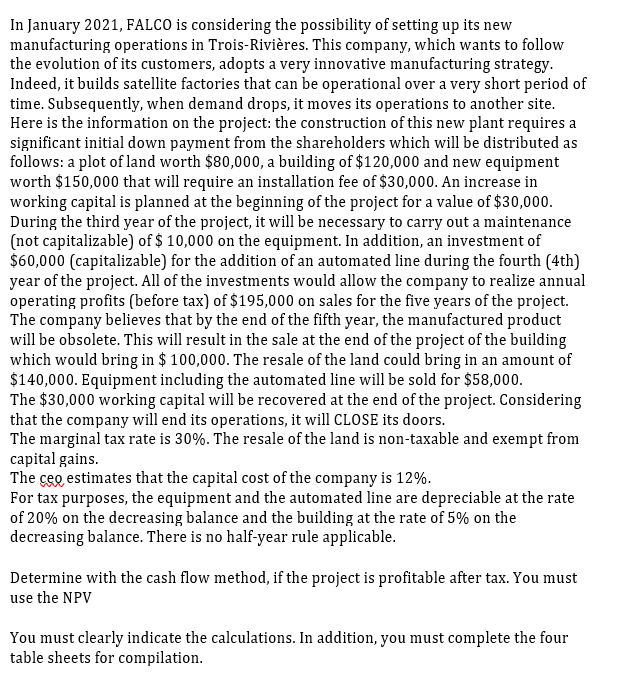

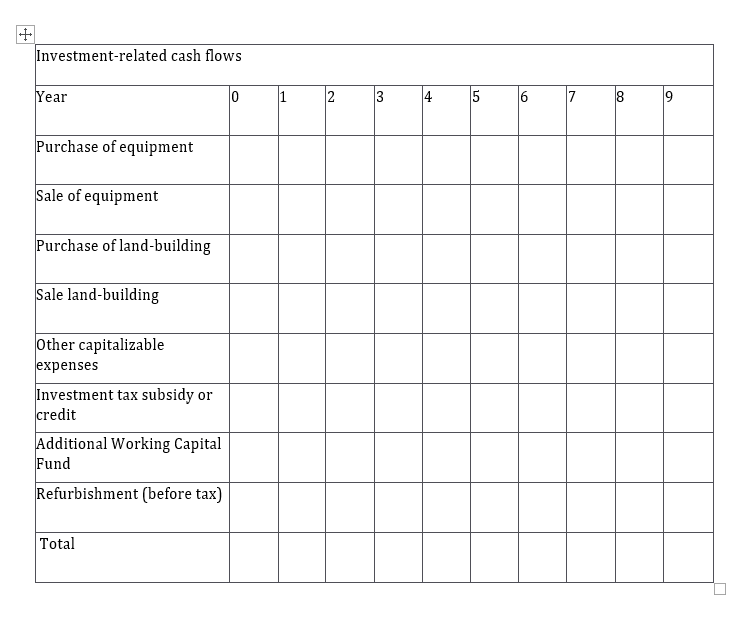

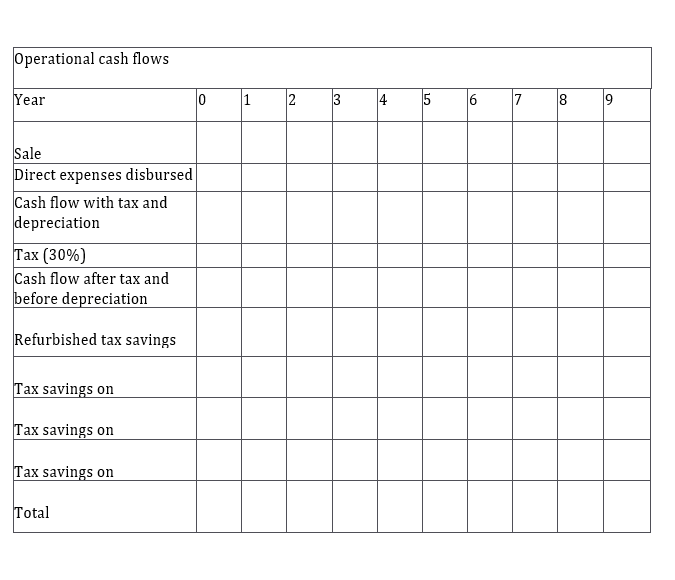

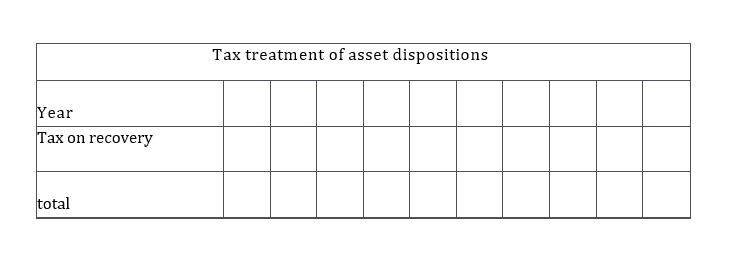

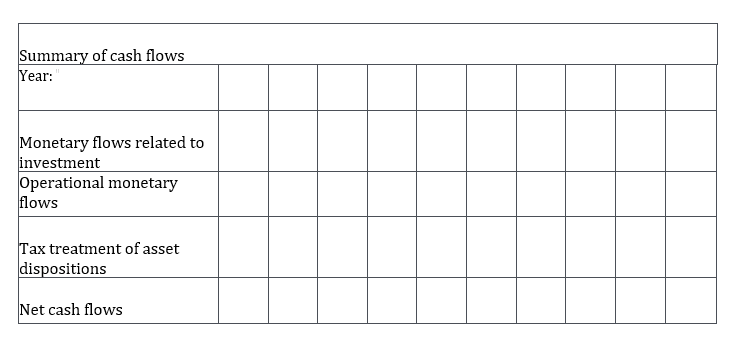

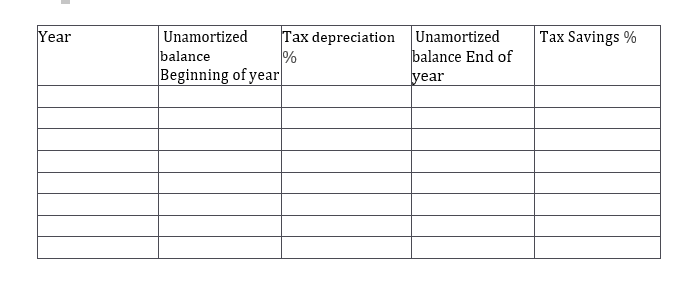

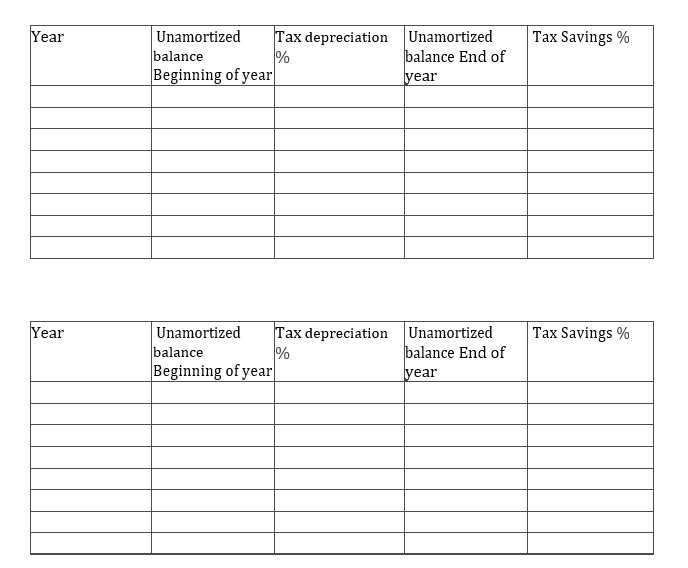

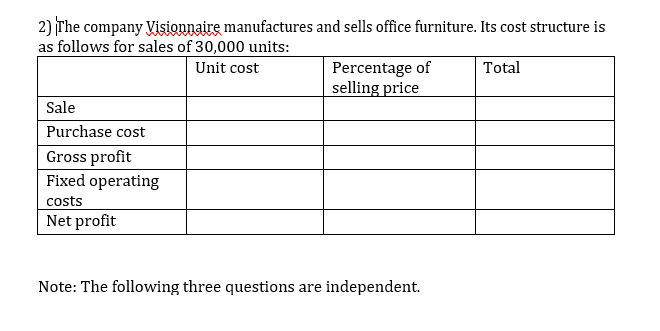

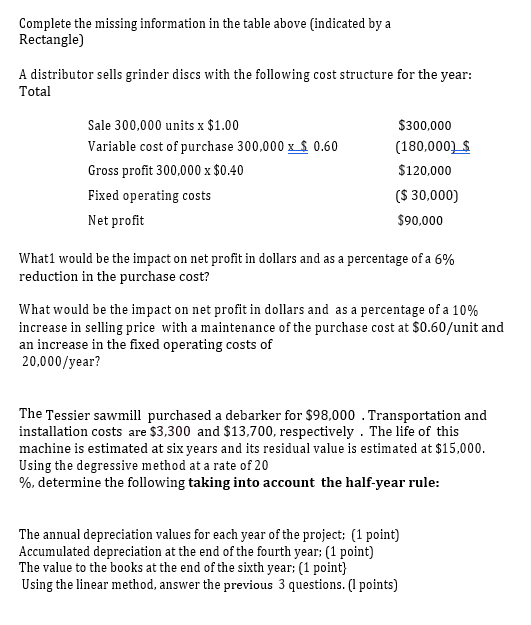

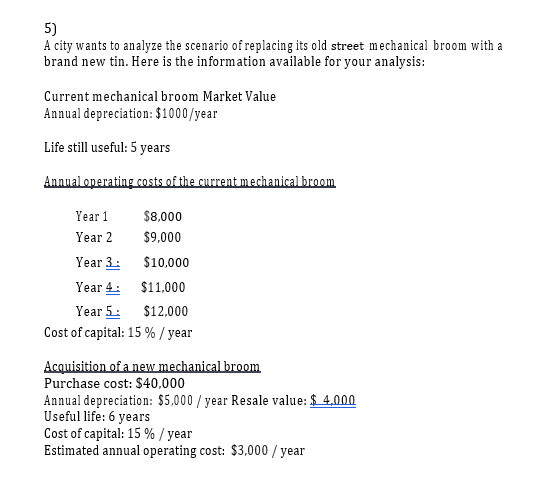

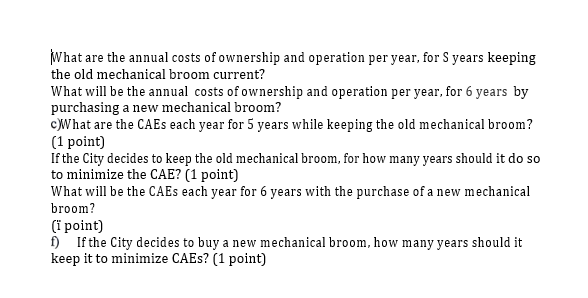

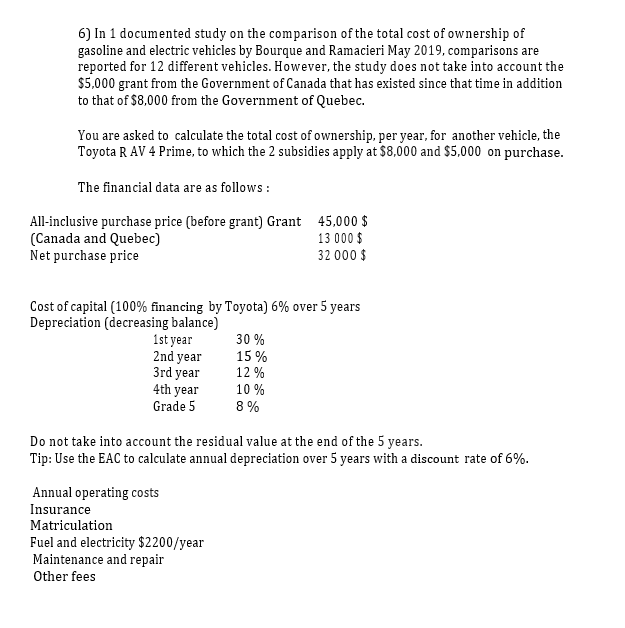

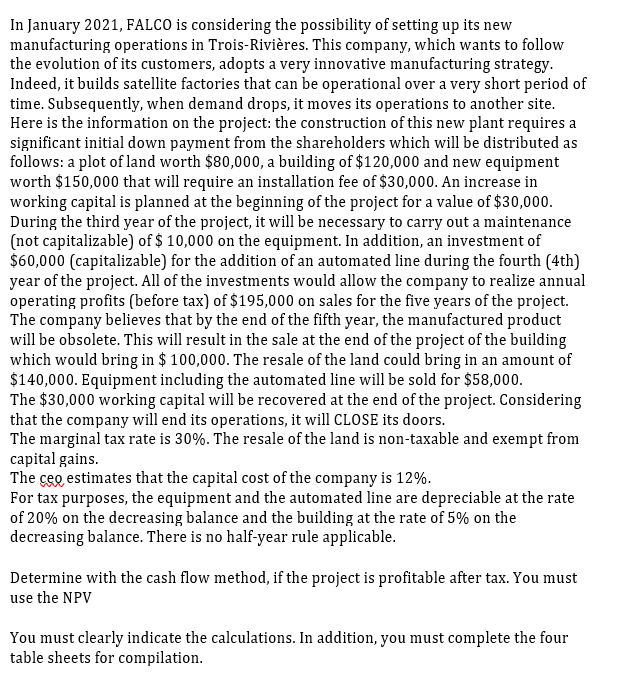

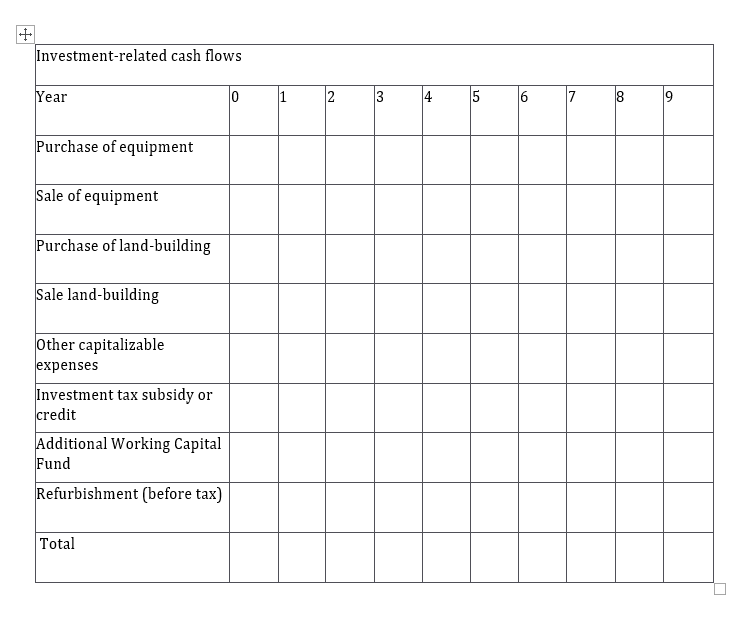

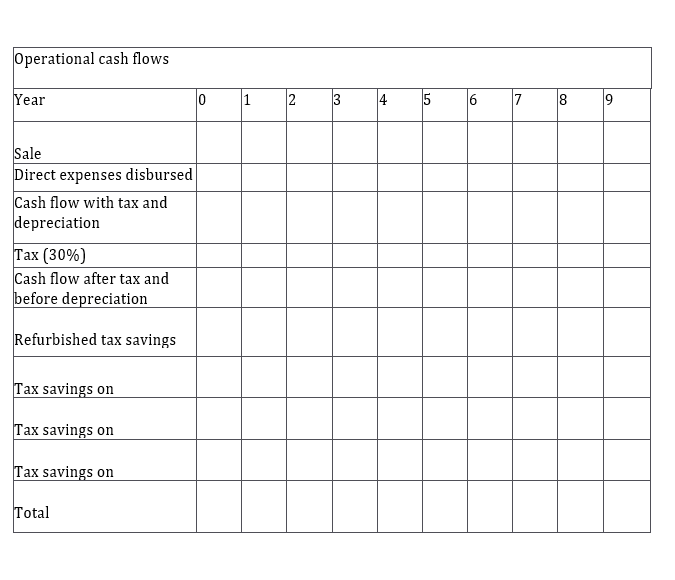

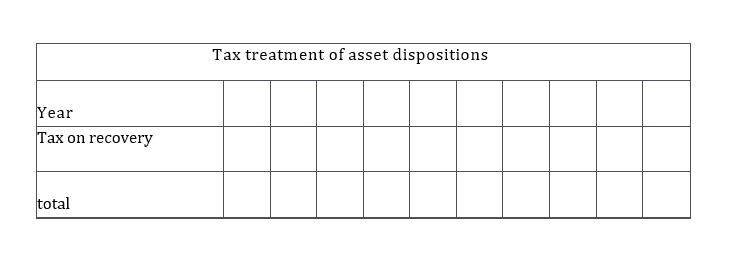

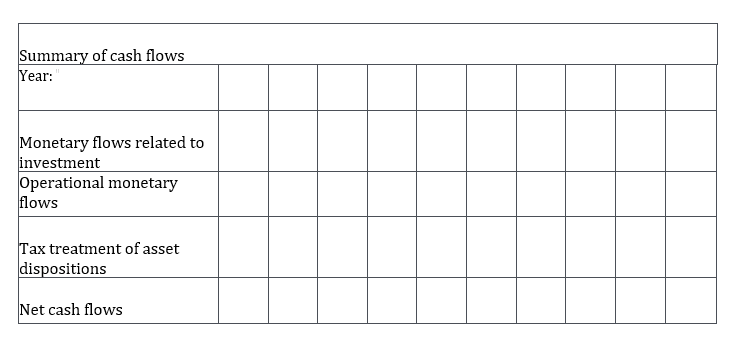

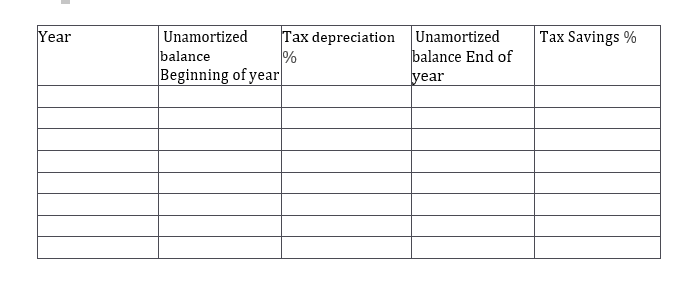

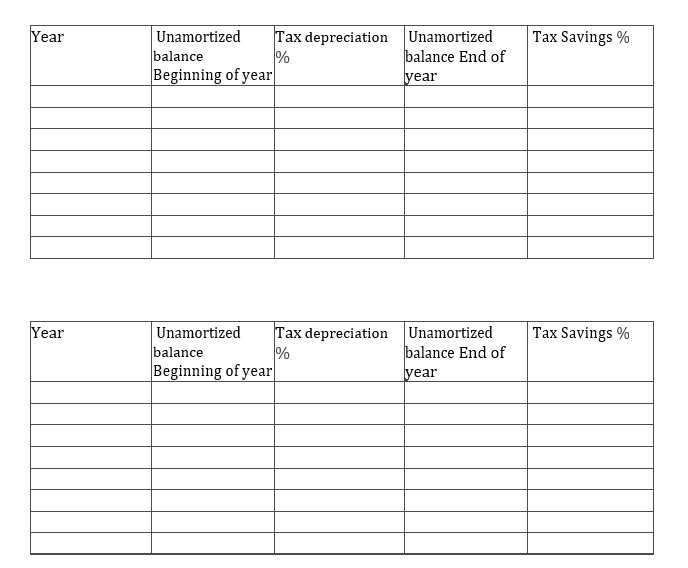

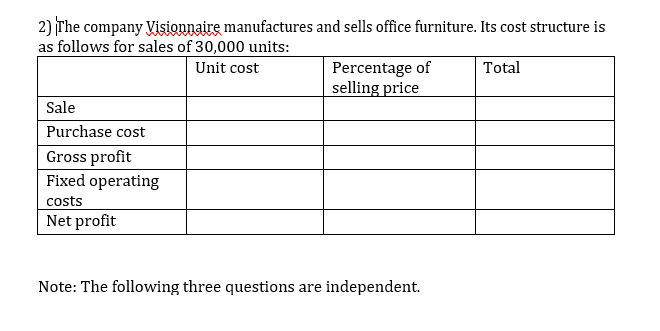

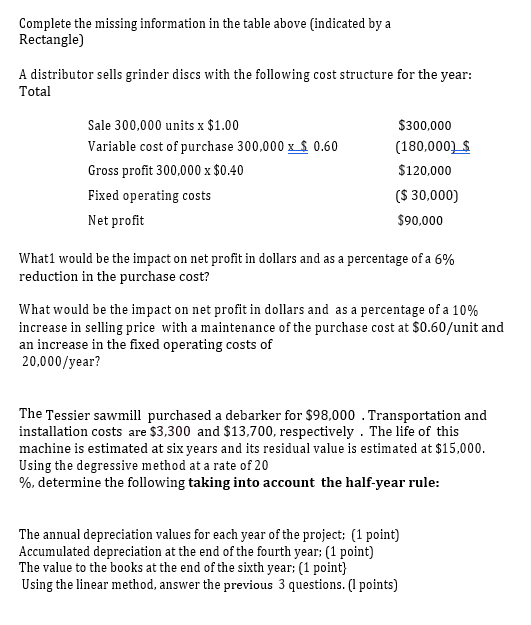

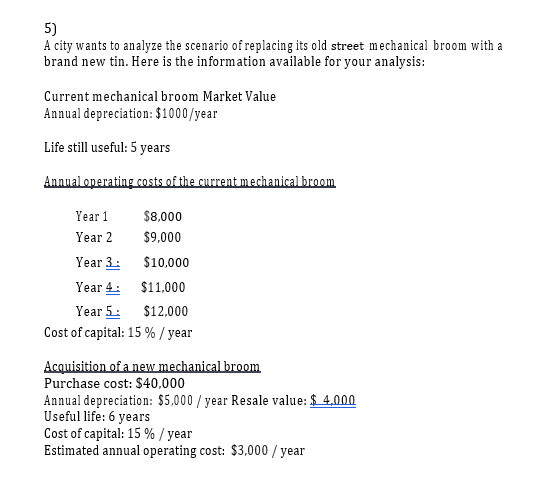

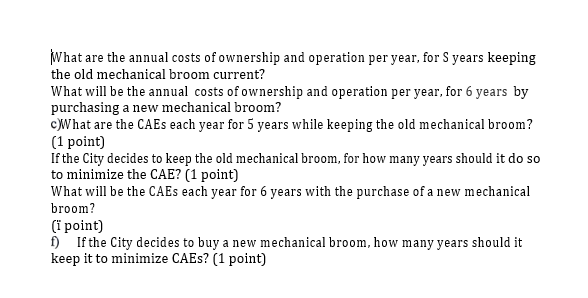

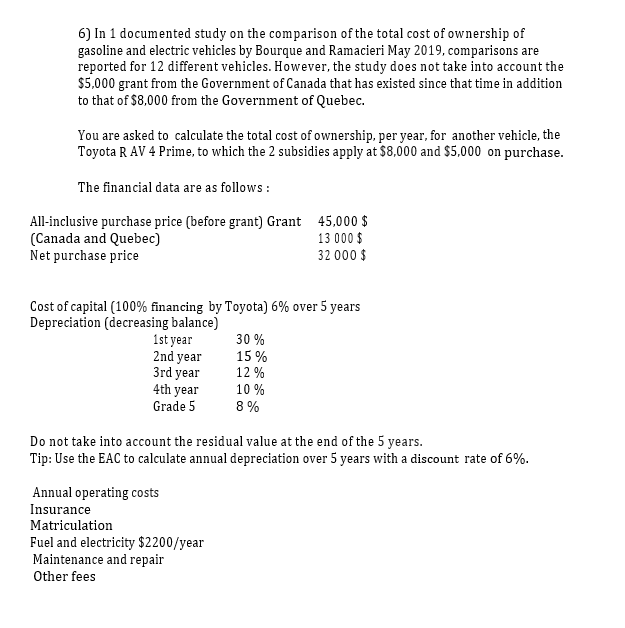

In January 2021, FALCO is considering the possibility of setting up its new manufacturing operations in Trois-Rivires. This company, which wants to follow the evolution of its customers, adopts a very innovative manufacturing strategy. Indeed, it builds satellite factories that can be operational over a very short period of time. Subsequently, when demand drops, it moves its operations to another site. Here is the information on the project: the construction of this new plant requires a significant initial down payment from the shareholders which will be distributed as follows: a plot of land worth $80,000, a building of $120,000 and new equipment worth $150,000 that will require an installation fee of $30,000. An increase in working capital is planned at the beginning of the project for a value of $30,000. During the third year of the project, it will be necessary to carry out a maintenance (not capitalizable) of $ 10,000 on the equipment. In