1.

What is the cost of the Pref. Stock with no flotation costs?

Cost of Pref. Stock with flotation cost?

SIVMEDs preferred stock is riskier to investors than its debt, yet the preferred stocks before tax yield to investors is lower than the yield to maturity on the debt. Why does this occur?

2. What is the CAPM:

What is the DCF:

What is the Own-Bond-Yield-Plus-Risk Premium:

( Rdis the cost of debt of SVMED and not the return on treasury bond. For simplicity let us assume 4% RP)

Average of three estimates?

Growth rate for DCF

Use historical growth rates

Use analysts estimates of future growth rates

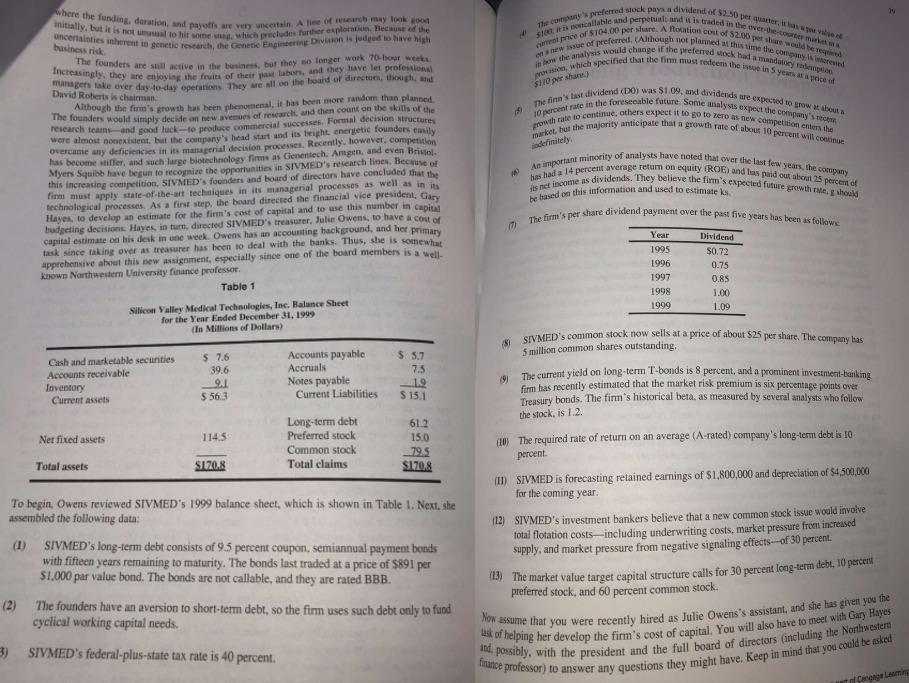

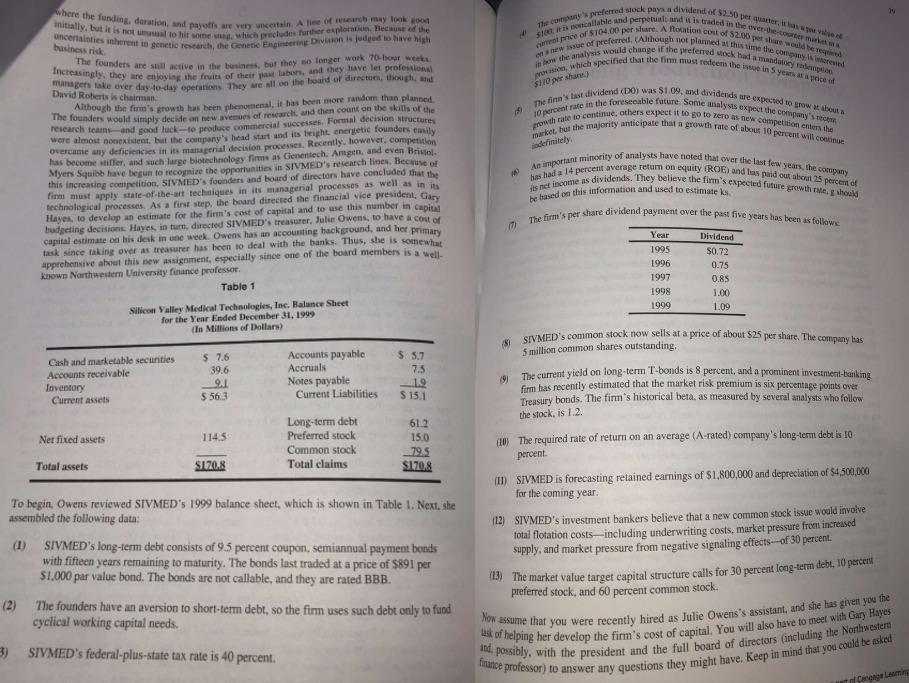

Formula method =Retention Ratio * retained earnings

where the funding duration, and payment. A lo manchey look good initially, but it is to some which precludes further exploration. Because of the uncertainties inherent in genetic research, the end Engineering Division is dedo have high business risk mange tale over day-to-day operations. They are all on the head of director, though and David Roberts is chairman The founders are all active in the business, but they no longer work 70 hour weeke Increasingly, they are calling borders of any hey have let profesche SH0 per shares) Although the firm's growth has been plenomenal, it has been more random than planned. The founders would simply decide on new wenues of rewarch, and then count on the skills of the research teams and good luck to produce commercial successes Formal decision structures were almost nonexistent, but the company head start and its bright, energetic founders easily overcame any deficiencies in its managerial decision processes. Recently, however, competition has become wiffer, and such large bistechnology firms as Genentech. Amgen, and even Bristol Myers Squibb have begun to recognize the opportunities in SIVMED's research lines. Because of this increasing competition, SIVMED's founders and board of directors have concluded that the firm must apply state-of-the-art techniques in its managerial processes as well as in its technological processes. As a fint step, the board directed the financial vice president, Gary Hayes, to develop an estimate for the firm's cost of capital and to use this number in capital budgeting decision. Hayes, in turn, directed SIVMED's treasurer, Julie Owens, to have a cost of capital estimate on his desk in one week Owens has an accounting background, and her primary task since taking over as treasurer has been to deal with the banks. Thus, she is somewhat apprehensive about this new assignment, especially since one of the board members is a well- known Northwestern University finance professor Table 1 Silicon Valley Medical Technologies, Inc. Balance Sheet for the Year Ended December 31, 1999 in Millions of Dollars) 77 preferred Mock pays dividend of 52.50 per quarter, 5 Acable and perpetual and it is traded in the e-ma ce of T04.00 per share. A flotion cost of 20 per share water Tue of preferred. Although not plamed at this time they need Iwon the analysis would change if the preferred Mock had many mi on which specified that the fimm must redeem there in Yerel 10 percentrare in the foreseeable future. Some analysis expect the cow'To The firm's last dividend (DO) was $1.09, and dividends are expected to the rate to continue, others expect it to go to meto as new competition the market, but the majority anticipate that a growth rate of about 10 percent will continue Husada 14 percent average return on equity (ROE) and las paid out about 25 percent of As important minority of analysts have noted that over the last few years, the company Ils ne income as dividends. They believe the firm's expected future growth. Whould be based on this information and used to estimate ks. The firm's per share dividend payment over the past five years