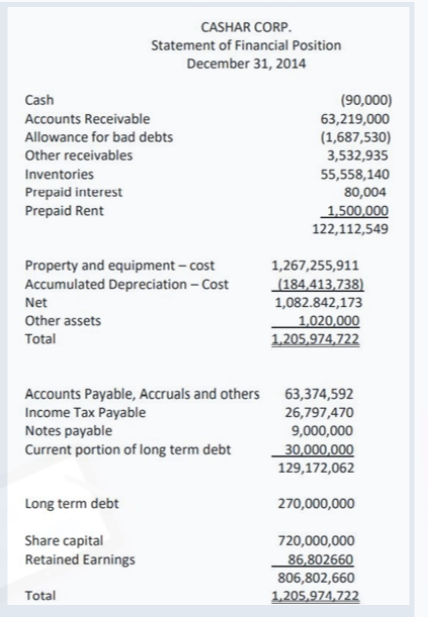

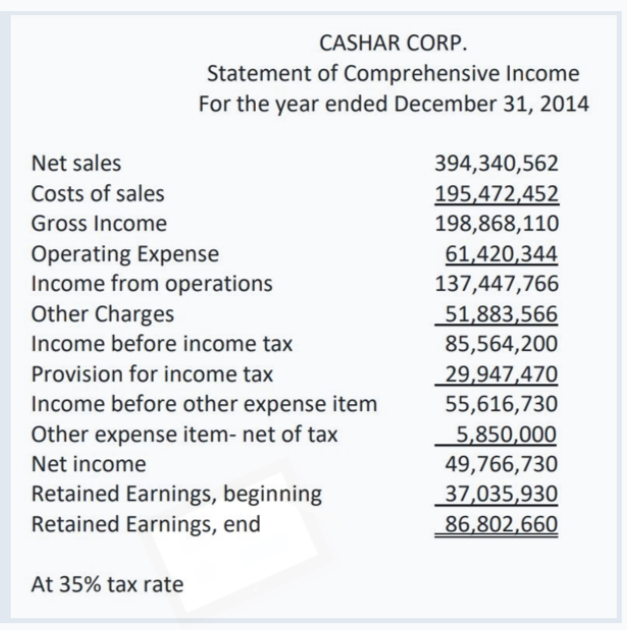

You are auditing the financial statements of CASHAR Corp for the year ended December 31, 2014. The bookkeeper of the Company Presented to you the following unadjusted balance sheet and income statement:

1. Based on the result of your audit, what is the correct cash balance ? 2. Based on the result of your audit, what is the correct bad debt expense? 3. Based on the result of your audit, what is the correct accounts receivable balance? 4. Based on the result of your audit, what is the correct net book value of accounts receivable? PLEASE ANSWER IMMEDIATELY SIR/MA'AM

1. Based on the result of your audit, what is the correct cash balance ? 2. Based on the result of your audit, what is the correct bad debt expense? 3. Based on the result of your audit, what is the correct accounts receivable balance? 4. Based on the result of your audit, what is the correct net book value of accounts receivable? PLEASE ANSWER IMMEDIATELY SIR/MA'AM