addition, an investment of $60,000 (capitalizable) for the addition of an automated line during the fourth (4th) year of the project. All of the investments would allow the company to realize annual operating profits (before tax) of $195,000 on sales for the five years of the project. The company believes that by the end of the fifth year, the manufactured product will be obsolete. This will result in the sale at the end of the project of the building which would bring in $ 100,000. The resale of the land could bring in an amount of $140,000. Equipment including the automated line will be sold for $58,000. The $30,000 working capital will be recovered at the end of the project. Considering that the company will end its operations, it will CLOSE its doors. The marginal tax rate is 30%. The resale of the land is non-taxable and exempt from capital gains. The ceo estimates that the capital cost of the company is 12%. For tax purposes, the equipment and the automated line are depreciable at the rate of 20% on the decreasing balance and the building at the rate of 5% on the decreasing balance. There is no half-year rule applicable. Determine with the cash flow method, if the project is profitable after tax. You must use the NPV You must clearly indicate the calculations. In addition, you must complete the four table sheets for compilation. + Investment-related cash flows Year 0 1 2 3 4 5 6 9 Purchase of equipment Sale of equipment Purchase of land-building Sale land-building Other capitalizable expenses Investment tax subsidy or credit Additional Working Capital Fund Refurbishment (before tax) Total Operational cash flows Year 0 1 2 3 4 5 6 7 8 9 Sale Direct expenses disbursed Cash flow with tax and depreciation Tax (30%) Cash flow after tax and before depreciation Refurbished tax savings Tax savings on Tax savings on Tax savings on Total Tax treatment of asset dispositions Year Tax on recovery total Summary of cash flows Year: Monetary