Question

1. What is the company's required rate of return on equity (i.e. expected rate of return) as of the beginning of 2011? 2. What is

1. What is the company's required rate of return on equity (i.e. expected rate of return) as of the beginning of 2011?

2. What is the present value of the company's total dividends during the forecast horizon period of 2011 through 2015 assuming a required rate of return on equity of 11% as of the beginning of 2011?

3. What is the Present Value of the company's continuing perpetuity at the START OF 2011 assuming that the increasing perpetuity (continuing value at the start of 2016 is $300,000, and the required rate of return is 11.0%?

4. What is the total equity value of the company at the beginning of 2011 assuming an expected equity cost of capital of 11% and an increasing perpetuity (continuing value) at the beginning of 2016 of $300,000?

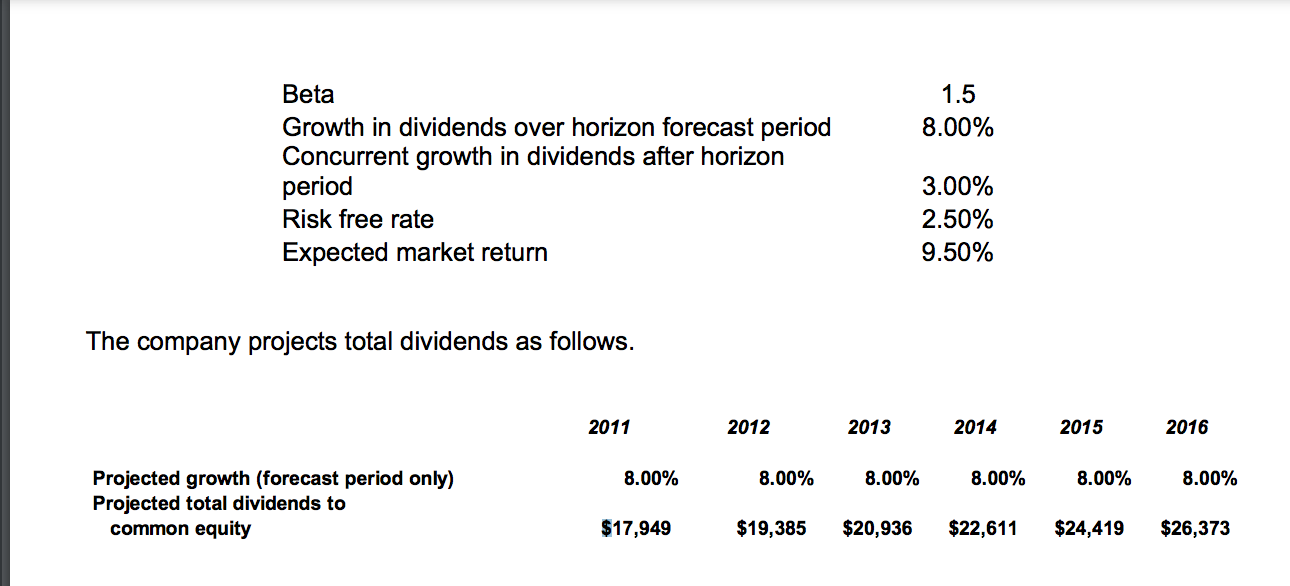

1.5 8.00% Beta Growth in dividends over horizon forecast period Concurrent growth in dividends after horizon period Risk free rate Expected market return 3.00% 2.50% 9.50% The company projects total dividends as follows. 2011 2012 2013 2014 2015 2016 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% Projected growth (forecast period only) Projected total dividends to common equity $17,949 $19,385 $20,936 $22,611 $24,419 $26,373

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started