Question

1. What is the expected return for both stocks? A. Yoyo Stock 23.6%, Zizi stock 24.7%. B. Yoyo Stock 23.6%, Zizi stock 26.2%. C. Yoyo

1. What is the expected return for both stocks? A. Yoyo Stock 23.6%, Zizi stock 24.7%. B. Yoyo Stock 23.6%, Zizi stock 26.2%. C. Yoyo Stock 14.5%, Zizi stock 24.7%. D. Yoyo Stock 18.1%, Zizi stock 12.4%.

2. What is th-e covariance between Yoyo Stock and Zizi stock? 19%. A. 22. B. -10.22. C. 12%. D. 13.2.

3. What is the expected portfolio and standard deviation of portfolio? A. 38.55%, 22.28%. B. 2.4%, 5.4%. C. 21.2%, 5.54%.

Page 3 of 8FINC2110/Sept/Oct2020 D. 24.04%, 2.28%. 4. What is the beta portfolio? A. 0.755. B. 1.235. C. 1.3075. D. None of the above.

5. What is the stock value for Yoyo stock? A. RM10.95. B. RM12.95. C. RM19.05. D. RM15.25.

6. What is the stock value for Zizi stock? A. RM45.53. B. RM43.93. C. RM34.35. D. RM39.43.

7. What would be the price of Zizi at the end of one year? A. RM14.90. B. RM1.235. C. RM1.3075. D. None of the above. 8. What would be the price of Zizi 6 years from now? A. RM10.95. B. RM12.95. C. RM19.05. D. RM15.25.

9. Which stock is worth to invest? A. Yoyo stock. B. Zizi stock. C. Both stocks. D. None.

10. Analyse both stocks? A. Both stocks are undervalued. B. Both stocks are overvalued. C. Yoyo is undervalued and Zizi is overvalued.

Page 4 of 8FINC2110/Sept/Oct2020 D. Zizi is undervalued and Yoyo is overvalued. 11. What would be the price of Zizi 6 years from now? A. RM10.95. B. RM12.95. C. RM19.05. D. RM15.25.

12. Which stock is worth to invest? A. Yoyo stock. B. Zizi stock. C. Both stocks. D. None.

13. What is the correlation for both stocks? A. Negative correlation means both are opposite directions. B. Positive correlation means both are opposite directions. C. Negative correlation means both are same directions. D. Positive correlation means both are same directions.

14. From beta portfolio and beta for each stock, which are more volatile? A. Yoyo stocks. B. Zizi stocks. C. Portfolio. D. None.

15. Which stock is more liquid? A. Yoyo stock. B. Zizi stock. C. Both stocks. D. None.

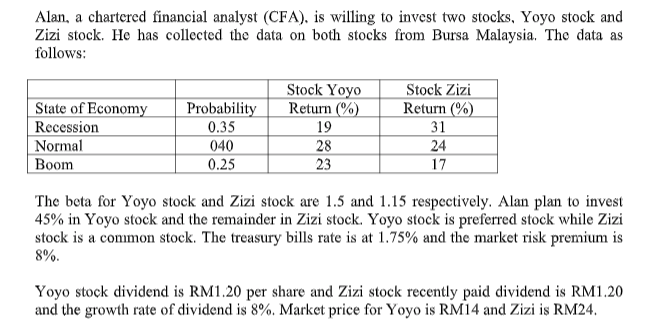

Alan, a chartered financial analyst (CFA), is willing to invest two stocks, Yoyo stock and Zizi stock. He has collected the data on both stocks from Bursa Malaysia. The data as follows: State of Economy Recession Normal Boom Probability 0.35 040 0.25 Stock Yoyo Return (%) 19 28 23 Stock Zizi Return (%) 31 24 17 The beta for Yoyo stock and Zizi stock are 1.5 and 1.15 respectively. Alan plan to invest 45% in Yoyo stock and the remainder in Zizi stock. Yoyo stock is preferred stock while Zizi stock is a common stock. The treasury bills rate is at 1.75% and the market risk premium is 8% Yoyo stock dividend is RM1.20 per share and Zizi stock recently paid dividend is RM1.20 and the growth rate of dividend is 8% Market price for Yoyo is RM14 and Zizi is RM24Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started