flows related to investment Operational monetary flows Tax treatment of asset dispositions Net cash flows Year Tax Savings % Unamortized Tax depreciation Unamortized balance % balance End of Beginning of year year Year Tax Savings % Unamortized Tax depreciation Unamortized balance % balance End of Beginning of year year Year Tax Savings % Unamortized Tax depreciation Unamortized balance % balance End of Beginning of year year 2) The company Visionnaire manufactures and sells office furniture. Its cost structure is as follows for sales of 30,000 units: Unit cost Percentage of Total selling price Sale Purchase cost Gross profit Fixed operating costs Net profit Note: The following three questions are independent. Complete the missing information in the table above (indicated by a Rectangle) A distributor sells grinder discs with the following cost structure for the year: Total Sale 300,000 units x $1.00 Variable cost of purchase 300,000 x $ 0.60 Gross profit 300,000 x $0.40 Fixed operating costs Net profit $300,000 (180,000 $ $120,000 ($ 30,000) $90,000 What1 would be the impact on net profit in dollars and as a percentage of a 6% reduction in the purchase cost? What would be the impact on net profit in dollars and as a percentage of a 10% increase in selling price with a maintenance of the purchase cost at $0.60/unit and an increase in the fixed operating costs of 20,000/year? The Tessier sawmill purchased a debarker for $98,000 . Transportation and installation costs are $3,300 and $13,700, respectively. The life of this machine is estimated at six years and its residual value is estimated at $15,000. Using the degressive method at a rate of 20 %, determine the following taking into account the half-year rule: The annual depreciation values for each year of the project: (1 point) Accumulated depreciation at the end of the fourth year: (1 point) The value to the books at the end of the sixth year; (1 point} Using the linear method, answer