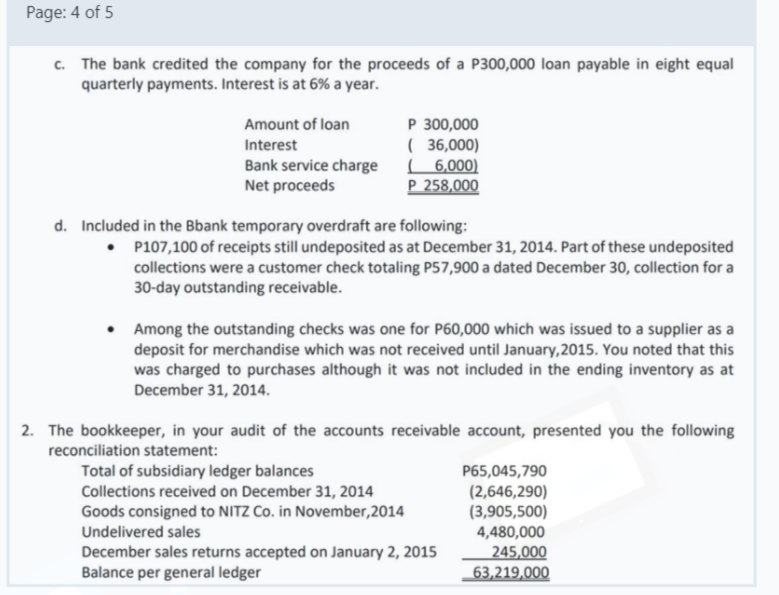

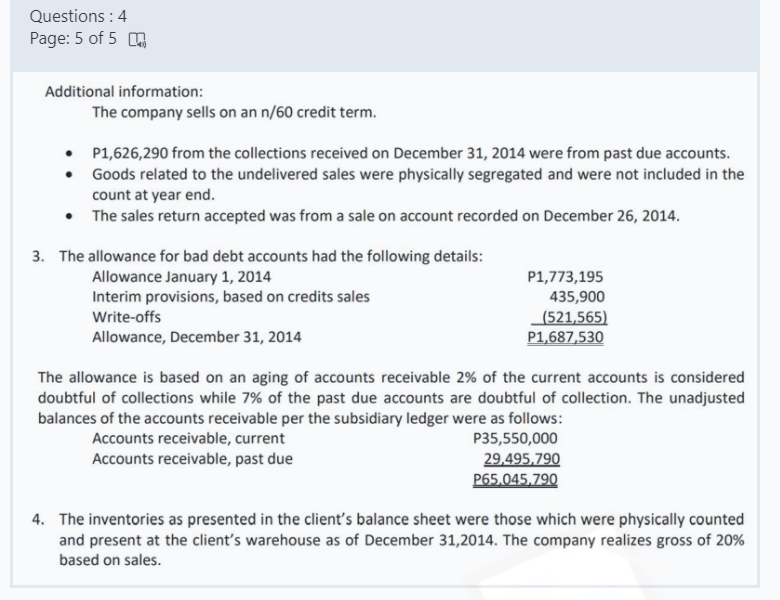

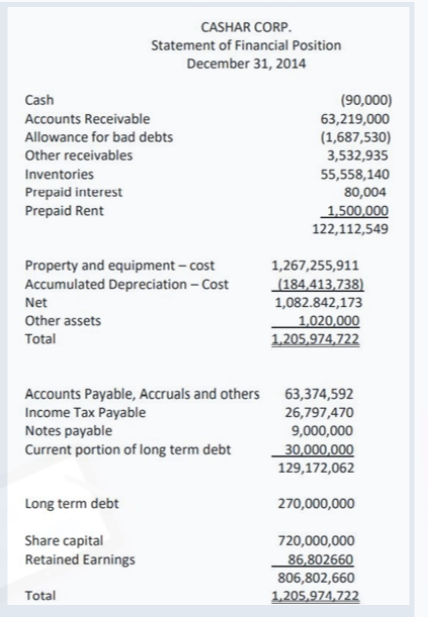

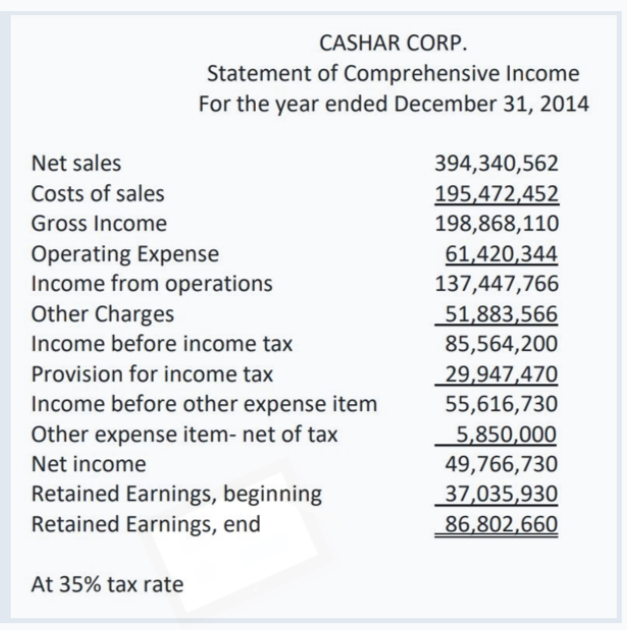

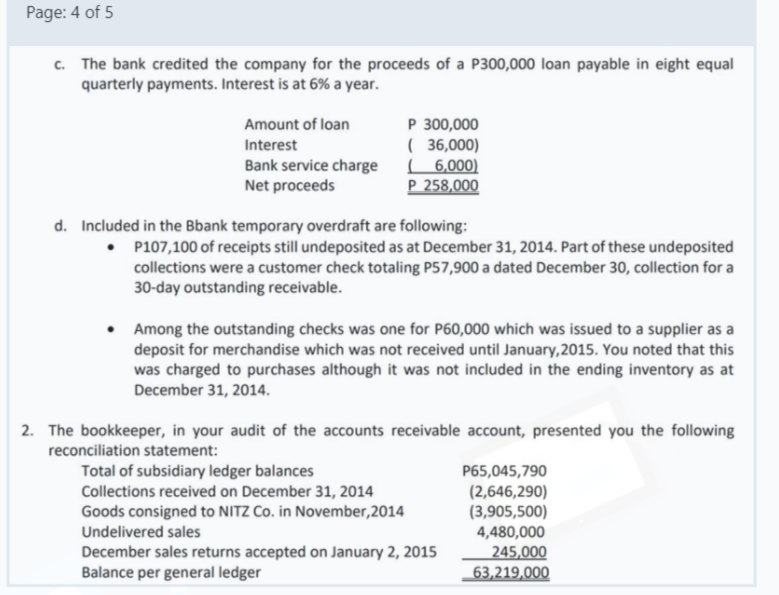

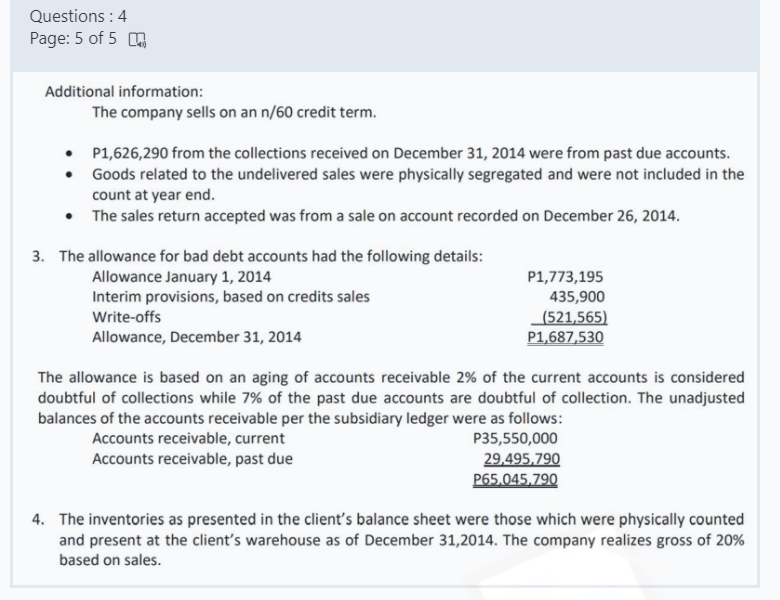

CASHAR CORP. Statement of Financial Position December 31, 2014 Cash Accounts Receivable Allowance for bad debts Other receivables Inventories Prepaid interest Prepaid Rent (90,000) 63,219,000 (1,687,530) 3,532,935 55,558,140 80,004 1,500,000 122,112,549 Property and equipment -cost Accumulated Depreciation - Cost Net Other assets Total 1,267,255,911 (184,413,738) 1,082.842,173 1,020,000 1.205.974,722 Accounts Payable, Accruals and others 63,374,592 Income Tax Payable 26,797,470 Notes payable 9,000,000 Current portion of long term debt 30,000,000 129,172,062 Long term debt 270,000,000 Share capital Retained Earnings 720,000,000 86,802660 806,802,660 1,205,974,722 Total Page: 4 of 5 C. The bank credited the company for the proceeds of a P300,000 loan payable in eight equal quarterly payments. Interest is at 6% a year. Amount of loan Interest Bank service charge Net proceeds P 300,000 ( 36,000) 6,000) P 258,000 d. Included in the Bbank temporary overdraft are following: P107,100 of receipts still undeposited as at December 31, 2014. Part of these undeposited collections were a customer check totaling P57,900 a dated December 30, collection for a 30-day outstanding receivable. Among the outstanding checks was one for P60,000 which was issued to a supplier as a deposit for merchandise which was not received until January, 2015. You noted that this was charged to purchases although it was not included in the ending inventory as at December 31, 2014. 