1) WHAT ARE BUDGET BASICS??? PLEASE HELP

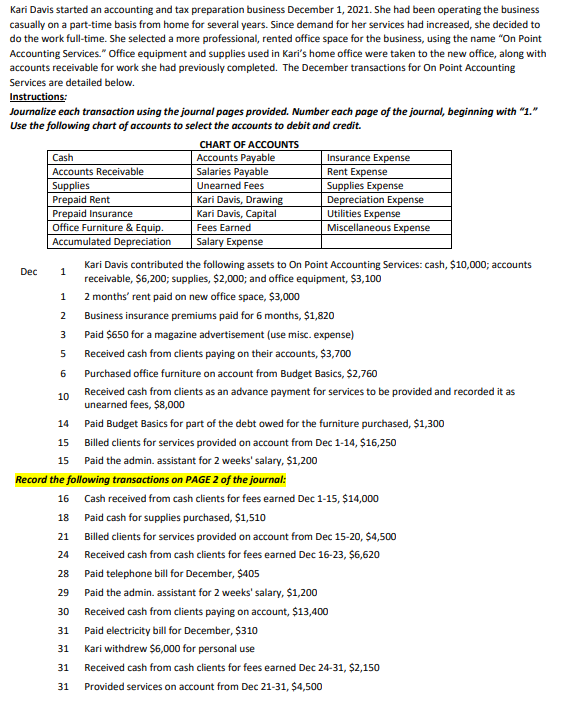

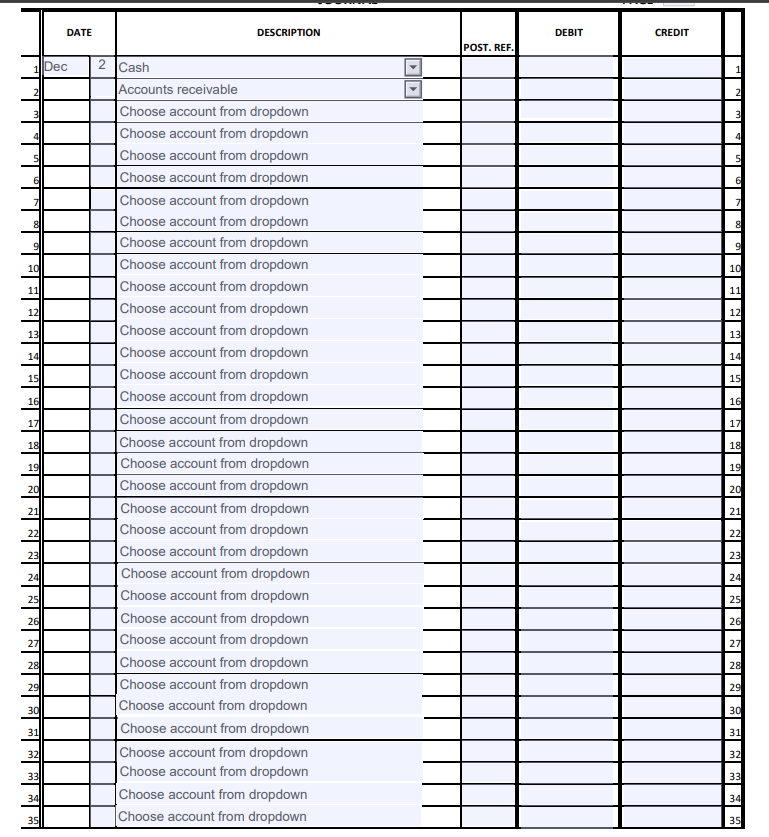

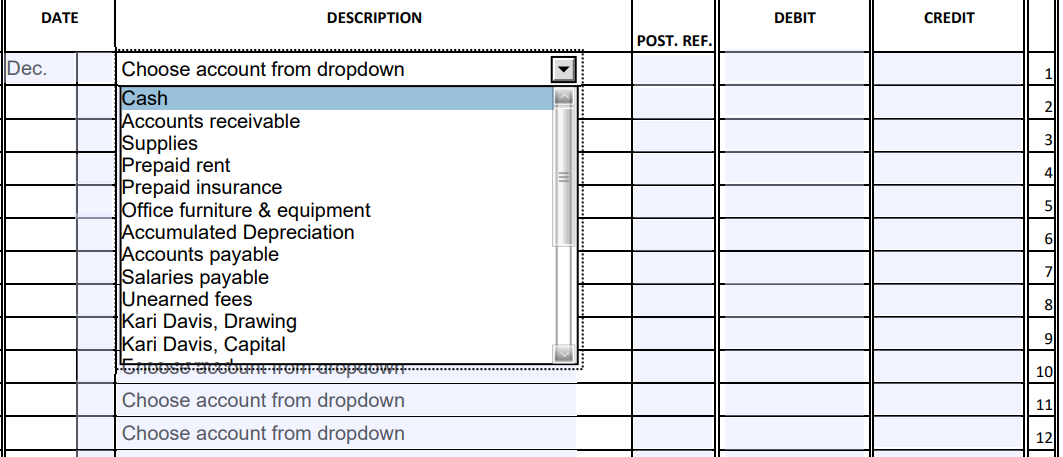

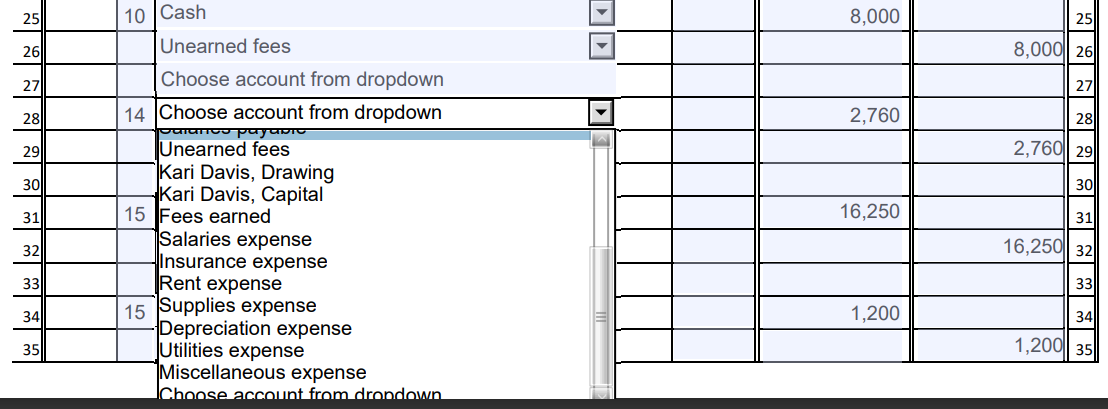

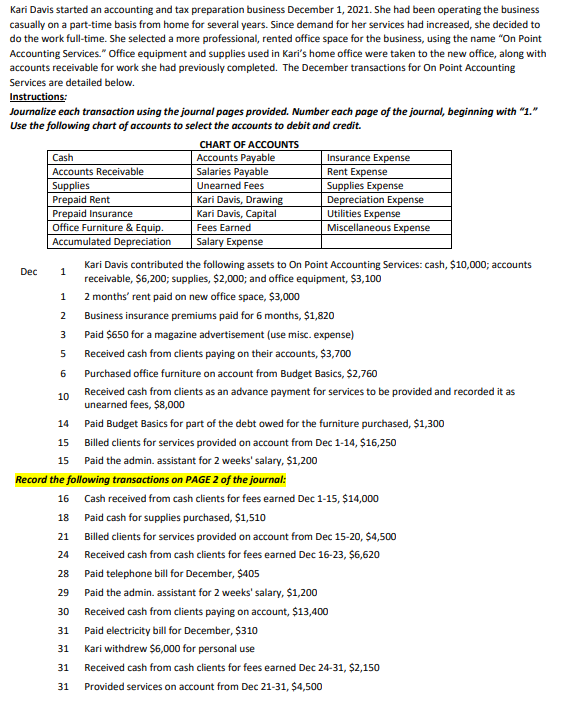

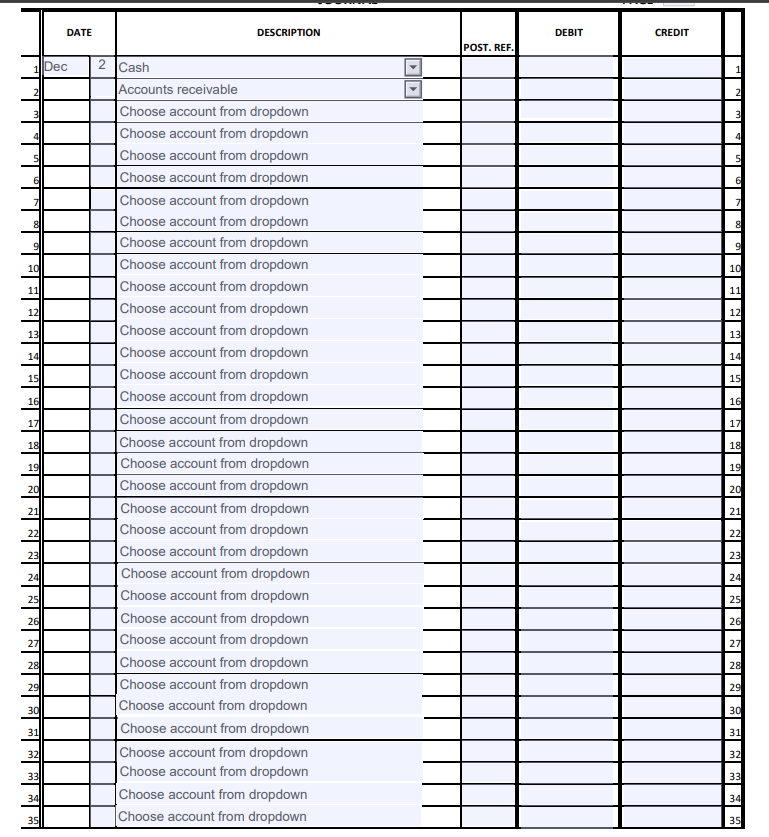

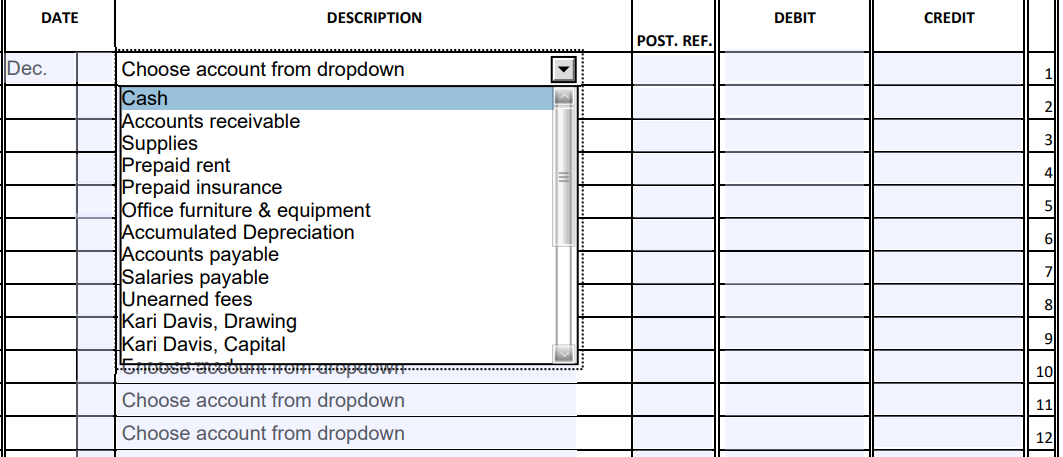

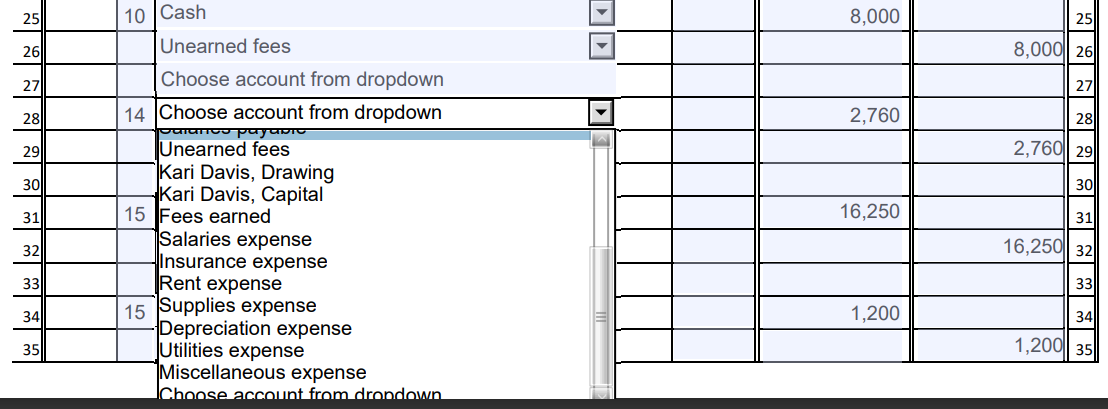

Kari Davis started an accounting and tax preparation business December 1,2021 . She had been operating the business casually on a part-time basis from home for several years. Since demand for her services had increased, she decided to do the work full-time. She selected a more professional, rented office space for the business, using the name "On Point Accounting Services." Office equipment and supplies used in Kari's home office were taken to the new office, along with accounts receivable for work she had previously completed. The December transactions for On Point Accounting Services are detailed below. Instructions: Journalize each transaction using the journal pages provided. Number each page of the journal, beginning with "1." Use the following chart of accounts to select the accounts to debit and credit. Dec 1 Kari Davis