the previous 3 questions. (I points) 5) A city wants to analyze the scenario of replacing its old street mechanical broom with a brand new tin. Here is the information available for your analysis: Current mechanical broom Market Value Annual depreciation: $1000/year Life still useful: 5 years Annual operating costs of the current mechanical broom Year 1 $8,000 Year 2 $9,000 Year 3: $10,000 Year 4: $11,000 Year 5. $12.000 Cost of capital: 15 % / year Acquisition of a new mechanical broom Purchase cost: $40,000 Annual depreciation: $5,000/year Resale value: $ 4,000 Useful life: 6 years Cost of capital: 15 % / year Estimated annual operating cost: $3,000/year What are the annual costs of ownership and operation per year, for years keeping the old mechanical broom current? What will be the annual costs of ownership and operation per year, for 6 years by purchasing a new mechanical broom? c)What are the CAEs each year for 5 years while keeping the old mechanical broom? (1 point) If the City decides to keep the old mechanical broom, for how many years should it do so to minimize the CAE? (1 point) What will be the CAEs each year for 6 years with the purchase of a new mechanical broom? (i point) f) If the City decides to buy a new mechanical broom, how many years should it keep it to minimize CAEs? (1 point) 6) In 1 documented study on the comparison of the total cost of ownership of gasoline and electric vehicles by Bourque and Ramacieri May 2019, comparisons are reported for 12 different vehicles. However, the study does not take into account the $5,000 grant from the Government of Canada that has existed since that time in addition to that of $8,000 from the Government of Quebec. You are asked to calculate the total cost of ownership, per year, for another vehicle, the Toyota RAV 4 Prime, to which the 2 subsidies apply at $8,000 and $5,000 on purchase. The financial data are as follows: All-inclusive purchase price (before grant) Grant 