2. The bookkeeper, in your audit of the accounts receivable account, presented you the following reconciliation statement: Total of subsidiary ledger balances P65,045,790 Collections received on December 31, 2014 (2,646,290) Goods consigned to NITZ Co. in November 2014 (3,905,500) Undelivered sales 4,480,000 December sales returns accepted on January 2, 2015 245,000 Balance per general ledger 63,219,000 CASHAR CORP. Statement of Financial Position December 31, 2014 Cash Accounts Receivable Allowance for bad debts Other receivables Inventories Prepaid interest Prepaid Rent (90,000) 63,219,000 (1,687,530) 3,532,935 55,558,140 80,004 1,500,000 122,112,549 Property and equipment -cost Accumulated Depreciation - Cost Net Other assets Total 1,267,255,911 (184,413,738) 1,082.842,173 1,020,000 1.205.974,722 Accounts Payable, Accruals and others 63,374,592 Income Tax Payable 26,797,470 Notes payable 9,000,000 Current portion of long term debt 30,000,000 129,172,062 Long term debt 270,000,000 Share capital Retained Earnings 720,000,000 86,802660 806,802,660 1,205,974,722 Total Page: 4 of 5 C. The bank credited the company for the proceeds of a P300,000 loan payable in eight equal quarterly payments. Interest is at 6% a year. Amount of loan Interest Bank service charge Net proceeds P 300,000 ( 36,000) 6,000) P 258,000 d. Included in the Bbank temporary overdraft are following: P107,100 of receipts still undeposited as at December 