Answered step by step

Verified Expert Solution

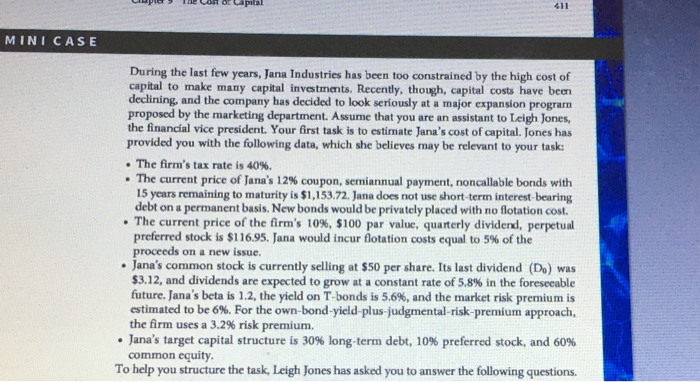

Question

1 Approved Answer

1. What is the estimated cost of equity using the dividend growth approach? 2. suppose the firm has historically earned 15% on equity (ROE) and

1. What is the estimated cost of equity using the dividend growth approach?

2. suppose the firm has historically earned 15% on equity (ROE) and has paid out 62% of earnings and suppose investors expect similar values to obtain in the future. How could you use this information to estimate the future dividend growth rate given earlier?

3. Could the dividend growth approach be applied if the growth rate were not Constant? Why?

4. What is the cost of equity based on the own bond yield plus judgmental risk premium method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started