45,000 $ (Canada and Quebec) 13 000 $ Net purchase price 32 000 $ Cost of capital (100% financing by Toyota) 6% over 5 years Depreciation (decreasing balance) 1st year 30 % 2nd year 15 % 3rd year 12 % 4th year 10% Grade 5 8 % Do not take into account the residual value at the end of the 5 years. Tip: Use the EAC to calculate annual depreciation over 5 years with a discount rate of 6%. Annual operating costs Insurance Matriculation Fuel and electricity $2200/year Maintenance and repair Other fees In January 2021, FALCO is considering the possibility of setting up its new manufacturing operations in Trois-Rivires. This company, which wants to follow the evolution of its customers, adopts a very innovative manufacturing strategy. Indeed, it builds satellite factories that can be operational over a very short period of time. Subsequently, when demand drops, it moves its operations to another site. Here is the information on the project: the construction of this new plant requires a significant initial down payment from the shareholders which will be distributed as follows: a plot of land worth $80,000, a building of $120,000 and new equipment worth $150,000 that will require an installation fee of $30,000. An increase in working capital is planned at the beginning of the project for a value of $30,000. During the third year of the project, it will be necessary to carry out a maintenance (not capitalizable) of $ 10,000 on the equipment. In addition, an investment of $60,000 (capitalizable) for the addition of an automated line during the fourth (4th) year of the project. All of the investments would allow the company to realize annual operating profits (before tax) of $195,000 on sales for the five years of the project. The company believes that by the end of the fifth year, the manufactured product will be obsolete. This will result in the sale at the end of the project of the building which would bring in $ 100,000. The resale of