contributed the following assets to On Point Accounting Services: cash, \$10,000; accounts receivable, $6,200; supplies, $2,000; and office equipment, $3,100 12 months' rent paid on new office space, $3,000 2 Business insurance premiums paid for 6 months, $1,820 3 Paid $650 for a magazine advertisement (use misc. expense) 5 Received cash from clients paying on their accounts, $3,700 6 Purchased office furniture on account from Budget Basics, $2,760 10 Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $8,000 14 Paid Budget Basics for part of the debt owed for the furniture purchased, $1,300 15 Billed clients for services provided on account from Dec 114,$16,250 15 Paid the admin. assistant for 2 weeks' salary, $1,200 Record the following transactions on PAGE 2 of the journal: 16 Cash received from cash clients for fees earned Dec 115,$14,000 18 Paid cash for supplies purchased, $1,510 21 Billed clients for services provided on account from Dec 1520,$4,500 24 Received cash from cash clients for fees earned Dec 1623,$6,620 28 Paid telephone bill for December, \$405 29 Paid the admin. assistant for 2 weeks' salary, $1,200 30 Received cash from clients paying on account, $13,400 31 Paid electricity bill for December, $310 31 Kari withdrew $6,000 for personal use 31 Received cash from cash clients for fees earned Dec 24-31, $2,150 31 Provided services on account from Dec 21-31, \$4,500 Kari Davis started an accounting and tax preparation business December 1,2021 . She had been operating the business casually on a part-time basis from home for several years. Since demand for her services had increased, she decided to do the work full-time. She selected a more professional, rented office space for the business, using the name "On Point Accounting Services." Office equipment and supplies used in Kari's home office were taken to the new office, along with accounts receivable for work she had previously completed. The December transactions for On Point Accounting Services are detailed below. Instructions: Journalize each transaction using the journal pages provided. Number each page of the journal, beginning with "1." Use the following chart of accounts to select the accounts to debit and credit. Dec 1 Kari Davis contributed the following assets to On Point Accounting Services: cash, \$10,000; accounts receivable, $6,200; supplies, $2,000; and office equipment, $3,100 12 months' rent paid on new office space, $3,000 2 Business insurance premiums paid for 6 months, $1,820 3 Paid $650 for a magazine advertisement (use misc. expense) 5 Received cash from clients paying on their accounts, $3,700 6 Purchased office furniture on account from Budget Basics, $2,760 10 Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $8,000 14 Paid Budget Basics for part of the debt owed for the furniture purchased, $1,300 15 Billed clients for services provided on account from Dec 114,$16,250 15 Paid the admin. assistant for 2 weeks' salary, $1,200 Record the following transactions on PAGE 2 of the journal: 16 Cash received from cash clients for fees earned Dec 115,$14,000 18 Paid cash for supplies purchased, $1,510 21 Billed clients for services provided on account from Dec 1520,$4,500 24 Received cash from cash clients for fees earned Dec 1623,$6,620 28 Paid telephone bill for December, \$405 29 Paid the admin. assistant for 2 weeks' salary, $1,200 30 Received cash from clients paying on account, $13,400 31 Paid electricity bill for December, $310 31 Kari withdrew $6,000 for personal use 31 Received cash from cash clients for fees earned Dec 24-31, $2,150 31 Provided services on account from Dec 21-31, \$4,500