Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What are the arguments for and against a Federal Reserve Bank operating independently? Should the Fed be independent? Why or why not? Explain.

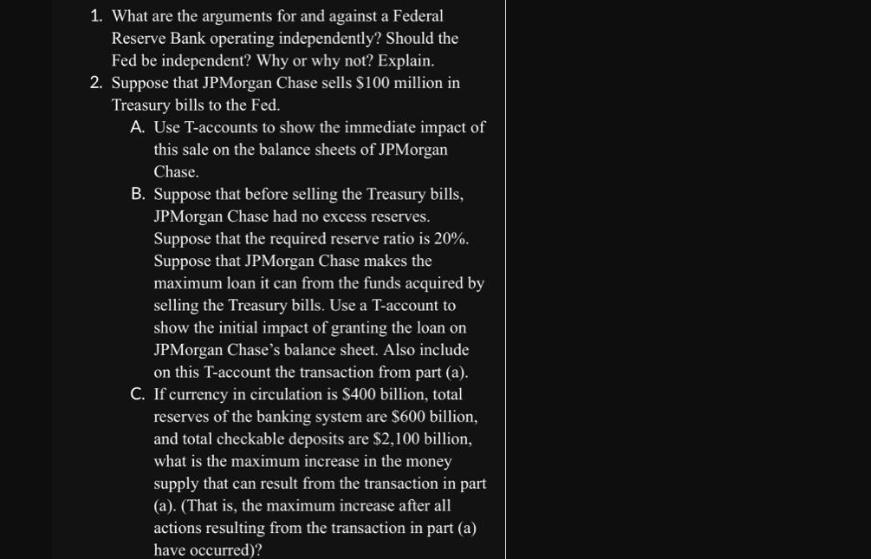

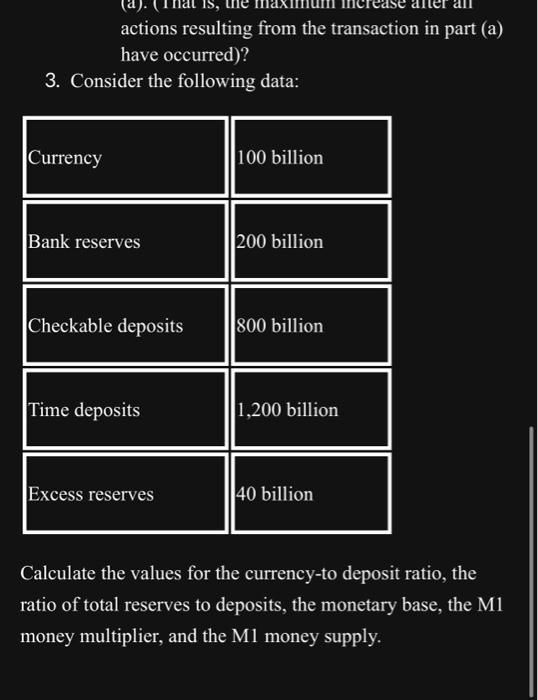

1. What are the arguments for and against a Federal Reserve Bank operating independently? Should the Fed be independent? Why or why not? Explain. 2. Suppose that JPMorgan Chase sells $100 million in Treasury bills to the Fed. A. Use T-accounts to show the immediate impact of this sale on the balance sheets of JPMorgan Chase. B. Suppose that before selling the Treasury bills, JPMorgan Chase had no excess reserves. Suppose that the required reserve ratio is 20%. Suppose that JPMorgan Chase makes the maximum loan it can from the funds acquired by selling the Treasury bills. Use a T-account to show the initial impact of granting the loan on JPMorgan Chase's balance sheet. Also include on this T-account the transaction from part (a). C. If currency in circulation is $400 billion, total reserves of the banking system are $600 billion, and total checkable deposits are $2,100 billion, what is the maximum increase in the money supply that can result from the transaction in part (a). (That is, the maximum increase after all actions resulting from the transaction in part (a) have occurred)? IS, actions resulting from the transaction in part (a) have occurred)? 3. Consider the following data: Currency Bank reserves Checkable deposits Time deposits Excess reserves 100 billion 200 billion 800 billion 1,200 billion 40 billion Calculate the values for the currency-to deposit ratio, the ratio of total reserves to deposits, the monetary base, the M1 money multiplier, and the M1 money supply.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Arguments for an Independent Federal Reserve Bank Monetary Policy Autonomy An independent Fed can make decisions based on economic conditions and longterm goals rather than being influenced by short...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started