Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Using the information at the bottom of pp 242 of the case, produce a pro forma income statement for 2012 2. Using the information

1. Using the information at the bottom of pp 242 of the case, produce a pro forma income statement for 2012

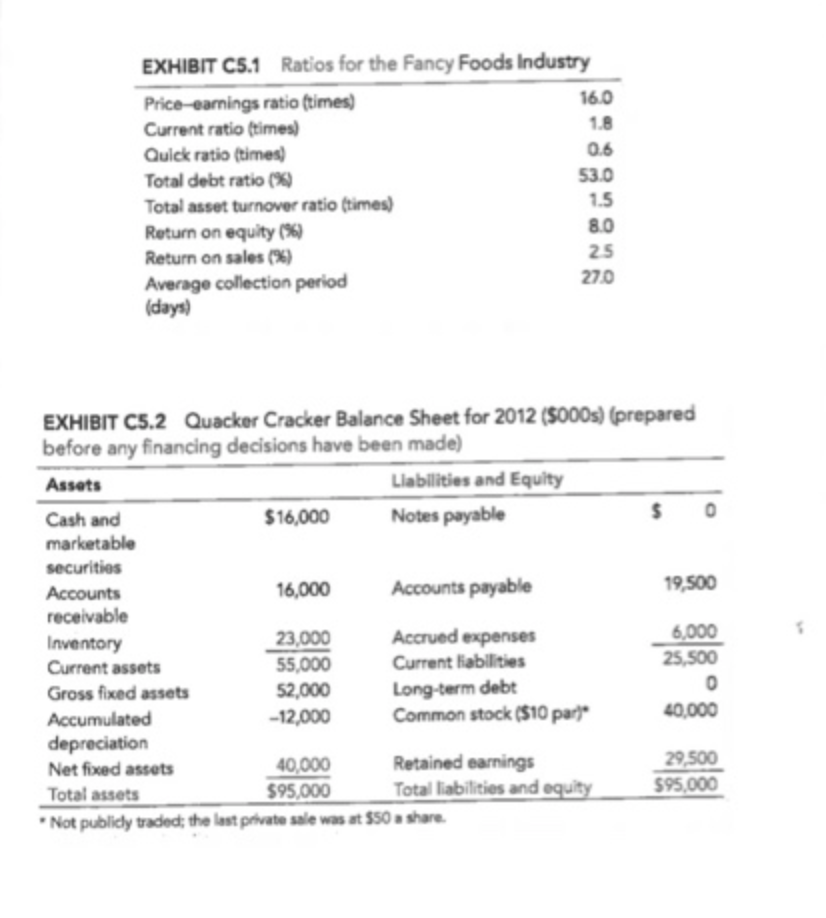

2. Using the information created in #1 above (the pro forma income statement) and if needed, Quaker Cracker's balance sheet (Exhibit C 5.2), calculate the following ratios : Current, Quick , Debt , Average Collection Period,Total Asset Turnover and Return on Equity .

Compare and discuss Quaker Cracker's ratios with the industry ratios found in Exhibit C 5.1.

(Note: show all ratio calculation in detail. Not just the answers)

0.6 EXHIBIT C5.1 Ratios for the Fancy Foods Industry Price-earnings ratio (times) 16.0 Current ratio (times) 1.8 Quick ratio (times Total debt ratio % 53.0 Total asset turnover ratio times) Return on equity (9 Return on sales (%) 25 Average collection period 270 (days) 1.5 80 EXHIBIT C5.2 Quacker Cracker Balance Sheet for 2012 (5000s) (prepared before any financing decisions have been made) Assets Liabilities and Equity Cash and $16,000 Notes payable $ 0 marketable securities Accounts 16,000 Accounts payable 19,500 receivable Inventory 23,000 Accrued expenses 6,000 Current assets 55,000 Current liabilities 25,500 Gross fixed assets 52,000 Long-term debt Accumulated -12,000 Common stock ($10 part 40.000 depreciation Net fixed assets 40,000 Retained earnings 29,500 Total assets 595,000 Total liabilities and equity $95.000 Not publicy traded, the last private sale was at $50 share 0.6 EXHIBIT C5.1 Ratios for the Fancy Foods Industry Price-earnings ratio (times) 16.0 Current ratio (times) 1.8 Quick ratio (times Total debt ratio % 53.0 Total asset turnover ratio times) Return on equity (9 Return on sales (%) 25 Average collection period 270 (days) 1.5 80 EXHIBIT C5.2 Quacker Cracker Balance Sheet for 2012 (5000s) (prepared before any financing decisions have been made) Assets Liabilities and Equity Cash and $16,000 Notes payable $ 0 marketable securities Accounts 16,000 Accounts payable 19,500 receivable Inventory 23,000 Accrued expenses 6,000 Current assets 55,000 Current liabilities 25,500 Gross fixed assets 52,000 Long-term debt Accumulated -12,000 Common stock ($10 part 40.000 depreciation Net fixed assets 40,000 Retained earnings 29,500 Total assets 595,000 Total liabilities and equity $95.000 Not publicy traded, the last private sale was at $50 shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started