(1) What is the ticker symbol for this company?

(2) Where is this company's World Headquarters located?

(3) Who is the CEO (Chief Executive Officer) of this company?

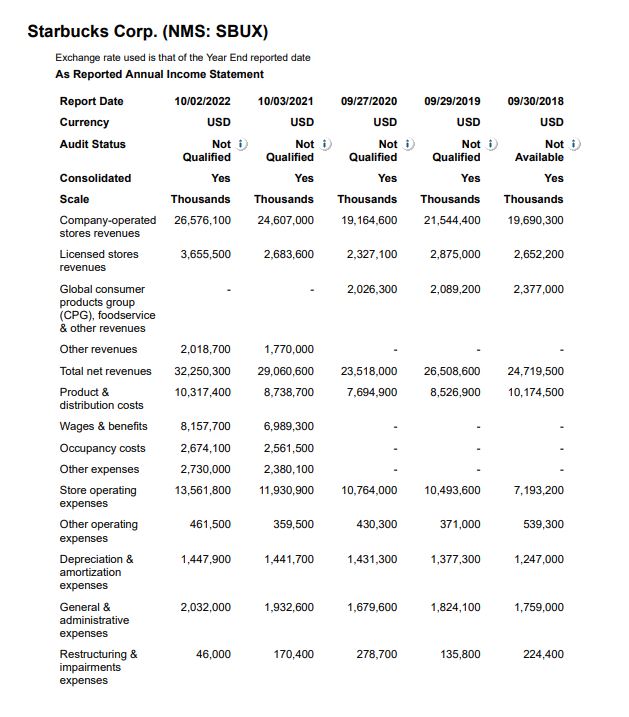

(4) What was the total net revenues for this company as of 10-02-2022?

(Hint: Use Mergent Online & Report in billions of dollars)

(5) What was the company's annual net sales CAGR (in %) between 09-30-2018 and 10-02-2022?

(6) What was this company's ROE (return on stockholder's equity) as of 10-02-2022? (Hint: Calculate from Mergent Online; you can't divide by a negative number)

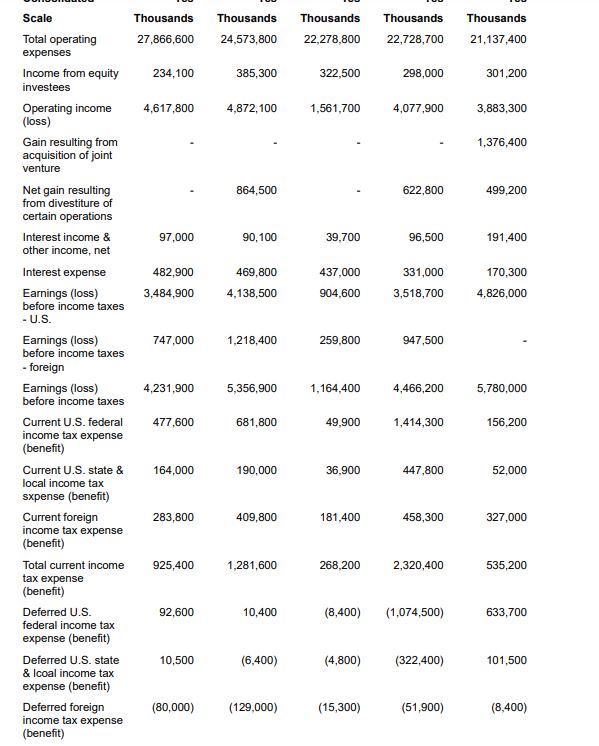

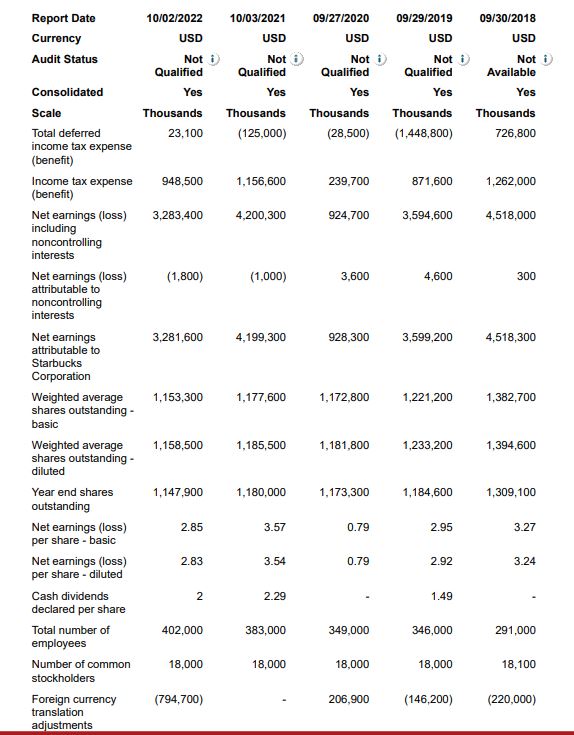

(7) What was this company's EPS (earnings per share, fully diluted) as of 10-02-2022? (Hint: on Mergent, from the Income Statement, the line is Net Earnings per Share - diluted. Report as $x.xx per share).

(8) Which of the 5 generic strategies described in Chapter 5, Figure 5.1 of the Gamble Textbook best describes the competitive strategy of this company? Why? Describe in one paragraph.

(9) Briefly describe in one full paragraph this company's business and operations. (What does this company do?) (Hint: Use Value Line or Mergent Online).

(10) What is the Fiscal 2023 EPS (Earnings per share) forecast for this company? (Hint: Use Value Line Investment Survey for the company dated November 18, 2022. Report as $x.xx per share).

