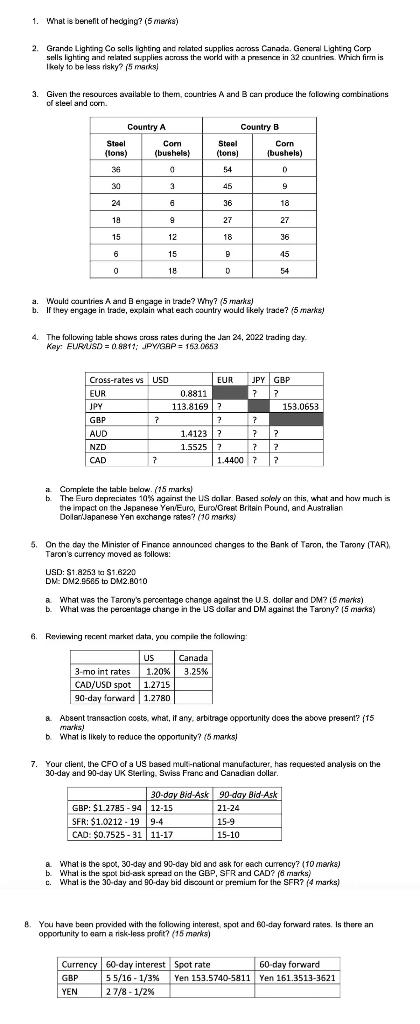

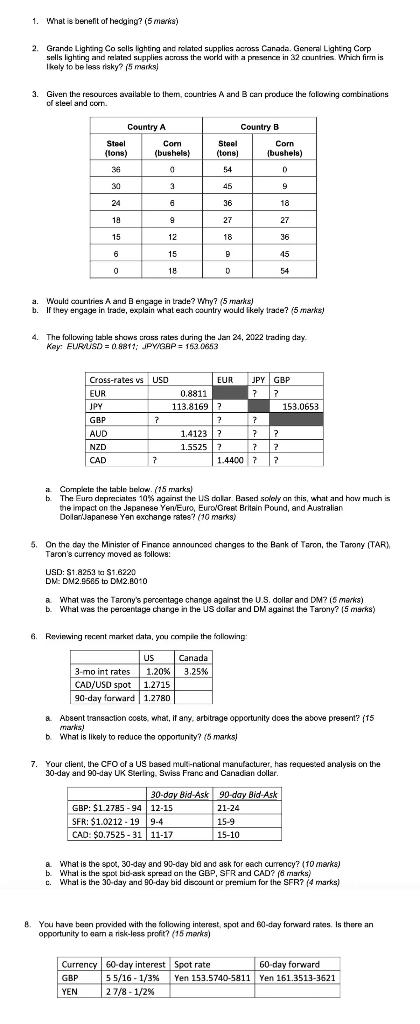

1. What is benefit of hedging? (5 mioka) 2. Grande Lighting Co sols lighting and related supplies across Canada. General Lighting Corp sells lighting and related supplies across the world with a presence in 32 countries. Which firm is Ikely to be less risky? (5 marks) 3. Given the resources available to them, countries A and B can produce the following combinations of sleel and corn Country A Steel (lons) 38 Com (bushels) a Country B Steel Corn (tone) Abushels) 54 D 45 9 30 3 24 G 36 18 18 9 27 27 12 36 15 6 15 18 D D 45 0 18 54 a. Would countries A and B engage in trade? Why? (5 marks) b. If they engage in trade, explain what each country would likely trade? (5 marks) 4. The following table shows cross rates during the Jan 24, 2022 trading day Key: EURUSD = 0.8811; JPV/GBP = 153 0653 Cross-rates vs USD EUR JPY GBP EUR 0.8811 ? 77 JPY 113.8169? 153.0653 GBP 7 ? ? ? AUD 1.4123? ? ?? NZD 1.55252 72 ? ? CAD ? 7 1.4400 72 a Complete the table below. (15 marks) b. The Euro depreciates 10% against the US dolar. Based solely an this, what and how much is the impact on the Japanese Yen Euro, EuroGreat Britain Pound, and Australian Dolar Japanese Yen exchange rates? (10 marks) 5. On the day the Minister of Finance announced charges to the Bank of Taron, the Tarony (TAR) Taron's currency moved as follows: USD: S1.8253 $1.6220 DM: DM2.9566 to DM2.600 a what was the Tarony's percentage change against the U.S. dollar and DM? (5 marks) b. What was the percentage change in the US dolar and DM against the Tarony? (5 marks) 6. Reviewing recent market data, you comple the following: Canada 3.25% US 3-mo int rates 1.20% CAD/USD spot 1.2715 90-day forward 1.2780 a. Absent transaction coets, what, if any, arbitrage opportunity does the above present? (15 mark What is likely to reduce the opportunity? (5 marks! 7. Your client, the CFO of a US based multi-national manufacturer, has requested analysis on the 30-day and 90-day UK Sterling Swiss Franc and Canadian dollar. 30-day Bid-Ask 90-day Bid Ask GBP: $1.2785-94 12-15 21-24 SFR: $1.0212 - 19 9-4 15-9 CAD: $0.7525 - 31 11-17 15-10 What is the spot, 30-day and 90-day bid and ask for each currency? (10 marka) b. What is the spot bid-ask spread on the GBP, SFR and CAD? (6 marks) What is the 30 day and 90-day bid discount or premium for the SFR? (4 marks) B. You have been provided with the following interest, spat and 60-day forward rates. Is there an opportunity to earn a nisk-less profit? (15 marks) Currency 60 day interest Spot rate 60 day forward GBP 55/16 - 1/3% Yen 153.5740-5811 Yen 161.3513-3621 YEN 27/8-1/2%