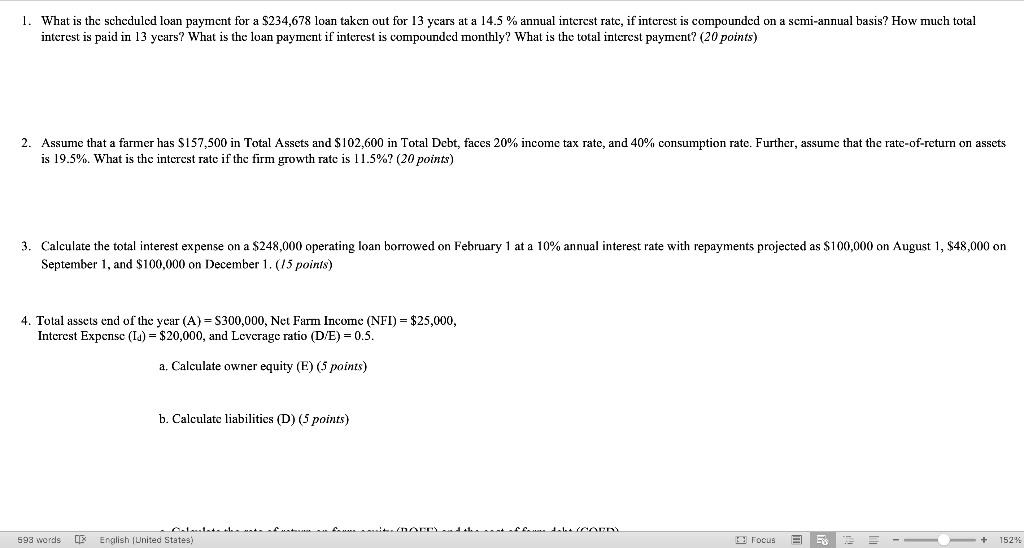

1. What is the scheduled loan payment for a $234,678 loan taken out for 13 years at a 14.5% annual interest rate, if interest is compounded on a scmi-annual basis? How much total interest is paid in 13 years? What is the loan payment if interest is compounded monthly? What is the total interest payment? (20 points) 2. Assume that a farmer has $157,500 in Total Assets and $102,600 in Total Debt, faces 20% income tax rate, and 40% consumption rate. Further, assume that the rate-of-return on assets is 19.5%. What is the interest rate if the firm growth rate is 11.5%? (20 points) 3. Calculate the total interest expense on a $248,000 operating loan borrowed on February 1 at a 10% annual interest rate with repayments projected as $100,000 on August 1, $48,000 on September 1, and $100,000 on December 1. (15 points) 4. Total assets end of the year (A)= $300,000, Net Farm Income (NFI) = $25,000, Interest Expense (Is) = $20,000, and Leverage ratio (D'E) = 0.5. a. Calculate owner equity (E) (5 points) b. Calculate liabilities (D) (5 points) the futute ( ALICA 593 words DE English (United States) Focus 1529 1. What is the scheduled loan payment for a $234,678 loan taken out for 13 years at a 14.5% annual interest rate, if interest is compounded on a scmi-annual basis? How much total interest is paid in 13 years? What is the loan payment if interest is compounded monthly? What is the total interest payment? (20 points) 2. Assume that a farmer has $157,500 in Total Assets and $102,600 in Total Debt, faces 20% income tax rate, and 40% consumption rate. Further, assume that the rate-of-return on assets is 19.5%. What is the interest rate if the firm growth rate is 11.5%? (20 points) 3. Calculate the total interest expense on a $248,000 operating loan borrowed on February 1 at a 10% annual interest rate with repayments projected as $100,000 on August 1, $48,000 on September 1, and $100,000 on December 1. (15 points) 4. Total assets end of the year (A)= $300,000, Net Farm Income (NFI) = $25,000, Interest Expense (Is) = $20,000, and Leverage ratio (D'E) = 0.5. a. Calculate owner equity (E) (5 points) b. Calculate liabilities (D) (5 points) the futute ( ALICA 593 words DE English (United States) Focus 1529