the land could bring in an amount of $140,000. Equipment including the automated line will be sold for $58,000. The $30,000 working capital will be recovered at the end of the project. Considering that the company will end its operations, it will CLOSE its doors. The marginal tax rate is 30%. The resale of the land is non-taxable and exempt from capital gains. The ceo estimates that the capital cost of the company is 12%. For tax purposes, the equipment and the automated line are depreciable at the rate of 20% on the decreasing balance and the building at the rate of 5% on the decreasing balance. There is no half-year rule applicable. Determine with the cash flow method, if the project is profitable after tax. You must use the NPV You must clearly indicate the calculations. In addition, you must complete the four table sheets for compilation. + Investment-related cash flows Year 0 1 2 3 4 5 6 9 Purchase of equipment Sale of equipment Purchase of land-building Sale land-building Other capitalizable expenses Investment tax subsidy or credit Additional Working Capital Fund Refurbishment (before tax) Total Operational cash flows Year 0 1 2 3 4 5 6 7 8 9 Sale Direct expenses disbursed Cash flow with tax and depreciation Tax (30%) Cash flow after tax and before depreciation Refurbished tax savings Tax savings on Tax savings on Tax savings on Total Tax treatment of asset dispositions Year Tax on recovery total Summary of cash flows Year: Monetary flows related to investment Operational monetary flows Tax treatment of asset dispositions Net cash flows Year Tax Savings % Unamortized Tax depreciation Unamortized balance % balance End of Beginning of year year Year Tax Savings % Unamortized Tax depreciation Unamortized balance % balance End of Beginning of year year Year Tax Savings % Unamortized Tax depreciation Unamortized balance % balance End of Beginning of year year 2) The company Visionnaire manufactures and sells office furniture. Its