Answered step by step

Verified Expert Solution

Question

1 Approved Answer

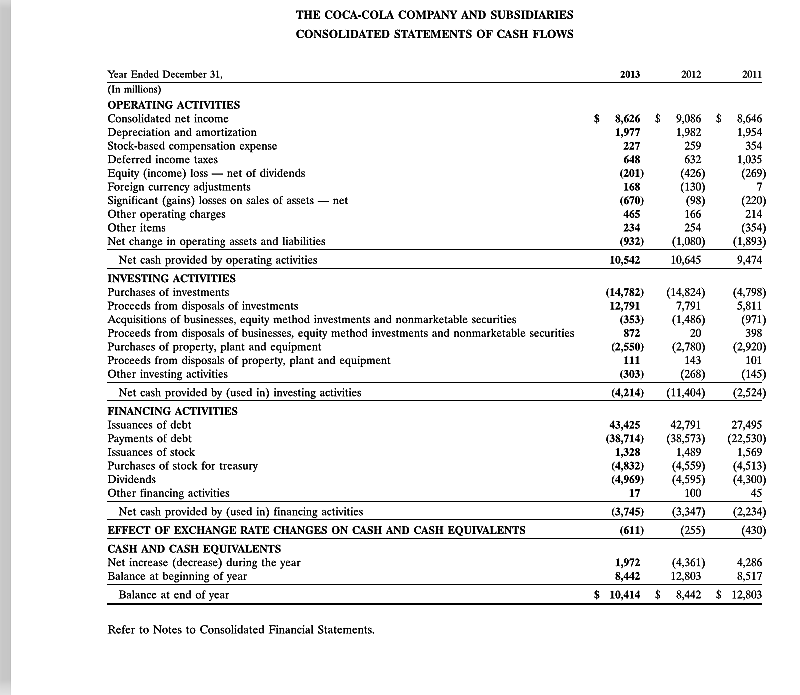

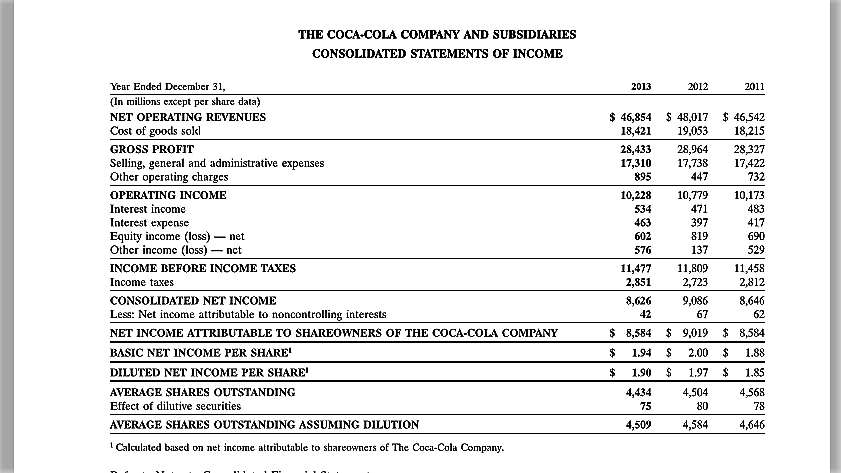

1. Was the indirect method used to calculate cash flow from operating activities? 1 a. How can you tell if the indirect method was used

1. Was the indirect method used to calculate cash flow from operating activities?

1 a. How can you tell if the indirect method was used or not?

2. What is the company's total cash flow for 2013?

2a. Was it cash inflow or cash outflow?

THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS 2012 2011 Year Ended December 31 (In millions) OPERATING ACTIMTIES Consolidated net income Depreciation and amortization Stock-based compensation expense Deferred income taxes Equity income) loss net of dividends Foreign currency adjustments Significant (gains) losses on sales of assets - net Other operating charges Other items Net change in operating assets and liabilities 2013 $ 8,626 $ 9,086 $ 8,646 1,954 1,982 1,977 227 648 (201) 168 (670) 465 234 1,035 426) (130) (98) 166 254 (269) 220) (354) (932)(1,080)(1,893) 9,474 10,645 Net cash provided by operating activities INVESTING ACTIVITTES Purchases of investments Procceds from disposals of invcstments Acquisitions of businesses, equity method investments and nonmarketable securities Proceeds from disposals of businesses, equity method investments and nonmarketable securities Purchases of property, plant and cquipment Proceeds from disposals of property, plant and equipment Other investing activities 10,542 (14,782) (14,824)(4,798) 5,811 7,791 (353)(1,486) 20 12,791 (971) 398 (2,550) (2,780 (2,920) 872 143 (268) Net cash provided by (used in) investing activities(4,214)(11,404) (303) (145) (2,524) FINANCING ACTIVITIES Issuances of debt Payments of debt Issuances of stock Purchases of stock for treasury Dividends Other financing activities 43,42542,791 27,495 (38,714)(38,573) (22,530) 1,569 1,489 1,328 (4,832)(4,559) (4,513) (4,969)(4,595) (4,300) (3,745) Net cash provided by (used in) financing activities EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS(611)(255)(430) CASH AND CASH EQUIVALENTS Net increase (decrease) during the year Balance at beginning of year (2,234) 1,972(4,361) 8.44212,803 4,286 8,517 Balancc at end of ycar $ 10,414 $ 8,442 S 12,803 Refer to Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started