Answered step by step

Verified Expert Solution

Question

1 Approved Answer

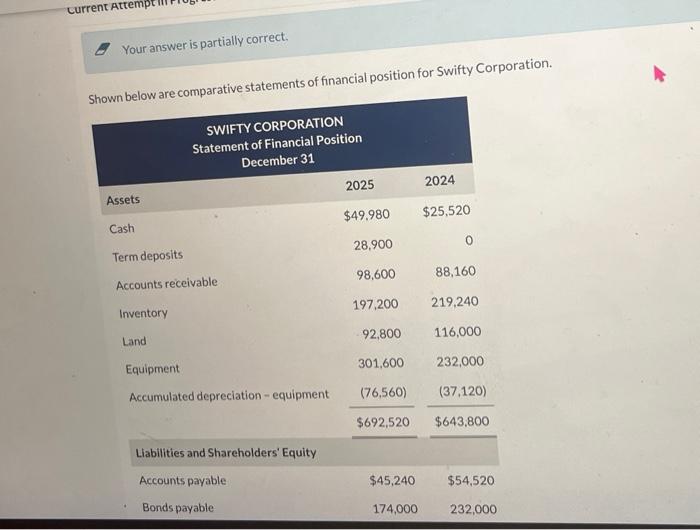

Current Attempt Your answer is partially correct. Shown below are comparative statements of financial position for Swifty Corporation. SWIFTY CORPORATION Statement of Financial Position

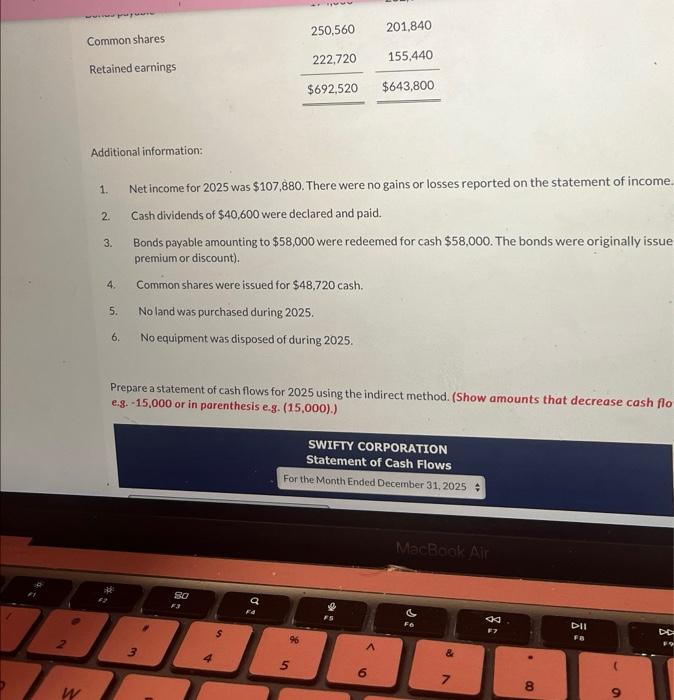

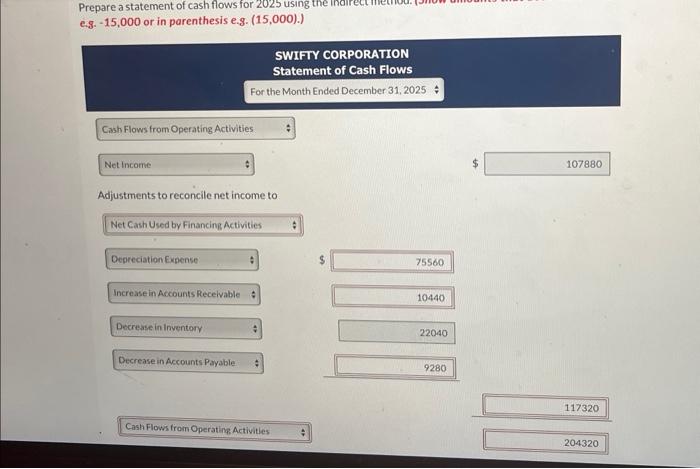

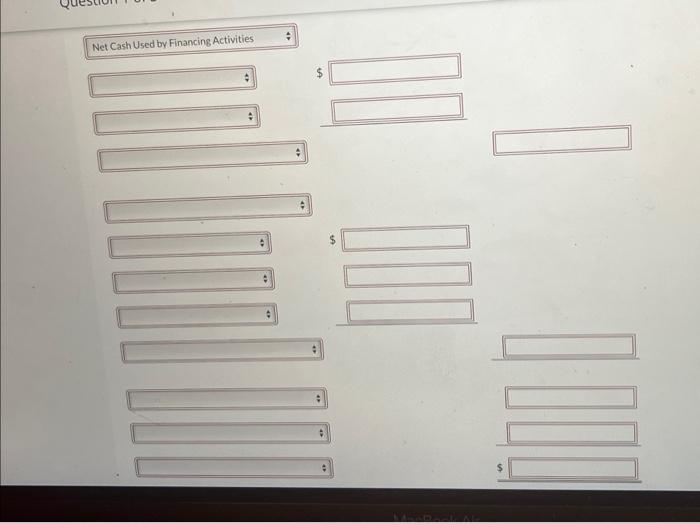

Current Attempt Your answer is partially correct. Shown below are comparative statements of financial position for Swifty Corporation. SWIFTY CORPORATION Statement of Financial Position December 31 2025 2024 Assets $49.980 $25,520 Cash 28,900 Term deposits Accounts receivable 98,600 88,160 Inventory 197,200 219,240 Land 92,800 116,000 Equipment 301,600. 232,000 Accumulated depreciation- equipment (76,560) (37,120) $692,520 $643,800 Liabilities and Shareholders' Equity Accounts payable $45,240 $54,520 Bonds payable 174,000 232,000 Common shares 250,560 201,840 Retained earnings 222,720 155,440 $692,520 $643,800 Additional information: 1. 2. 3. Net income for 2025 was $107,880. There were no gains or losses reported on the statement of income. Cash dividends of $40,600 were declared and paid. Bonds payable amounting to $58,000 were redeemed for cash $58,000. The bonds were originally issue premium or discount). 4. Common shares were issued for $48,720 cash. 5. No land was purchased during 2025. 6. No equipment was disposed of during 2025. Prepare a statement of cash flows for 2025 using the indirect method. (Show amounts that decrease cash flo e.g. -15,000 or in parenthesis e.g. (15,000).) SWIFTY CORPORATION Statement of Cash Flows For the Month Ended December 31, 2025 + W m SO 13 MacBook Air 96 7 D-II DC 17 FB 19 8 00 6 Prepare a statement of cash flows for 2025 using the TRAIN e.g. -15,000 or in parenthesis e.g. (15,000).) Cash Flows from Operating Activities SWIFTY CORPORATION Statement of Cash Flows For the Month Ended December 31, 2025 Net Income Adjustments to reconcile net income to Net Cash Used by Financing Activities Depreciation Expense: 75560 Increase in Accounts Receivable 10440 Decrease in Inventory 22040 Decrease in Accounts Payable 9280 Cash Flows from Operating Activities 107880 117320 204320 Net Cash Used by Financing Activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started