Answered step by step

Verified Expert Solution

Question

1 Approved Answer

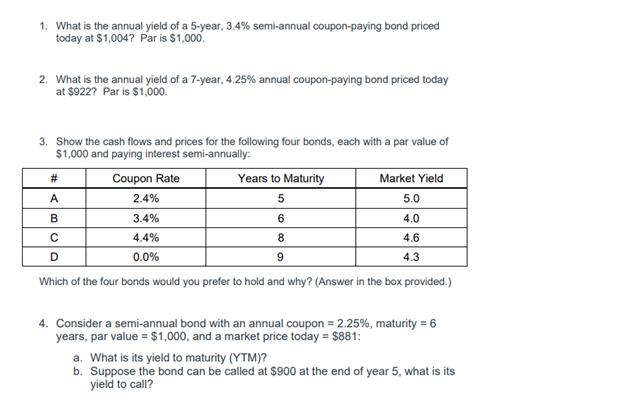

1. What is the annual yield of a 5-year, 3.4% semi-annual coupon-paying bond priced today at $1,004? Par is $1,000. 2. What is the

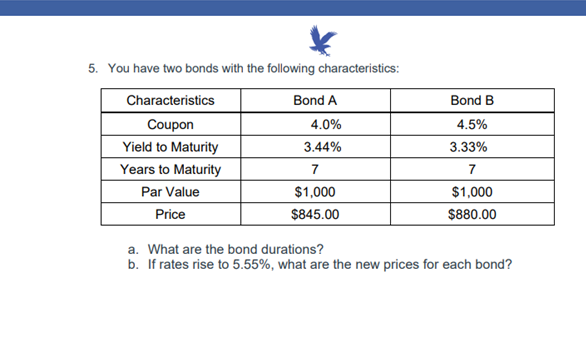

1. What is the annual yield of a 5-year, 3.4% semi-annual coupon-paying bond priced today at $1,004? Par is $1,000. 2. What is the annual yield of a 7-year, 4.25% annual coupon-paying bond priced today at $922? Par is $1,000. 3. Show the cash flows and prices for the following four bonds, each with a par value of $1,000 and paying interest semi-annually: Coupon Rate 2.4% 3.4% 4.4% 0.0% Years to Maturity 5 # A B C D 9 Which of the four bonds would you prefer to hold and why? (Answer in the box provided.) Market Yield 5.0 4.0 4.6 4.3 6 8 4. Consider a semi-annual bond with an annual coupon = 2.25%, maturity = 6 years, par value = $1,000, and a market price today = $881: a. What is its yield to maturity (YTM)? b. Suppose the bond can be called at $900 at the end of year 5, what is its yield to call? 5. You have two bonds with the following characteristics: Characteristics Coupon Yield to Maturity Years to Maturity Par Value Price Bond A 4.0% 3.44% 7 $1,000 $845.00 Bond B 4.5% 3.33% 7 $1,000 $880.00 a. What are the bond durations? b. If rates rise to 5.55%, what are the new prices for each bond?

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Yield of 34 semiannual coupon bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started