has been as follows Year Dividend 1995 $0.72 1996 0.75 1997 0.83 1998 1.00 1999 1.09 Cash and marketable securities Accounts receivable Inventory Current assets $ 7.6 39.6 9.1 $ 563 $ 5.7 7.5 19 S 15.1 SIVMED's common stock now sells at a price of about $25 per share. The company has 5 million common shares outstanding, The current yield on long-term T-bonds is 8 percent, and a prominent investment-banking firm has recently estimated that the market risk premium is six percentage points over Treasury bonds. The firm's historical beta, as measured by several analysts who follow 19 Accounts payable Accruals Notes payable Current Liabilities Long-term debt Preferred stock Common stock Total claims the stock, is 1.2 Net fixed assets 114.5 612 15.0 79.5 S170,8 Total assets S120.8 To begin, Owens reviewed SIVMED's 1999 balance sheet, which is shown in Table 1. Next, she assembled the following data: SIVMED's long-term debt consists of 9.5 percent coupon, semiannual payment bonds with fifteen years remaining to maturity. The bonds last traded at a price of $891 per $1.000 par value bond. The bonds are not callable, and they are rated BBB. (2) The founders have an aversion to short-term debt, so the firm uses such debt only to fund cyclical working capital needs. (10) The required rate of return on an average (A-rated) company's long-term debt is 10 percent (11) SIVMED is forecasting retained earnings of $1,800,000 and depreciation of $4,500,000 for the coming year. (12) SIVMED's investment bankers believe that a new common stock issue would involve total flotation costs-including underwriting costs, market pressure from increased supply, and market pressure from negative signaling effects--of 30 percent. (13) The market value target capital structure calls for 30 percent long-term debt, 10 percent preferred stock, and 60 percent common stock. Now assume that you were recently hired as Julie Owens's assistant, and she has given you the ask of helping her develop the firm's cost of capital. You will also have to meet with Gary Hayes and possibly, with the president and the full board of directors (including the Northwester finance professor) to answer any questions they might have. Keep in mind that you could be asked SIVMED's federal-plus-state tax rate is 40 percent. of Cong Learning where the funding duration, and payment. A lo manchey look good initially, but it is to some which precludes further exploration. Because of the uncertainties inherent in genetic research, the end Engineering Division is dedo have high business risk mange tale over day-to-day operations. They are all on the head of director, though and David Roberts is chairman The founders are all active in the business, but they no longer work 70 hour weeke Increasingly, they are calling borders of any hey have let profesche SH0 per shares) Although the firm's growth has been plenomenal, it has been more random than planned. The founders would simply decide on new wenues of rewarch, and then count on the skills of the research teams and good luck to produce commercial successes Formal decision structures were almost nonexistent, but the company head start and its bright, energetic founders easily overcame any deficiencies in its managerial decision processes. Recently, however, competition has become wiffer, and such large bistechnology firms as Genentech. Amgen, and even Bristol Myers Squibb have begun to recognize the opportunities in SIVMED's research lines. Because of this increasing competition, SIVMED's founders and board of directors have concluded that the firm must apply state-of-the-art techniques in its managerial processes as well as in its technological processes. As a fint step, the board directed the financial vice president, Gary Hayes, to develop an estimate for the firm's cost of capital and to use this number in capital budgeting