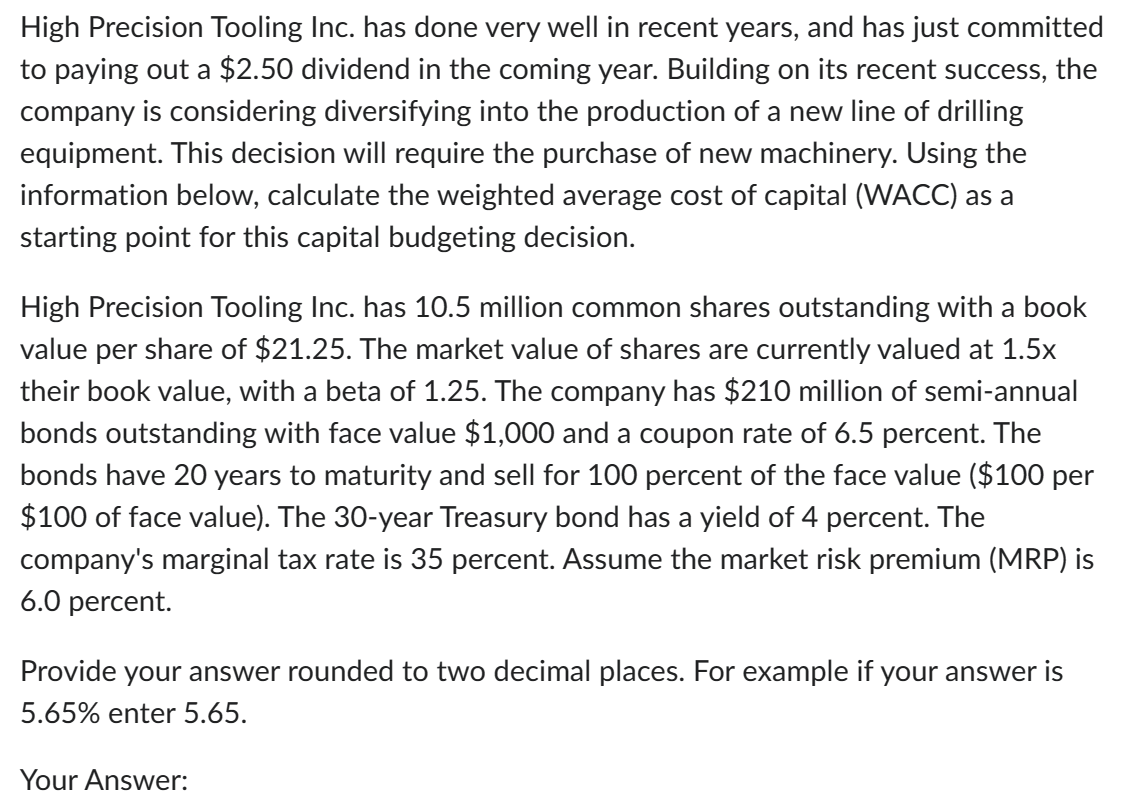

What is the expected standard deviation of Stock B? Provide your answer rounded to two decimal places. If your answer is 5.65% enter 5.65 What is the expected standard deviation of a portfolio formed of 40% of Stock B and 60% of Stock C? Provide your answer rounded to two decimal places. If your answer is 5.65% enter 5.65. Your Answer: A bond has a coupon rate of 4%. Select par/premium/discount to match the yield to maturities listed. YTM=4% 1. Par YTM=6% 2. Premium YTM=2% 3. Discount YTM=8% What is the yield to maturity on a 11 year semi-annual zero-coupon bond that is priced at $80 per $100 of face value? Provide your answer to 2 decimal places. Provide your answer to 2 decimal places, for example 2.13. Your Answer: High Precision Tooling Inc. has done very well in recent years, and has just committed to paying out a $2.50 dividend in the coming year. Building on its recent success, the company is considering diversifying into the production of a new line of drilling equipment. This decision will require the purchase of new machinery. Using the information below, calculate the weighted average cost of capital (WACC) as a starting point for this capital budgeting decision. High Precision Tooling Inc. has 10.5 million common shares outstanding with a book value per share of $21.25. The market value of shares are currently valued at 1.5x their book value, with a beta of 1.25 . The company has $210 million of semi-annual bonds outstanding with face value $1,000 and a coupon rate of 6.5 percent. The bonds have 20 years to maturity and sell for 100 percent of the face value ( $100 per $100 of face value). The 30-year Treasury bond has a yield of 4 percent. The company's marginal tax rate is 35 percent. Assume the market risk premium (MRP) is 6.0 percent. Provide your answer rounded to two decimal places. For example if your answer is 5.65% enter 5.65 . Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started