(11) Does Value Line rate this stock as a good long-term investment? State Yes or No and explain your conclusion in 1-2 paragraphs. (Hint: Use Value Line Investment Survey for the company dated November 18, 2022).

(12) What does the Chief Executive Officer for your company state is the company's strategic plan going into 2023 and beyond? Briefly summarize the company's goals in one or two full paragraphs. (Hint: Use Starbucks Annual CEO Letter to Shareholders).

Industry Questions

What is the name of your company's primary industry? (Hint: Use Ibis World)

Coffee & Snack Shops in the US

_________________________________________________________________

(13) What are the primary products and/or services for this industry?

(14) What company has the largest market share in this industry and what is their US market share?

(15) What were the total sales (revenues) for this industry in 2022? (Hint: Use Ibis World, Industry Data Table. Report sales in $ billions).

Starbucks Corp. (NMS: SBUX) Exchange rate used is that of the Year End reported date As Reported Annual Income Statement Report Date 10/02/2022 10/03/2021 09/27/2020 09/29/2019 09/30/2018 Currency USD USD USD USD USD Audit Status Not i Not i Not i Not i Not i Qualified Qualified Qualified Qualified Available Consolidated Yes YOS YOS Yes Scale Thousands Thousands Thousands Thousands Thousands Company-operated 26,576,100 24.607,000 19. 164.600 21,544,400 19,690,300 stores revenues Licensed stores 3,655,500 2,683,600 2,327,100 2,875,000 2,652,200 revenues Global consumer 2,026,300 2,089,200 2,377,000 products group (CPG), foodservice & other revenues Other revenues 2,018,700 1,770,000 Total net revenues 32,250,300 29,060,600 23,518,000 26,508,600 24,719,500 Product & 10,317,400 8,738,700 7.694,900 8,526,900 10,174,500 distribution costs Wages & benefits 8,157,700 6,989,300 Occupancy costs 2,674,100 2,561,500 Other expenses 2,730,000 2.380, 100 Store operating 13,561,800 11,930,900 10,764,000 10,493,600 7,193,200 expenses Other operating 461,500 359,500 430.300 371,000 539,300 expenses Depreciation & 1,447,900 1,441,700 1,431,300 1,377,300 1,247,000 amortization expenses General & 2,032,000 1,932,600 1,679,600 1,824,100 1,759,000 administrative expenses Restructuring & 46,000 170,400 278,700 135,800 224,400 impairments expensesScale Thousands Thousands Thousands Thousands Thousands Total operating 27,866,600 24,573,800 22,278,800 22,728,700 21,137,400 expenses Income from equity 234,100 385,300 322,500 298,000 301,200 investees Operating income 4,617,800 4,872,100 1,561,700 4,077,900 3,883,300 (loss Gain resulting from 1,376,400 acquisition of joint venture Net gain resulting 864,500 622,800 499,200 from divestiture of certain operations Interest income & 97,000 90,100 39.700 96,500 191,400 other income, net Interest expense 482,900 469,800 437,000 331,000 170,300 Earnings (loss) 3,484,900 4,138,500 904.600 3,518,700 4,826,000 before income taxes - U.S. Earnings (loss) 747,000 1,218,400 259.800 947,500 before income taxes - foreign Earnings (loss) 4,231,900 5,356,900 1,164,400 4,466,200 5,780,000 before income taxes Current U.S. federal 477,600 681,800 49,900 1,414,300 156,200 income tax expense (benefit) Current U.S. state & 164,000 190,000 36,900 447,800 52,000 local income tax sxpense (benefit) Current foreign 283,800 409,800 181.400 458,300 327,000 income tax expense (benefit) Total current income 925,400 1,281,600 268,200 2,320,400 535,200 tax expense (benefit) Deferred U.S. 92,600 10,400 (8,400) (1,074,500) 633,700 federal income tax expense (benefit) Deferred U.S. state 10,500 (6,400) (4,800) (322,400) 101,500 & Icoal income tax expense (benefit) Deferred foreign (80,000) (129,000) (15,300) (51,900) (8,400) income tax expense (benefit)Report Date 10/02/2022 10/03/2021 09/27/2020 09/29/2019 09/30/2018 Currency USD USD USD USD USD Audit Status Not i Not Not i Not i) Not i Qualified Qualified Qualified Qualified Available Consolidated Yes Yes Yes Yes Yos Scale Thousands Thousands Thousands Thousands Thousands Total deferred 23,100 (125,000) (28,500) (1,448,800) 726,800 income tax expense (benefit) Income tax expense 948,500 1,156,600 239.700 871,600 1,262,000 (benefit) Net earnings (loss) 3,283,400 4,200,300 924,700 3,594,600 4,518,000 including noncontrolling interests Net earnings (loss) (1,800) (1,000) 3.600 4,600 300 attributable to noncontrolling interests Net earnings 3,281,600 4,199,300 928,300 3,599,200 4,518,300 attributable to Starbucks Corporation Weighted average 1,153,300 1,177,600 1,172,800 1,221,200 1,382,700 shares outstanding - basic Weighted average 1,158,500 1,185,500 1, 181,800 1,233,200 1,394,600 shares outstanding - diluted Year end shares 1,147,900 1,180,000 1,173,300 1,184,600 1,309,100 outstanding Net earnings (loss) 2.85 3.57 0.79 2.95 3.27 per share - basic Net earnings (loss) 2.83 3.54 0.79 2.92 3.24 per share - diluted Cash dividends 2 2.29 1.49 declared per share Total number of 402,000 383,000 349,000 346,000 291,000 employees Number of common 18,000 18,000 18,000 18,000 18,100 stockholders Foreign currency (794,700) 206,900 (146,200) (220,000) translation adjustments