cost structure is as follows for sales of 30,000 units: Unit cost Percentage of Total selling price Sale Purchase cost Gross profit Fixed operating costs Net profit Note: The following three questions are independent. Complete the missing information in the table above (indicated by a Rectangle) A distributor sells grinder discs with the following cost structure for the year: Total Sale 300,000 units x $1.00 Variable cost of purchase 300,000 x $ 0.60 Gross profit 300,000 x $0.40 Fixed operating costs Net profit $300,000 (180,000 $ $120,000 ($ 30,000) $90,000 What1 would be the impact on net profit in dollars and as a percentage of a 6% reduction in the purchase cost? What would be the impact on net profit in dollars and as a percentage of a 10% increase in selling price with a maintenance of the purchase cost at $0.60/unit and an increase in the fixed operating costs of 20,000/year? The Tessier sawmill purchased a debarker for $98,000 . Transportation and installation costs are $3,300 and $13,700, respectively. The life of this machine is estimated at six years and its residual value is estimated at $15,000. Using the degressive method at a rate of 20 %, determine the following taking into account the half-year rule: The annual depreciation values for each year of the project: (1 point) Accumulated depreciation at the end of the fourth year: (1 point) The value to the books at the end of the sixth year; (1 point} Using the linear method, answer the previous 3 questions. (I points) 5) A city wants to analyze the scenario of replacing its old street mechanical broom with a brand new tin. Here is the information available for your analysis: Current mechanical broom Market Value Annual depreciation: $1000/year Life still useful: 5 years Annual operating costs of the current mechanical broom Year 1 $8,000 Year 2 $9,000 Year 3: $10,000 Year 4: $11,000 Year 5. $12.000 Cost of capital: 15 % / year Acquisition of a new mechanical broom Purchase