31, 2014. Part of these undeposited collections were a customer check totaling P57,900 a dated December 30, collection for a 30-day outstanding receivable. Among the outstanding checks was one for P60,000 which was issued to a supplier as a deposit for merchandise which was not received until January, 2015. You noted that this was charged to purchases although it was not included in the ending inventory as at December 31, 2014. 2. The bookkeeper, in your audit of the accounts receivable account, presented you the following reconciliation statement: Total of subsidiary ledger balances P65,045,790 Collections received on December 31, 2014 (2,646,290) Goods consigned to NITZ Co. in November 2014 (3,905,500) Undelivered sales 4,480,000 December sales returns accepted on January 2, 2015 245,000 Balance per general ledger 63,219,000

1. Based on the result of your audit, what is the correct cash balance ? 2. Based on the result of your audit, what is the correct bad debt expense? 3. Based on the result of your audit, what is the correct accounts receivable balance? 4. Based on the result of your audit, what is the correct net book value of accounts receivable? PLEASE ANSWER IMMEDIATELY SIR/MA'AM

1. Based on the result of your audit, what is the correct cash balance ? 2. Based on the result of your audit, what is the correct bad debt expense? 3. Based on the result of your audit, what is the correct accounts receivable balance? 4. Based on the result of your audit, what is the correct net book value of accounts receivable? PLEASE ANSWER IMMEDIATELY SIR/MA'AM