Question

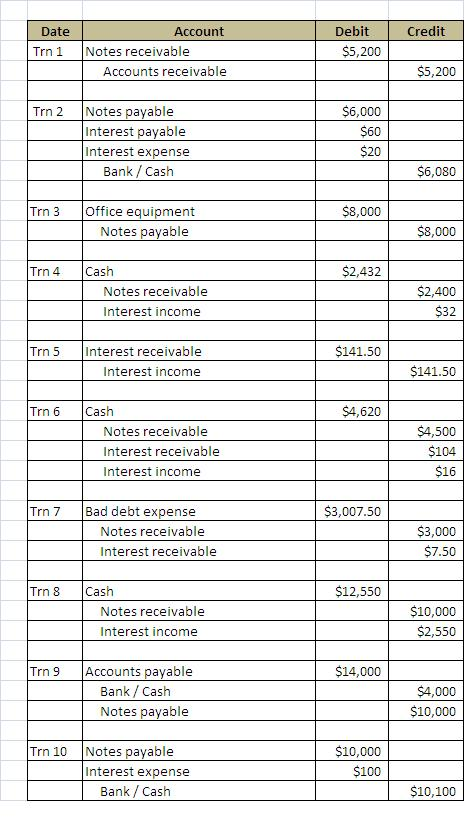

1. What is the current balance of the Interest Earned account? A. $2,984.50 B. $2,996.50 C. $3,034.50 D. $3,196.50 ______________ 2. What was the balance

1. What is the current balance of the Interest Earned account? A. $2,984.50 B. $2,996.50 C. $3,034.50 D. $3,196.50 ______________

2. What was the balance of Interest Earned after Transaction 4 was recorded? A. $403.50 B. $431.50 C. $262.00 D. $230.00 ______________

3. What is the current balance of Notes Receivable? A. $(200) B. $48,800 C. $48,900 D. $50,000 ______________

4. What was the balance of Notes Receivable account before the collection of the $4,500 note? A. $59,800 B. $60,800 C. $66,300 D. None of the above ______________

5. If the balance of a Note Receivable is $40,000, for a 60-day, 5% note, what is the accrued interest for 45 days? A. $300.00 B. $250.00 C. $400.00 D. $333.33 ______________

6. What was the total amount of interest expense for transactions 1-10? A. $120.00 B. $140.00 C. $470.00 D. $570.00 E. None of the above

7. $100,000 was borrowed from a bank on July 1, 2004, with an agreement that five annual $20,000 payments, plus interest of 7.5% on the unpaid balance would be made on June 30 of each year. What will be the full amount of the payment to be made on June 30, 2008? A. $43,000 B. $23,000 C. $21,500 D. $20,000 E. None of the above ______________

8. If a 180-day, $15,000, Note Receivable, dated November 25, 2006, was received on November 28, 2006, what would be the due date of this note, assuming 28 days in February? A. May 23 B. May 24 C. May 27 D. May 28 E. None of the above ______________

9. Assume the interest expense on a $5,000.00 Note Payable was $60.00 for a 90-day period. What was the annual interest rate on this note? A. 4.00% B. 4.40% C. 4.80% D. 4.90% E. None of the above ______________

10. Assume an account payable of $5,000 with credit terms of 2/10, n30 was exchanged on the 30th day for a 60-day, 6%, note payable of $5,000. What will be the total cost for the lost discount and the interest on the note payable? A. $80.00 B. $100.00 C. $150.00 D. $240.00 E. None of the above

http://www.pklsoftware.com/Student_Manuals/W4Me2_Manuals/W4Me_II_Problem_12.PDF

Date Account Debit Credit Trn 1Notes receivable $5,200 Accounts receivable $5,200 $6,000 $60 $20 Trn 2Notes pavable Interest payable Interest expense Bank/ Cash $6,080 Trn 3 Office equipment Notes payable $8,000 $8,000 Trn 4 Cash $2,432 $2,400 $32 Notes receivable Interest income Trn 5 nterest receivable $141.50 Interest income $141.50 Trn 6 Cash $4,620 Notes receivable Interest receivable Interest income $4,500 104 $16 Trn 7 Bad debt expense 3,007.50 Notes receivable Interest receivable $3,000 $7.50 Trn 8 Cash 12,550 $10,000 $2,550 Notes receivable Interest income Trn 9 Accounts pavable $14,000 Bank/ Cash Notes payable $4,000 $10,000 10,000 100 Trn 10 Notes pavable Interest expense Bank/Cash $10,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started