decision. Hayes, in turn, directed SIVMED's treasurer, Julie Owens, to have a cost of capital estimate on his desk in one week Owens has an accounting background, and her primary task since taking over as treasurer has been to deal with the banks. Thus, she is somewhat apprehensive about this new assignment, especially since one of the board members is a well- known Northwestern University finance professor Table 1 Silicon Valley Medical Technologies, Inc. Balance Sheet for the Year Ended December 31, 1999 in Millions of Dollars) 77 preferred Mock pays dividend of 52.50 per quarter, 5 Acable and perpetual and it is traded in the e-ma ce of T04.00 per share. A flotion cost of 20 per share water Tue of preferred. Although not plamed at this time they need Iwon the analysis would change if the preferred Mock had many mi on which specified that the fimm must redeem there in Yerel 10 percentrare in the foreseeable future. Some analysis expect the cow'To The firm's last dividend (DO) was $1.09, and dividends are expected to the rate to continue, others expect it to go to meto as new competition the market, but the majority anticipate that a growth rate of about 10 percent will continue Husada 14 percent average return on equity (ROE) and las paid out about 25 percent of As important minority of analysts have noted that over the last few years, the company Ils ne income as dividends. They believe the firm's expected future growth. Whould be based on this information and used to estimate ks. The firm's per share dividend payment over the past five years has been as follows Year Dividend 1995 $0.72 1996 0.75 1997 0.83 1998 1.00 1999 1.09 Cash and marketable securities Accounts receivable Inventory Current assets $ 7.6 39.6 9.1 $ 563 $ 5.7 7.5 19 S 15.1 SIVMED's common stock now sells at a price of about $25 per share. The company has 5 million common shares outstanding, The current yield on long-term T-bonds is 8 percent, and a prominent investment-banking firm has recently estimated that the market risk premium is six percentage points over Treasury bonds. The firm's historical beta, as measured by several analysts who follow 19 Accounts payable Accruals Notes payable Current Liabilities Long-term debt Preferred stock Common stock Total claims the stock, is 1.2 Net fixed assets 114.5 612 15.0 79.5 S170,8 Total assets S120.8 To begin, Owens reviewed SIVMED's 1999 balance sheet, which is shown in Table 1. Next, she assembled the following data: SIVMED's long-term debt consists of 9.5 percent coupon, semiannual payment bonds with fifteen years remaining to maturity. The bonds last traded at a price of $891 per $1.000 par value bond. The bonds are not callable, and they are rated BBB. (2) The founders have an aversion to short-term debt, so the firm uses such debt only to fund cyclical working capital needs. (10) The required rate of return on an average (A-rated) company's long-term debt is 10 percent (11) SIVMED is forecasting retained earnings of $1,800,000 and depreciation of $4,500,000 for the coming year. (12) SIVMED's investment bankers believe that a new common stock issue would involve total flotation costs-including underwriting costs, market pressure from increased supply, and market pressure from negative signaling effects--of 30 percent. (13) The market value target capital structure calls for 30 percent long-term debt, 10 percent preferred stock, and 60 percent common stock. Now assume that you were recently hired as Julie Owens's assistant, and she has given you the ask of helping her develop the firm's cost of capital. You will also have to meet with Gary Hayes and possibly, with the president and the full board of directors (including the Northwester finance professor) to answer any questions they might have. Keep in mind that you could be asked SIVMED's federal-plus-state tax rate is 40 percent. of Cong Learning