cost: $40,000 Annual depreciation: $5,000/year Resale value: $ 4,000 Useful life: 6 years Cost of capital: 15 % / year Estimated annual operating cost: $3,000/year What are the annual costs of ownership and operation per year, for years keeping the old mechanical broom current? What will be the annual costs of ownership and operation per year, for 6 years by purchasing a new mechanical broom? c)What are the CAEs each year for 5 years while keeping the old mechanical broom? (1 point) If the City decides to keep the old mechanical broom, for how many years should it do so to minimize the CAE? (1 point) What will be the CAEs each year for 6 years with the purchase of a new mechanical broom? (i point) f) If the City decides to buy a new mechanical broom, how many years should it keep it to minimize CAEs? (1 point) 6) In 1 documented study on the comparison of the total cost of ownership of gasoline and electric vehicles by Bourque and Ramacieri May 2019, comparisons are reported for 12 different vehicles. However, the study does not take into account the $5,000 grant from the Government of Canada that has existed since that time in addition to that of $8,000 from the Government of Quebec. You are asked to calculate the total cost of ownership, per year, for another vehicle, the Toyota RAV 4 Prime, to which the 2 subsidies apply at $8,000 and $5,000 on purchase. The financial data are as follows: All-inclusive purchase price (before grant) Grant 45,000 $ (Canada and Quebec) 13 000 $ Net purchase price 32 000 $ Cost of capital (100% financing by Toyota) 6% over 5 years Depreciation (decreasing balance) 1st year 30 % 2nd year 15 % 3rd year 12 % 4th year 10% Grade 5 8 % Do not take into account the residual value at the end of the 5 years. Tip: Use the EAC to calculate annual depreciation over 5 years with a discount rate of 6%. Annual operating costs Insurance Matriculation Fuel and electricity $2200/year Maintenance and repair Other fees